How to Make the Most of Equity Compensation

Table of Contents

Maximize the opportunity by managing risks.

Equity compensation can be one of the most important benefits you receive during your career. You’re not only getting a reward for your talent and hard work, you’re getting an asset that can help build long-term wealth. But the value of that benefit depends on more than just the performance of your company’s stock. Thoughtfully managing key decisions involved with equity compensation — especially those related to taxes — can make a big difference in how much you ultimately gain.

Equity compensation encompasses a range of programs, including stock options, restricted stock units, and employee stock purchase plans. Each form comes with its own set of rules and tax implications that require careful consideration to avoid costly mistakes. In fact, even successful individuals who have always managed their own investments often find themselves hiring a financial advisor once equity compensation becomes part of their portfolio.

Examining the role of company stock in your overall financial strategy and planning ahead is the key to making the most of your equity compensation. This eBook will help with that process. In it, you’ll learn to:

-

- Understand the different types of equity compensation and how they work.

- Maximize your benefit and minimize your tax obligation.

- Make a plan for using equity compensation to achieve your financial goals.

- Find advisors with the experience to help.

Thanks for reading! Want the full guide in your inbox?

What is Equity Compensation?

Equity compensation comes in many forms, but they all give employees a stake in the financial success of the company. Employers like to offer equity compensation to attract and retain employees, because it aligns the interests of individual employees with the company’s goals — if the company grows and profits, employees can share in that growth.

Here are four of the most common types of equity compensation:

- Incentive Stock Options (ISO). Employees get the right to buy shares of company stock at a set price, known as the strike price, for a period of time. In addition to the potential benefit of buying shares at a discount if the share price rises above the strike price, ISOs also offer potential income tax advantages. However, you will face capital gains tax implications when you sell those shares in the future.

- Non-Qualified Stock Options (NSO). Like ISOs, NSOs give employees the right to buy shares of company stock at a preset price during a certain period of time. The tax treatment of NSOs is different from ISOs, however, in that you must pay income and payroll tax on the difference between the market price and the price you pay for the shares.

- Restricted Stock Units (RSU). RSUs are a promise to award you shares of company stock in the future, but at today’s price. Think of RSUs as similar to a future cash bonus—unlike options, you don’t need to buy the shares first to realize any profit (as long as the stock price has risen since you were granted shares). However, you will owe income and payroll tax on the value of your RSUs.

- Employee Stock Purchase Plans (ESPP). These programs let employees purchase company stock at a discounted price using contributions they make through payroll deductions. The discounted stock price is typically 5%-15% lower than the stock’s market price

Understanding Equity Compensation Rules and Restrictions

Because employers typically use equity compensation to retain and motivate talented team members, these awards often come with rules that require employees to stay with the company or meet performance goals. There also may be rules that limit when and how you can use the option or shares.

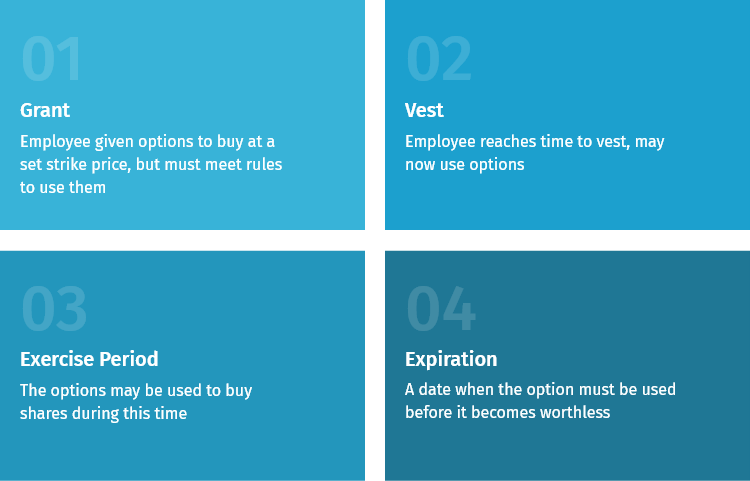

Here is a breakdown of common restrictions placed on equity compensation.

Time-based restrictions

Vesting schedules

Stock options and RSUs come with vesting schedules — a waiting period before you take possession of stock options or restricted shares. Companies have several ways to set up vesting schedules, including:

Cliff Vesting

Employees receive all granted shares once.

Graded Vesting

Employees receive a percentage or dollar-value of shares over regular intervals.

