Global stock markets have fallen significantly in response to the spread of the coronavirus. While market losses of this magnitude are not uncommon, the speed at which the losses have occurred are a bit more unusual.

In my opinion, the best course of action in these situations is calling your advisor to share your concerns and let them provide you with meaningful insights into your specific situation.

With that in mind, here are a few other thoughts in response to the recent market losses.

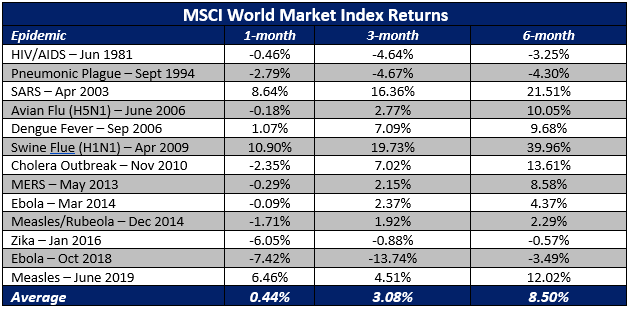

1. Past epidemics have historically had only a short-term impact on stocks.

Nobody knows how the coronavirus will impact the global population, the economy, and your portfolio. But we do know past epidemics have historically had short-term impact on stocks.¹

Stocks reward investors who maintain a long-term outlook. The challenge is that the long-term feels like an eternity to live through in the moment. But over shorter periods, market losses test one's commitment to a long-term strategy, which brings me to my next point...

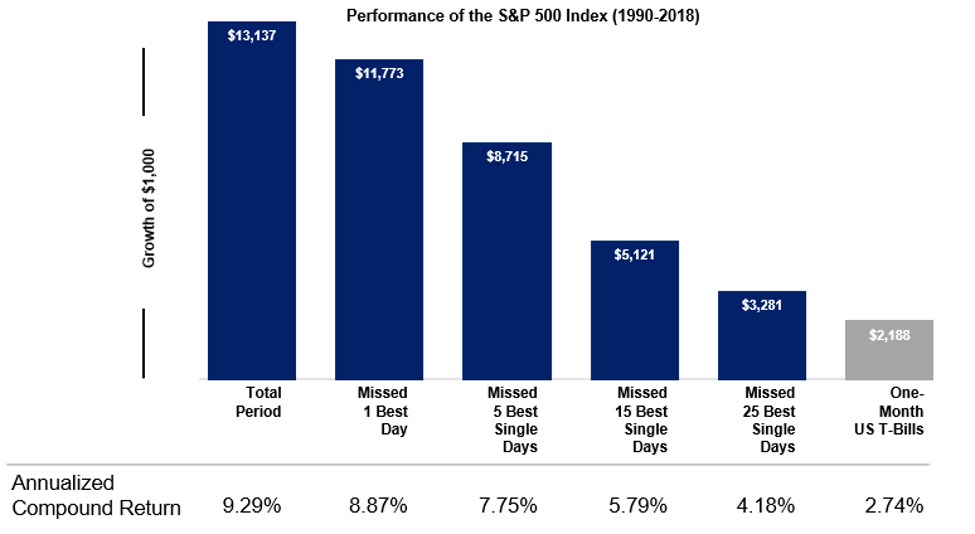

2. Reacting to losses can hurt performance.

Market drops are an unavoidable part of investing, but how you respond is the most important factor.

Historically the best days in the market tend to follow the worst days, and missing only a few days of strong returns can drastically impact your overall performance.²

When the market goes down, our human fear instinct kicks in and makes us feel the need to do something. When our ancient ancestors heard a rustle in the bushes, they ran out of fear.

They didn’t have to time to calculate the probability that the noise in the bushes was a lion. If it was, taking the time to think about it posed too much of a risk of being pounced on. Better to get away first and evaluate later.

Thankfully, most of us no longer need to worry about being hunted down by lions – but that instinct to react when we feel afraid or threatened remains.

That makes it tough to not react when we get spooked by the stock market. But knowing how ugly things can get and understanding your short-term desire to react emotionally is essential to sticking with a long-term investment plan.

