Schedule Your Private Strategy Session

Start your path to financial clarity with a Private Strategy Session, your first step toward working with Plancorp.

What to expect:

Ask a Plancorp Advisor

What's on your mind? We're here to solve problems in your financial plan.

Personalized Strategy Insights

Let's move beyond basic advice to align your wealth with your long-term goals.

No-Obligation Fit Assessment

See if our philosophy aligns with your financial goals - no pressure, just insights, in only 30 minutes.

No Prep Work Needed

Don't worry about collecting old documents first. We're ready to talk at a high level about what we can do for you!

- No prep

- No cost

- No obligation

-

Managing over $7.6B in client assets

-

Helping successful families for 40+ years

-

Fee-only fiduciary. Your interests come first.

-

98% client retention

Getting Started with Plancorp

- 01 Book a Private Strategy Session

- 02 Explore Your Draft Financial Plan

- 03 Become a Plancorp Client

Step 01

Book a Private Strategy Session

Curious about working with Plancorp? Schedule your no-obligation 30-minute Private Strategy Session with our wealth advisors to explore how we can help you achieve your goals.

No need to prep anything—we'll use this time to get to know you, answer your questions, and see if we're the right fit.

Schedule My Strategy SessionStep 02

Explore Your Draft Financial Plan

To move forward, we’ll ask for a bit of information through a secure portal to start drafting a custom Financial Independence Analysis (FIA).

We’ll meet to review the results, discussing one big question: with what we know today what are your chances of meeting your financial goals? How can Plancorp help?

As a client, the FIA will get refined and becomes the backbone of your financial plan, revisiting to aid in making big decisions.

Schedule My Strategy SessionStep 03

Become a Plancorp Client

The FIA discussion will conclude with a clear breakdown of what a client relationship with Plancorp would look like for you and your family in a client agreement.

Our team will then do the heavy lifting to get you on board, including key components of your financial plan like an investment allocation, tax projection and estate and insurance plan review.

As our relationship continues, we’ll set a regular communication cadence that meets your needs so you feel supported through life’s milestones, big and small.

Schedule My Strategy SessionCTA Goes Here Lorem Ipsum Dolor

Let's Draft Your Plan

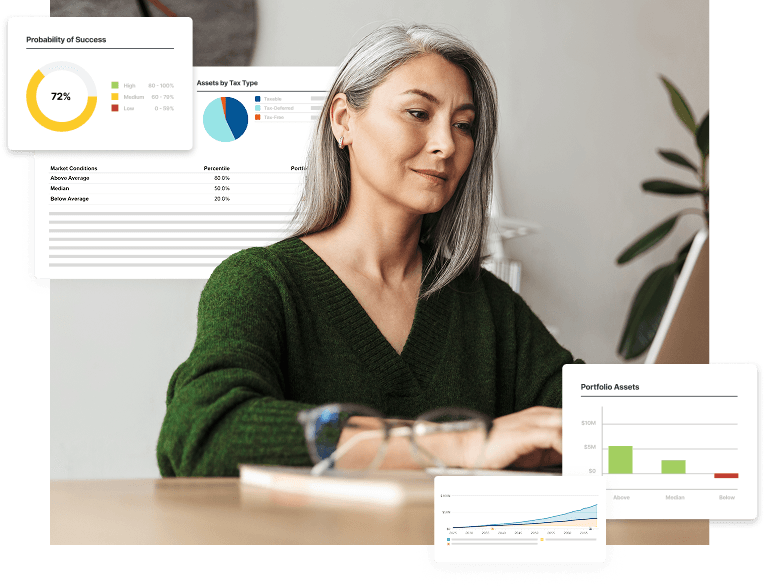

What's Your Probability of Success?

Once you've had your private strategy session and shared a bit more about yourself, we'll start a draft plan that includes a financial independence analysis. The FIA is a powerful financial modeling tool that helps you know if you're on track to achieve financial goals, big and small.

Want a preview of what’s possible?

Don’t just take our word for it. Here’s what our clients say:

Your Journey to Wealth Alignment Starts Here

Don't Settle For Basic Advice

A short call today could reshape your financial future for years to come. Whether you're feeling reactive in your finances or skeptically content, Plancorp specializes in reaching a deep level of financial alignment.

Curious to learn more about the client experience that ranked us as a CNBC Top 100 advisor?

Frequently Asked Questions

At Plancorp, we take a holistic and comprehensive approach. Financial planning is the foundation of our relationship, and we integrate every area of your financial life together to achieve full wealth alignment with your goals at the center. Explore each service that’s included:

Even great advisor relationships can benefit from a second look as your needs evolve. Switching is easier than most people expect. We handle everything behind the scenes, and you don’t even need to contact your current advisor. Our complimentary second-opinion review helps you see if you’re getting the full value you deserve.

Check out our guide - What to Expect During an Advisor Transition

Many of our clients started out with a DIY approach to their finances — until the complexity and time management became too great to manage alone.

As your wealth grows, so do the tax, investment, and estate considerations that require specialized coordination. Plancorp helps you uncover opportunities and reduce risks that are often hard to spot without a dedicated team.

Hiring an advisor ensures you’re not leaving money on the table and are taking strategic advantage of every opportunity available to you.

Plancorp's annual fee for wealth management services is based on a percentage of a client's total assets under management (AUM). We charge 1% for the first $2,000,000 under management, and the rate lowers from there.

No. We are a fiduciary firm, meaning we don’t receive commissions or kickbacks for recommending certain products or investment funds. Our fee-only structure allows us to remain unbiased and provide advice that is always within the client’s best interest.

We adhere to an evidence-based investment philosophy for our clients. This strategy focuses on risk reduction through systematic diversification across asset classes rather than on an attempt to beat the market or pick stocks.

Each of our clients has a dedicated team of advisors made up of a Wealth Manager, a Financial Planner, and a Client Service Representative. You’ll meet at least annually with the members of your specific team, and we may also pull in other specialists, depending on your personal needs.

No matter with whom you meet, you will always hear a consistent message from our team. We all agree on our recommended investment style, as well as the best ways to handle our clients’ planning needs. We all provide impartial advice that is free from hidden financial incentives.

We believe in maintaining absolute transparency with our clients and always put their interests ahead of our own. This philosophy has served us well, as we have built long-lasting relationships with clients across the country over more than 40 years of business.

As a client of Plancorp, you can be certain there are no hidden fees or agendas, just a life advocate who is looking out for what’s best for you and your family.

Plancorp does not have an account minimum for who may become a client, but we do have a minimum annual fee for individuals: $12,000.

This gives us the flexibility to serve clients who are accumulating assets or have upcoming life events. Even if we are not the right fit, we may be able to help you find someone who can assist with your needs.

Schedule a Call With a Wealth Manager to Get Started

Let Plancorp help so you can focus on making the most of your wealth

- Personal & Business Solutions

- Popular Resources

- Free Financial Analysis Tool

- Money Match Quiz

- Fee & Value Calculator

- Early Retirement Guide

- Equity Compensation Guide

- Estate Planning Guide

- Employee Stock Purchase Plan (ESPP) Guide

- Restricted Stock Units Guide

- Invest by Age Series

- Glossary of Financial Terms

- Client Guide

- What to Expect During an Advisor Transition

St. Louis, MO | Nashville, TN | Sarasota, FL | San Francisco, CA

Direct: 636-532-7824 | Toll Free: 888-220-1163

- Legal Notices

- Privacy Policy

- ADV Part 2A

- View Cefex Certificate

- Form CRS

- Press Room

- Cyber Security Policies

- © 2026 Plancorp, LLC.

© 2026 Plancorp, LLC. All Rights Reserved.