Hybrid Vesting

A mix of cliff and graded vesting. For example, shares may vest over four years, with 25% vesting after the first year and the rest vesting in equal monthly installments over the next three years..

Vesting example: Let’s say your options grant vests monthly over five years with a one-year “cliff.” This means that you earn the first 20% of shares (i.e., one-fifth) after the one-year mark, and then you earn about 2% monthly for the remaining four years.

Exercise period

Once you reach the end of the vesting period for ISO/NSO awards, you have a limited window in which to purchase those shares at your preset strike price — known as the exercise period. A typical exercise period is 10 years after the original grant date.

Expiration date

You must purchase all vested options within the exercise period, after which they expire and become worthless. If you leave a company with vested but unexercised options, they typically expire in 60 or 90 days.

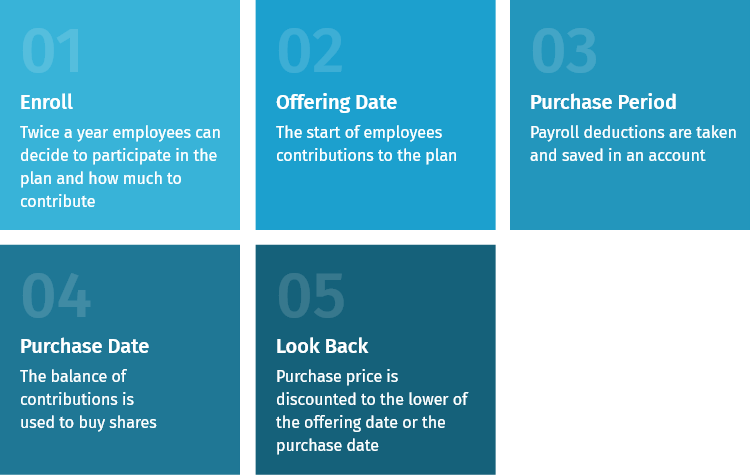

ESPP enrollment and purchase period

ESPP plans have time-based restrictions that determine when you can participate in the plan. First, there’s the enrollment period, which typically takes place twice per year. Once you enroll, you decide how much you’ll contribute from each paycheck beginning at the next offering date.

At the end of a purchase period (often six months), you reach a purchase date, when the money you contributed is used to buy company shares at a discounted price.

ESPP enrollment and purchase example

Alex enrolls in her company ESPP during the November enrollment period. The company starts taking payroll deductions on a December 1 offering date. It purchases shares for Alex on June 15, using the accumulated cash from the December 1 – May 31 purchase period. Alex’s company automatically re-enrolls her for the next cycle, taking payroll deductions for the June 1 – November 30 purchase period.

Performance-based restrictions

Performance restrictions put limitations on when, or even if, you have access to your equity compensation. As with cash bonuses, companies may tie equity awards to revenue growth, profits, or share price goals. At the same time, the company may require an employee to complete education or training or hit personal targets for sales or other criteria before receiving shares.

Limits on sales and use

Shares received through equity compensation may come with further restrictions, particularly if you work for a private company. Transfer and resale restrictions may limit when or to whom you can sell stock. Some companies limit pledging, which is the use of stock as collateral for a loan.

Taking Ownership of Your Company Shares

Reaching the end of a vesting period or an ESPP purchase date means you finally gain possession of your company shares. But the purchase process varies based on the type of equity compensation you’ve received and the details of your plan. In some cases, you also must decide which strategy you’ll use to purchase those shares — a decision that comes with additional financial considerations.

Exercising options

To exercise ISOs or NSOs, you must purchase those shares based on the strike price established in the original grant. You also may owe taxes, but you have some choices for how to cover all those costs.

With ISOs you can choose:

- A cash exercise. If you have sufficient savings in another account, you can pay cash upfront to cover the strike price and taxes/fees associated with the exercise. At the end, you’ll retain all of your shares.

- A stock swap. If you already own company shares — such as those purchased through previous options grants — you can swap the number of those shares needed (based on current market value) to cover the exercise costs of your new options. However, you will still need cash to cover taxes and fees.

With NSOs you also can choose a cash exercise, but you have other ways to cover the cost of the shares, taxes and fees:

- Sell to cover. You can direct your employer to sell enough of your exercised shares immediately to cover the total exercise value, taxes and other costs. This approach leaves you holding the remaining shares.