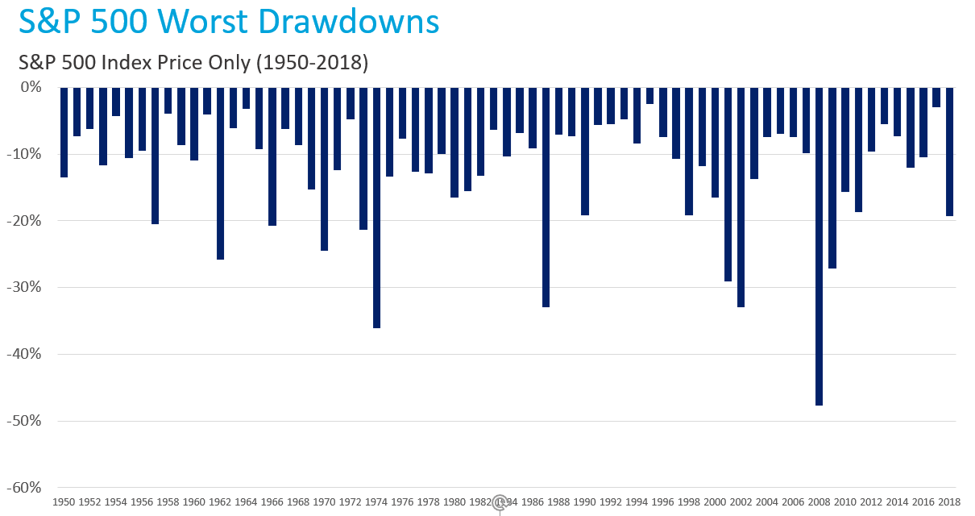

3. Losses are normal.

There is no way for people to reasonably predict when and why downturns occur. But we can reasonably expect them to continue occurring with a similar degree of frequency in the future.

The chart below shows the worst drawdowns for the S&P 500 every year dating back to 1926.³ Double digit losses occur in 65% of calendar years and nearly a quarter of the time losses are greater than 20%.

Losses are the cost of higher expected returns that stocks earn over bonds and cash. Trying to avoid losses means sitting in cash and missing out on the disproportionately greater gains.

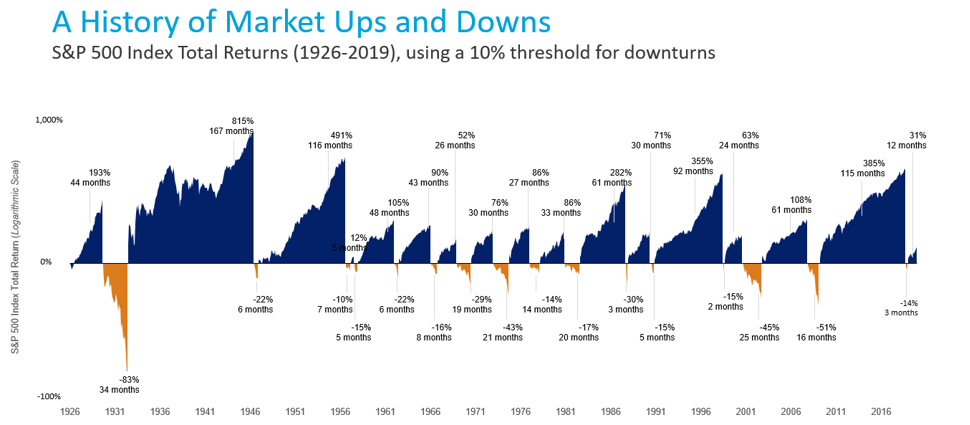

Consider the chart below comparing periods when the market was rising (in blue) and falling (in orange).⁴ As you can see, up markets generate disproportionately higher returns and last for longer periods of time than down markets.

Rather than worry about avoiding relatively short-lived downturns, as difficult as they feel in the moment, you must focus on the things we can control to capture all the returns the market offers in the good times.

4. If you are feeling uncertain, review your financial plan before your portfolio.

Human nature and easy access to real-time market data makes checking your portfolio the typical first response during periods of uncertainty, but a better course of action is reviewing the underlying assumptions in your financial plan.

A thoughtfully crafted financial plan takes those periods of bad performance into account, and does so without emotion. As a result, you can know the comforts of your lifestyle are protected.

We develop financial plans that run thousands of scenarios, each randomly drawing from historical levels of return and volatility to generate a probability that your financial plan will be successful. That means your financial plan does all of the prediction work for you.

And when there is additional uncertainty, we can run a Safety Net Analysis to help you understand how a prolonged downturn would impact your plan.

If you’d like to learn more about working with Plancorp, click here to get started.

Sources and Disclosures:

For educational purposes only; should not be used as investment advice. Past performance is no guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio

- Chart data source: Charles Schwab using Factset data as of 2/21/2020.

- Chart data source: Dimensional Fund Advisors.

- Chart data source: Bloomberg.

- Chart data source: Dimensional Fund Advisors.