Smarter Investing Starts Here

Discover insights from Plancorp’s fiduciary experts on building, managing, and preserving wealth through evidence-based and tax-advantaged investment strategies tailored to your goals.

Plancorp’s investment philosophy is evidence-based and informed by decades of academic research. The pillars of our strategy are rooted in:

-

Deep Diversification

-

Long-Term Value Creation

-

Low-Cost Portfolios

-

Tax-Efficient Vehicles

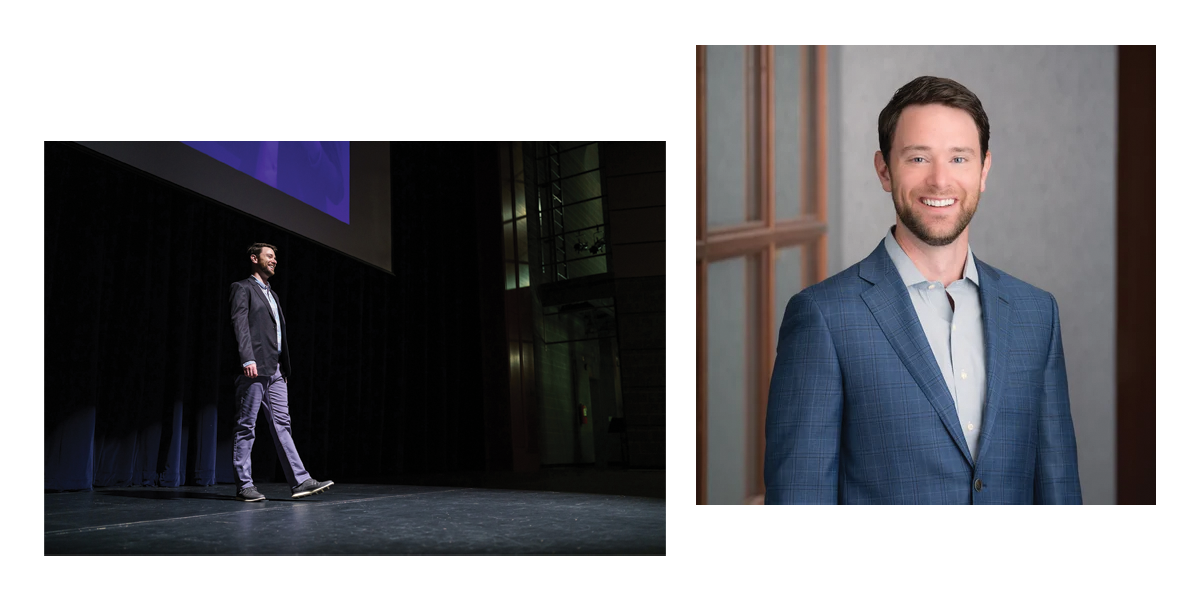

Guided by Expertise: Meet Peter Lazaroff

Peter Lazaroff, CFA CFP®, leads Plancorp's investment strategy as our Chief Investment Officer. He is a leading voice in the financial industry as the host of The Long Term Investor podcast, and is a go-to source for outlets like CNBC, The Wall Street Journal, and Forbes.

Peter is nationally recognized for his expertise, consistently ranking in Investopedia's Top 100 Financial Advisors list year after year, even reaching the top 5 in recent years.

His approachable and clear way of explaining complex topics makes him a trusted resource and a steady guide for our clients as they navigate important financial decisions.

Evidence-Based Investing

- A Better Investing Experience

- Long-Term Investing

- Deep Diversification

- Tax Efficiency

- Balancing & Harvesting

A Better Investing Experience

When the market dips, how confident are you that your plan is still on track? We strive to make sure every Plancorp client isn't glued to the news during market volatility, but instead has the confidence going in that their portfolio is diversified in a way to weather what are natural peaks and valleys in the market.