- Exercise and sell. Alternatively, you can direct your employer to immediately sell all exercised shares, using the proceeds to cover all taxes and exercise costs. You’ll receive the leftover cash.

Vesting of RSUs

Like stock options, RSUs vest over time. But unlike stock options, you don’t have to buy them. As soon as they vest, they are no longer restricted and are treated exactly the same as if you had bought those shares on the open market.

Buying shares in an ESPP

Purchasing shares through an ESPP is a largely automatic process. The regular contributions you make after enrollment will accrue until the purchase date. Then your company will use the accumulated funds to purchase the number of shares you can afford based on the employee-discounted stock price.

Some plans offer a lookback provision for determining that price. With a lookback, the plan can discount your purchase price to the lower of either the offering date share price or the purchase date share price.

How Equity Compensation is Taxed

Equity compensation may not look like a normal paycheck, but the IRS still wants its share. Each type of equity award comes with slightly different tax rules, so it’s important to understand how and when you’ll be taxed and plan ahead to avoid paying more than you have to.

Here are tax considerations to help maximize the value of your options, RSUs, or ESPP awards:

Incentive stock options

One of the advantages of ISOs is that you don’t owe income and payroll taxes when you exercise — as long as you hold those shares for at least two years from the grant date and one year after the exercise date. (If you sell before one year, the difference between the market value of the shares and the strike price will be taxed as ordinary income.)

However, ISOs are not exactly tax-free. The difference between what you pay for the shares and the stock’s fair market value counts towards your alternative minimum taxable income (AMTI).

.png?width=750&name=incentive-stock-options-example%20(1).png)

When you sell the shares, you’ll face capital gains taxes on the difference between the strike price and the sale price. The gain or loss will be measured from your exercise cost — even if you’ve already paid AMT.

Nonqualified stock options

When you exercise NSOs, you owe income tax and payroll taxes (Social Security and Medicare) on the difference between what you paid for the shares (your strike price) and their current market value.

Again, let’s say you exercise 1,000 options at a strike price of $35 per share, and the stock’s current price is $47. You would be taxed on $12,000 of income ($47,000 - $35,000).

Your company may automatically withhold the mandatory minimum 22% for federal taxes, as well as any state minimum withholding, but there’s a good chance your actual tax rate is much higher. It’s important to run a tax projection when planning to exercise options so you don’t face a big tax bill when you file your return for that year.

Once you exercise NSOs, you can sell or hold those shares. When you do sell, any capital gain or loss will be measured from the shares’ fair market value on the date of exercise. If you hold those shares for at least one year after your exercise date, you’ll qualify for the long-term capital gains rate on any increase in value.

Restricted Stock Units

With restricted stock units, there are no taxes at the time of grant since the shares are not technically yours yet. But, in the year your RSUs vest, their share value is considered ordinary income, and you are taxed just as if you had received the same amount in cash. Even if you don’t sell them, the share value is subject to federal, payroll and applicable state and local taxes for that year.

After that, any change in value from the vesting price is taxed as a capital gain or loss when you sell the shares. If you vest and then immediately sell your shares, it stands to reason that you incur neither a gain nor a loss.

Employee Stock Purchase Plans

With an ESPP you only incur taxes when you sell the shares, not when you purchase them. The less-good news is that ESPP tax planning is complicated by “qualifying” vs. “disqualifying” dispositions.

A disqualifying position (selling right away)

Selling ESPP shares held for less than two years after the offering date or less than one year after the purchase date is a disqualifying disposition. In a disqualifying disposition, any gains in the shares are taxed at (typically higher) ordinary income tax rates.

A qualifying position (selling after a waiting period)

ESPP shares are eligible for preferential tax treatment under a qualifying disposition. To make a qualifying disposition, shares must be held for at least two years after the offering date, and at least one year after the purchase date.

A qualifying disposition allows gains above the discount to be taxed at (typically lower) long-term capital gains rates. The company discount is always taxed as ordinary income.

Tax smart strategies - Common mistakes to avoid

The complex tax rules that govern equity compensation can sometimes result in people making costly missteps. Before you take action with newly acquired company shares, it’s important to develop a strategy for what you will hold and what you will sell.

Here are three common tax mistakes to watch out for:

1. Holding RSUs longer than necessary

Employees often get confused about the holding periods required for different kinds of equity compensation. For RSUs there are no tax advantages to holding the shares after they vest. In fact, selling them at the time of vesting limits potential appreciation, which may make it a tax-efficient time to sell.

