Last week President Obama signed the Bipartisan Budget Act of 2015, which raised the federal debt limit and avoided another debt ceiling issue. Tucked within this new law is a provision labeled “closure of unintended loopholes,” which eliminates a couple strategies for maximizing Social Security benefits. These changes are summarized in greater detail here by our president Chris Kerckhoff.

If you aren’t interested in reading through all the details yourself, my advice would be to contact your wealth manager to understand the strategies still available if: (1) you will be at full retirement age by April 29, 2016 or (2) you were born in 1953 or earlier.

Although the legislation eliminates some nice opportunities, one could argue that determining when to begin collecting Social Security is dramatically simpler. Below is a replay of an interview from this summer on common factors that will determine your start date for collecting benefits.

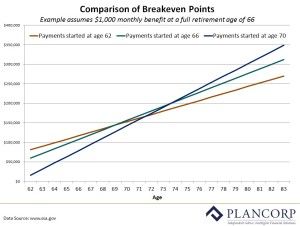

Monthly benefits increase by 8% for each year that you delay collecting benefits beyond your full retirement age. Taking benefits prior to full retirement age results in a smaller monthly payment – the formula is a little more nuanced and is listed at the bottom of the article.

If you live to your average life expectancy, then you will receive about the same total amount of benefits whether you take benefits early, late, or at full retirement age. If you think you’ll live beyond the average life expectancy, then delaying payments makes sense. If you are in poor health, then you may be better to take benefits early.

The average life expectancy is 75 years for men and 81 years for women, but your life expectancy rises once you reach age 65 – average life expectancy rises to 82 for men and 85 for women. For married couples that reach age 65 together, the odds of at least one spouse living to age 90 is 60%.

Life expectancy is useful in calculating the breakeven rate for taking benefits early, late, or at full retirement age. Perhaps you add a few years if your family has a history of longevity or subtract a few years if you don’t live a healthy lifestyle. It isn’t an exact science, but you can at least weigh the different options and make a more informed decision.

If you knew the exact date you will pass away, the optimal solution would be a simple math problem. Since we don’t know when people will pass, the factors that we consider include:

- Life expectancy and breakeven rates

- Your spouse’s age, health, and earnings history

- Cash needs

- Employment status and prospects

- Taxes and Medicare premiums