Asset allocation is a relatively simple concept: It involves dividing your investment portfolio among various assets—including stocks, bonds and cash—in an effort to balance risk and reward.

That said, because everyone’s goals and tolerance for risk are different, the process is more sophisticated and individualized than you might think. And the allocation that works best for you now will likely change over the course of your life.

Finding the right asset allocation requires detailed conversations with an advisor to review variables like the timelines for different goals, your income level, and your comfort with risk. Then, you can create a portfolio with the right risk and reward profile for your situation. Yet achieving this personalization doesn’t mean the best portfolio is one you must create yourself. In many cases, it makes sense to use a model portfolio that’s optimized for people just like you, based on key factors such as your goals, risk tolerance and age.

Developing an Asset Allocation Strategy

The allocation of assets in a portfolio depends on three primary factors: personal goals, risk tolerance and time horizon.

Goals could represent a target return you want to achieve, or a level of savings you need for a particular objective, such as having a comfortable retirement.

Risk tolerance is the amount of variability in investment returns you are willing to accept—and that level is closely linked to the time horizon. You typically can take on more risk for long-term goals because you have years to recover from temporary market declines. But most investors shift to a more conservative allocation as they approach a goal to preserve their savings or supplement their income. Consider someone 10 years from retirement compared to someone in their early 30’s. They would likely pursue a very different risk level.

That said, risk tolerant investors at any age may choose to invest aggressively in higher volatility equities to take advantage of higher potential returns, while risk averse investors might choose to invest in a higher proportion of less volatile fixed-income investments.

Risk tolerance is also highly personal, based on your personal reactions to real and potential loss, past positive or negative experiences in the market, and even how you were raised to approach money. That’s why it’s important to carefully discuss these factors with a financial advisor to help determine the right mix of investments in your portfolio. A key tenant that sets Wealth Managers like Plancorp apart from a big box advisor is the proactive deep dive into your goals and what portfolio mix makes sense for you to maximize your peace of mind over the coming years.

The Role for Asset Allocation Models

Although asset allocation is based on personal characteristics, not every portfolio needs to be completely customized. Wealth management firms often use a range of model portfolios that can suit most clients’ needs. A model portfolio is a diversified collection of assets—comprising domestic and international stocks as well as government and corporate bonds, for instance—that’s been carefully allocated to meet specific return and risk objectives. In many cases, you can fully adopt a model portfolio that’s aligned with your goals, or a model portfolio can serve as a jumping-off point for building a more individualized portfolio.

For example, Plancorp uses three model portfolios:

- The Index Model closely follows a benchmark and provides clients with broad market exposure.

- The Factor Model is designed for long-term investors and targets specific drivers of return, such as small size and value.

- The Environment, Social and Governance (ESG) Model helps investors align their values with their investments.

One of the big advantages for model portfolios is that they are carefully selected, optimized and constantly monitored and updated to take advantage of the best tools the market has to offer. We also believe that model portfolios help position investors for long-term success. They provide consistent market exposure over time, which allows the portfolio to proactively follow their targets throughout different market conditions instead of reacting to short-term market changes.

Adjusting Asset Allocation Models by Age and Other Factors

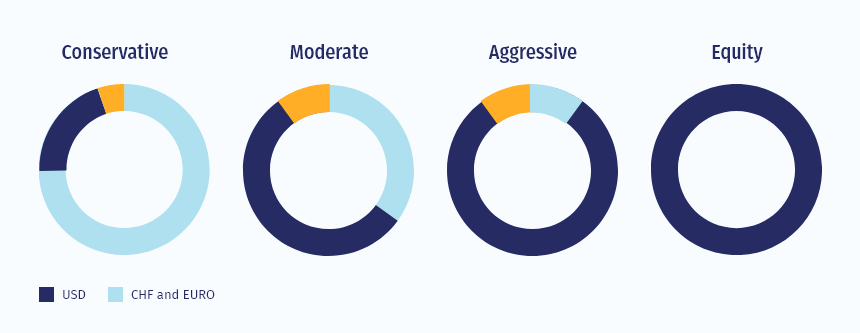

Depending on a client’s risk tolerance and goals, model portfolios can be weighted more toward stocks or fixed income. A person’s age is typically one of the main triggers for changing these weightings. For example, a client in their 30s in a model portfolio may be weighted more toward stocks than a client in their late 50s.

Model portfolios are also customizable if a client has specific needs, such as including certain securities or fulfilling investment needs. However, when we get these kinds of customization requests, we make sure to discuss how these additions could impact your overall asset allocation.

Often, our new clients arrive with an existing portfolio. In these cases, we have to examine their current assets and see how they fit into the asset allocation of the new model portfolio they’ve chosen, with an eye toward diversification and tax efficiency.

No matter what portfolio a client uses, we test whether that allocation is a good fit. Running Monte Carlo simulations lets us see how changing market conditions or other variables would affect a client’s ability to meet their goals. For example, we can see if rising health care costs would cause you to fall short of your retirement goal, or estimate how moving to a more expensive city in retirement might affect the level of returns you need. Repeatedly running these simulations over time helps ensure that your portfolio is always targeted to achieving your goals.

Asset Allocation Models for Retirement and Beyond

For model portfolios used in retirement, asset allocations are typically more conservative to support income needs. Holding a greater proportion of fixed-income investments helps address a retirement threat called “sequence of return risk”—the danger that market downturns early in retirement combined with withdrawals could cause you to deplete your savings earlier than expected.

However, some people may already have more than enough savings to carry them through retirement. In these cases, they may be focused more on managing assets for future generations. That longer time horizon typically allows investors to take on more risk, so we would suggest an aggressive asset allocation that includes more equities.

We also may suggest splitting the portfolio to accommodate these different goals. For example, we might use one relatively conservative portfolio for maintaining retirement income while using a more aggressive portfolio geared toward developing multigenerational wealth.

Rebalancing Your Asset Allocation

Over time, asset allocations will experience natural drift. For example, stocks have outperformed bonds overall during the past decade, so the equity portion of a diversified portfolio may be highly appreciated, taking up a larger percentage of the overall allocation than originally targeted. The result is more risk than the investor planned.

We would rebalance a portfolio like this by selling appreciated stocks and buying fixed income until allocations for stocks and bonds are back in line with their targets—ensuring clients’ still hold the portfolio they intended. Alternatively, we could invest new funds into fixed-income assets until we reach the target allocation.

Making these moves is easier because we started with a model portfolio that provides an optimized asset allocation for your age, risk tolerance and goals. Regular review and rebalancing helps keep that portfolio on track over time, something Plancorp incorporates into every client relationship. This process reduces the complexity of creating and maintaining the mix of investments that provides the best chance of achieving all of your financial objectives.