2. Selling ISOs and ESPP shares too soon

The long-term capital gains tax rates are the lowest available tax rates for stock options and ESPP shares. You should consider hanging onto ISO/ESPP shares for at least two years from the grant date and one year after you take possession of the shares to qualify for those rates.

3. Selling shares without a tax strategy

Although you may face a significant tax bill when you sell company shares, you can manage those costs if you develop a good strategy in advance. For instance, you can time your sales to spread the tax bill over different tax years, or focus your sales on years when your tax bracket might be lower. An advisor may be able to help you identify other assets that have suffered losses to sell, so you can take advantage of tax-loss harvesting to offset taxes on your equity compensation shares. You might also use other strategies, like selling during market dips or making a charitable gift of appreciated securities.

How to Factor Equity Compensation into Your Financial Plan

Taxes are just one of several important financial variables you must examine to make the most of your equity compensation — and even people who’ve done a good job managing their assets can be challenged by the process. The key is to factor equity compensation into your overall financial plan.

For example, one of the first steps is to see how equity compensation impacts your overall investment mix. With large options and RSU grants or longtime participation in an ESPP, you might quickly build a concentrated position in your employer’s stock. That position might not seem to raise any red flags because you’re probably relatively informed about your employer’s operations, and hopefully you feel confident about its future. But a concentrated position in any one stock poses unnecessary investment risk:

- Most companies underperform the market as a whole. Even worse, 40% of all stocks suffer a permanent decline from their peak value of 70% or more.

- The financial risk is compounded because a large portion of your investments and your income are tied to the same company.

A good way to frame your thinking about equity compensation is to ask yourself what you would have done with a cash bonus instead of stock award. Would you still have invested all of the cash in your company’s shares?

Most people would answer “no,” which is why it often makes sense to sell shares acquired through equity compensation and invest the proceeds in a diversified portfolio. If you want to maintain a stake in the financial success of your company, it’s best to limit this holding to no more than 10% of your overall net worth.

If you have multiple types of equity compensation, you can be strategic about what type to sell first:

- Selling recently vested RSUs or recently exercised non-restricted stock options (NSOs) will likely have minimal tax consequences.

- Next, consider selling ISOs that meet the special holding requirements before selling recently exercised ISOs.

- Selling shares acquired through an ESPP might be your last option, since they are often taxed at higher rates.

Another important consideration is how you can use equity compensation to meet different financial objectives. Your options might include:

- Supplementing your cash flow. Selling portions of company stock each year can help fund ongoing expenses, provided you mind the tax consequences carefully to ensure you still come out ahead.

- Saving for near-term goals. The value of company stock can accelerate savings for near-term goals like purchasing a home or paying for a child’s upcoming tuition. But because stock prices are volatile, you may want to sell company shares and invest the proceeds into more stable assets.

- Investing toward long-term goals. With good planning and appropriate diversification, equity compensation you earn during your career can be put to work toward retirement or other goals that may be decades away.

How an Advisor Can Help

Most professionals who earn equity compensation are successful and capable people. But that doesn’t mean you have time or interest to manage those awards in the context of your overall financial plan. That’s where an experienced financial advisor can help.

An advisor with a complete picture of your income, assets and financial goals can look for ways to unlock the wealth-building potential of equity compensation. You can ask your advisor to:

- Track your awards and vesting schedules.

- Model different scenarios for your exercise strategies.

- Run tax projections to help reduce the amount you’ll owe.

- Look holistically at your overall portfolio and financial goals to develop a customized strategy for selling shares and reinvesting the proceeds.

The key is finding an advisor who specializes in helping professionals in these situations. Here are some important questions to ask to help choose the right partner:

Are you experienced with equity compensation?

You want an advisor with experience performing the kind of in-depth tax-planning and other strategic decisions required with equity awards. You can get more details by asking specific questions like, “What are some of the tax strategies you evaluate for your clients?” and “How have you helped clients manage equity compensation issues?”

Are you a fiduciary?

A fiduciary has a legal obligation to put your interests first. Also consider the individual advisor’s experience and credentials, services, wealth management approach, and fees.

How will we work together?

It’s important to be comfortable with how often you will meet, what kind of updates you can expect, and how you can get answers to questions as they arise.

How are you compensated?

