We frequently say that risk and return are related, but many people don’t understand exactly what we mean by the word “risk.”

The investment world typically uses “risk” to describe the volatility of returns. An investment with erratic and volatile returns is considered to be riskier than an investment with returns that are smooth and consistent. In theory, we should expect higher risk investments to provide higher returns than lower risk investments.

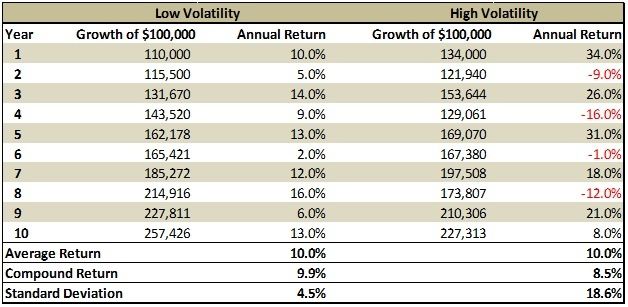

When given a choice of two portfolios with identical returns, a rational investor should choose the portfolio with less risk (i.e. lower volatility). A good example is the table below that I am borrowing from The Investment Answer (a quick and easy read that I highly recommend for everyone).

The fancy statistical name for risk is standard deviation, which is a measure of how much an investment’s return varies from its average return. In this example, both investments have an average return of 10%, but their drastically different levels of volatility (as measured by standard deviation) lead to different compound returns and, thus, different levels of wealth.

[A quick example to understand the difference between compound return and average return…You invest $100 Year 1 and lose 50%, thus leaving you with $50. In the second year, if you earn a 50% return on your money, because you only had $50 to invest, you only made $25, so the investment is now only worth $75. The average return for the two years was zero (-50% in Year 1 and +50% in Year 2), but because of the volatility, the compound (actual) return was -25%.]

To briefly summarize, we now can see that given the choice of portfolios with identical returns, we should prefer the one with the lowest amount of risk. The word “risk” is used to describe the volatility of returns, which we quantify using standard deviation. The higher the standard deviation, the more volatile (risky) the investment is expected to be.

Volatility isn’t the enemy; it is the cost of higher returns. In theory, we expect more volatile (risky) investment to earn higher returns. The key is to have the appropriate amount of risk (volatility) in your portfolio.

This article originally appeared on Forbes.com.

Next Steps:

If you’re ready to start making smart decisions with your money and build your wealth, take a brief financial wellness analysis and learn in just 9 questions your biggest areas of opportunities you should be focusing on in your finances.

Disclosure:

This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own tax, legal and accounting advisors.