The inherent risk of investing drives the growth, and we use decades of evidence to help decide how to craft portfolios in a way that lasts. We're less worried about making sure the latest trend is incorporated and instead ask whether something is compelling enough to deviate from a good plan.

If you're ready to pursue that better investing experience, we should talk.

Long-Term Investing

A lot of the internet chatter about investing focuses on trying to pick the next big thing that will triple in value overnight. While many of those stories are written by the (few) winners, the reality is no one has a crystal ball.

At Plancorp, our investing philosophy is steeped in academic research, not click bait. We know that investing isn't about short-term gains, but driving long-term wealth creation with low-cost vehicles that you can reasonably count on to help you achieve your goals.

If you're tired of only hearing from your advisor when they have something new for you to buy or struggle to get them on the phone when there's a dip in the market, our philosophy will feel like a breath of fresh air.

Deep Diversification

You might think of diversification as a simple breakdown of equities and bonds in your portfolio, but we take it a step further.

We work with fund partners that help us deeply diversify our portfolios: constantly balancing not just stocks and bonds but small and large cap, domestic and global, funds and classes.

Through ETFs and strong relationships, we help select low-cost options with broad exposures and won't shy away from providing you with regular reporting with benchmarking. We're in it for the long-haul, and want your portfolio to give fuel to the life you want to live and the legacy you want to leave.

Tax Efficiency

We work with successful people who have already responsibly saved and invested for their future. But they often come to us with concentrated portfolios in one way or another.

One common issue is a ballooning tax-deferred portfolio held in a 401k. While an incredible tool to save those pre-tax dollars early on, there comes a time where this could put you in a position where you're required to take large required minimum distributions before you're ready. We help with multi-year Roth conversion strategies that help keep the tax impact of your smart investments as low as possible.

This is just one example of how we help make sure your savings aren't eaten away by unnecessary tax burdens.

Balancing & Harvesting

When you invest with Plancorp, you can be confident that your portfolio is being kept within the allocation you set with regular rebalancing.

Our portfolio management team is always on the lookout for opportunities to maintain the risk exposure you truly need to achieve your goals, as well as taking advantage of opportunities to "harvest" any losses in an effort to balance the tax burden on your nest egg.

If your advisor hasn't talked about tax loss harvesting through volatility, it might be a sign you've outgrown basic investment management.

Featured Resources

The Long Term Investor

PURSUING A BETTER INVESTMENT EXPERIENCE

EVIDENCE-BASED INVESTMENT INSIGHTS

INVEST BY AGE SERIES

Listen: The Latest Episode of The Long Term Investor

Tune in as Peter Lazaroff distills complex financial matters into easily digestible lessons. If you’re ready to get a clear plan for your investments and personal finances, stream a recent episode here and subscribe wherever you listen to podcasts.

More to Explore

Your Next Investing Read

Browse more expert insights to help you invest with clarity and confidence.

See All ResourcesLike What You're Reading?

Get Investing Insights to Your Inbox. Unsubscribe Anytime.

Schedule a Call With a Wealth Manager to Get Started

Let Plancorp help so you can focus on making the most of your wealth

- Personal & Business Solutions

- Popular Resources

- Free Financial Analysis Tool

- Money Match Quiz

- Fee & Value Calculator

- Early Retirement Guide

- Equity Compensation Guide

- Estate Planning Guide

- Employee Stock Purchase Plan (ESPP) Guide

- Restricted Stock Units Guide

- Invest by Age Series

- Glossary of Financial Terms

- Client Guide

- What to Expect During an Advisor Transition

St. Louis, MO | Nashville, TN | Sarasota, FL | San Francisco, CA

Direct: 636-532-7824 | Toll Free: 888-220-1163

- Legal Notices

- Privacy Policy

- ADV Part 2A

- View Cefex Certificate

- Form CRS

- Press Room

- Cyber Security Policies

- © 2026 Plancorp, LLC.

© 2026 Plancorp, LLC. All Rights Reserved.

-4.png)