While executing an estate plan might not be at to the top of your to-do list, it’s one of the most important pieces of your financial plan. I’ll admit, it took me expecting my first daughter to get my estate plan in order—but hopefully this post will motivate you to get your estate plan in place, regardless of your age or life stage.

What Happens If You Don’t Have an Estate Plan

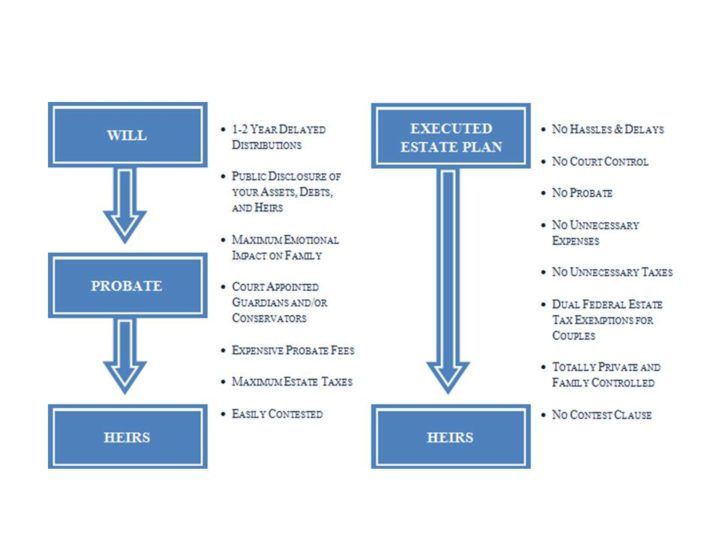

Even without an estate plan, your assets will still likely make it to your heirs, albeit following the defaults established by the laws of intestacy for the state you live (with no exceptions). This can differ dramatically from what the person really would have wanted. Dying without an estate plan in place requires that all of your assets will have to go through the court system, or “probate.” As you might imagine, this process can be costly, time consuming and inefficient. Plus, during this process, all of your probate assets and heirs become part of public record and can therefore be easily contested.

Start with Your Objectives

Before you rush to sign documents, take a step back and determine your objectives. Maybe you want to have a secure plan in place that protects the privacy of your loved ones, ensures your wishes are carried out both during and after your lifetime, or minimizes your tax liability and the cost of administering your estate.

After you determine your objectives, you and your attorney will decide what instruments to use to execute your plan. These are some of the common documents you might use:

- Will: Instructs that assets pour over into your trust, names an executor and designates beneficiaries. This was a particularly important document for me, because it also recommends a guardian for your minor children.

- Revocable Living Trust: Designates trustees both during and after your lifetime and spells out specific instructions on the distribution of your assets (e.g., provides creditor protection for your heirs, restricts the age at which they have control of their inheritance or even can designate who has authority over the assets they inherit).

- Health care Power of Attorney / Healthcare Directive / HIPAA: Specifies who should make your healthcare decisions if you’re unable to do so, instructs your health care team about your wishes to receive life sustaining procedures, and names individuals who should receive information about your health.

- Financial Power of Attorney: Specifies who can make your financial and legal decisions if you’re unable to do so.

The first three documents are also particularly important for your adult children. Once a child is the age of majority (age 18 – 21 depending on what state you live in), parents no longer have automatic authority to make healthcare decisions or receive information about their child’s health. At a minimum, check out your State Bar’s website, as many publish free templates.

Steps after Signing

The work isn’t done once you sign your documents. Your attorney will provide guidance on how to re-title your assets appropriately; this may include titling assets in the name of your trust, adding a transfer on death (TOD) designation to your tangible and investment assets or a payable on death (POD) designation on your savings and checking accounts, and putting a beneficiary deed on your house.

Also, make sure the executors and trustees you named are aware of your wishes and know where your documents are located. You want to keep your documents in a safe place—but not so safe that they can’t be found when needed! It’s also helpful to create an estate memo listing all of your financial information (you can find a template here); staying organized helps ease the burden of administering your estate for your loved ones. Finally, it’s important to review your estate plan every few years to make sure it remains up-to-date with current laws and reflects your wishes as life changes.

The process may seem overwhelming, but once you execute your estate plan, your peace of mind will be worth it. I sleep better at night knowing that if anything were to happen to my wife or me, we have a plan in place for our daughters.