Look for a fee-only financial advisor. Some advisors get paid through commissions they receive when they buy and sell investments on your behalf. You want someone whose only financial motivation is to help you.

Putting your Hard Work to Work for You

Equity compensation can be a significant addition to your salary, both in immediate value of the stock you earn and potential tax advantages these plans offer. Once you understand the type of compensation you’ve received, important dates and restrictions, and relevant tax implications, you can develop a strategy that ensures you get the most value out of those shares.

The process can be complex, but you don’t have to manage it alone. Plancorp wealth managers have extensive experience advising clients with equity compensation and always advocate for our clients’ financial interests. We are pleased to offer a complimentary equity compensation review to identify opportunities to maximize your overall wealth.

Key Terms & Definitions

- Stock option. The right to buy shares of stock at a preset price during a predetermined time period (often 10 years), subject to vesting or performance restrictions.

- RSU/RSA. A promise from employers to grant company shares to an employee based on a vesting schedule or performance requirements.

- Bargain element. The difference between the grant price of equity compensation shares and the stock’s fair market value on the day you purchase them. The bargain element is often the basis for tax calculations.

- Fair Market Value (FMV). The value of stock shares based on the current market price.

- Grant. The commitment made by a company to award employees RSUs or options. The grant includes the grant date, which starts the clock on time-based restrictions, the number of shares awarded, the strike price, any vesting requirements, the exercise period, and the expiration date.

- Vesting. The process that gives employees the right to purchase company shares awarded through an equity compensation grant.

- Vesting period. The waiting period before you can exercise your stock options or receive RSUs. Vesting can happen in stages (such as a percentage of the overall award each year for 5 years) or all at once at the end of the vesting period.

- Exercise. The act of purchasing company shares awarded through an options grant at the established strike price.

- Exercise price/strike price. The price the employee will pay for the shares if they exercise the option.

- Exercise period. The time you have to exercise vested options.

- Exercise date. The day you choose to purchase company stock, which starts the clock on any required holding period as well as future tax implications based on your future sale date.

- Expiration date. The deadline to exercise options, which is often 10 years after the grant date. If you don’t use them by the expiration date, you lose them.

- Sale date. The day you sell exercised shares, which will be used to calculate potential capital gain or loss based on the change in value from the exercise date.

- Disqualifying disposition. ESPP shares held for less than two years from the grant date and one year from the exercise date don’t qualify for preferential tax treatment and are subject to ordinary income tax.

Download a PDF of this Guide

Enter your information below to receive a PDF copy of this Equity Compensation guide.

Disclosure

This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own tax, legal and accounting advisors.

Plancorp is a registered investment advisor with the Securities and Exchange Commission ("SEC") and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not imply a certain level of skill or training. Please refer to our Form ADV Part 2A disclosure brochure and our Form CRS for additional information regarding the qualifications and business practices of Plancorp.

Disclosure

For informational purposes only; should not be used as investment tax, legal or accounting advice. Plancorp LLC is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC. All investing involves risk, including the loss of principal. Past performance does not guarantee future results. Plancorp's marketing material should not be construed by any existing or prospective client as a guarantee that they will experience a certain level of results if they engage our services, and may include lists or rankings published by magazines and other sources which are generally based exclusively on information prepared and submitted by the recognized advisor. Plancorp is a registered trademark of Plancorp LLC, registered in the U.S. Patent and Trademark Office.

Like What You’re Reading? Get Insights to Your Inbox. Unsubscribe Anytime.

Schedule a Call With a Wealth Manager to Get Started

Let Plancorp help so you can focus on making the most of your wealth

- Personal & Business Solutions

- Popular Resources

- Free Financial Analysis Tool

- Money Match Quiz

- Fee & Value Calculator

- Early Retirement Guide

- Equity Compensation Guide

- Estate Planning Guide

- Employee Stock Purchase Plan (ESPP) Guide

- Restricted Stock Units Guide

- Invest by Age Series

- Glossary of Financial Terms

- Client Guide

- What to Expect During an Advisor Transition

St. Louis, MO | Nashville, TN | Sarasota, FL | San Francisco, CA

Direct: 636-532-7824 | Toll Free: 888-220-1163

- Legal Notices

- Privacy Policy

- ADV Part 2A

- View Cefex Certificate

- Form CRS

- Press Room

- Cyber Security Policies

- © 2026 Plancorp, LLC.

© 2026 Plancorp, LLC. All Rights Reserved.