Everything You Need to Know About Restricted Stock Units

Table of Contents

Unlike traditional stock options, RSUs provide employees with company shares at a future date, contingent upon meeting specific conditions such as continued employment or performance milestones.

This comprehensive guide will delve into the intricacies of RSUs, exploring their types, advantages, disadvantages, tax implications, and strategies for incorporating them into your financial plan.

Whether you're new to RSUs or looking to optimize your existing equity compensation, this page will equip you with the knowledge you need to make informed decisions and maximize the benefits of your RSUs.

What are Restricted Stock Units?

RSUs are a type of equity compensation. If certain conditions are met—more on that below—employees are rewarded with future ownership of a certain amount company stock shares. At that point, the employee can choose how to handle their shares.

For the company offering RSUs, it’s a pretty straightforward type of compensation. They offer a way to motivate and retain top talent without immediately diluting shares or paying out cash bonuses.

For employees, the benefit of RSUs is clear: a financial award that could grow over time. Receiving this type of benefit could incentivize you to stay with the company and perform well.

Types of Restricted Stock Units

RSUs are generally structured in two ways: time-based or performance-based. Some companies use a hybrid approach, combining elements of each.

Time-Based RSUs

The vesting schedule of time-based RSUs is relatively straightforward. You are typically required to stay with the company for a predetermined amount of time (e.g. five years) before the shares fully vest and you take ownership.

Performance-Based RSUs

Performance-based RSUs are a bit more complex as they are generally tied to specific performance milestones. For example, going public via an IPO, being acquired, reaching specific goals, or completing a major project could all be scenarios by which your RSUs would vest.

You’ll typically find that RSUs are either one or the other when it comes to timing of the grant. These are referred to as single-trigger RSUs. There are also double-trigger RSUs, which is a hybrid approach—i.e. a certain amount of time elapsing and a specific performance metric being met.

Restricted Stock Units vs. Restricted Stock Awards

A more immediate equity offering, read more:

RSAs offer employees a more immediate form of equity ownership compared to RSUs. With RSAs, you receive shares of company stock upfront. While you typically don’t have to pay for these shares, some companies may require employees to pay a nominal amount or the FMV of the shares at the time of the grant.

Although you receive shares right away, RSAs are still “restricted.” Even though your RSAs have restrictions against selling, they often do give the recipient any associated voting rights or dividends that you wouldn’t be entitled to with an RSU grant until after vesting. And like RSUs, the removal of these restrictions are usually tied to time-based requirements to encourage employees to remain with the company and meet certain milestones.

Startups and early-stage companies usually favor RSAs, as lower stock prices and greater growth potential make them a tax-efficient way to incentivize employees. Additionally, employees can gain voting rights and could even receive dividends, regardless of whether their shares have fully vested.

How do RSAs work? The 83(b) Election:

RSAs differ from RSUs in both tax treatment and timing of ownership. One key distinction is the ability to file an 83(b) election, which can significantly affect how and when your RSAs are taxed. This election must be submitted in writing to the IRS within 30 days of the RSA grant date.

To get the full scoop on 83(b) elections and everything you need to know about RSAs, read this blog.

Vesting Schedules of Restricted Stock Units

Understanding the vesting schedule of your Restricted Stock Units (RSUs) is crucial as it determines when you gain full ownership of the shares.

Vesting schedules outline the milestones you must reach for your shares to transfer to your ownership. These schedules can vary significantly, impacting how and when you can benefit from your RSUs.

Let's explore the different types of vesting schedules and what they mean for you.

Cliff Vesting

With cliff vesting, all granted shares

are delivered at once.

Graded Vesting

With graded vesting, your shares are vested in portions over regular intervals. Graded vesting tends to be monthly, quarterly or annually.

Occasionally, RSUs that vest on a graded schedule may have a waiting period before first vest. Let’s look at an example:

- Your shares vest monthly

- You receive your first grant of shares on April 1, and subsequent grants on the 1st of each following month.

- You have a three-month waiting period before first vest

- On June 1, your shares from April, May, and June will all vest all once.

- From there, your subsequent grants will vest monthly with no waiting period.

Advantages of Restricted Stock Units

Simple and Flexible: RSUs follow a set vesting period, making them fairly simple and easier to understand compared to other types of equity compensation like employee stock purchase plans (ESPP). You don’t have to worry about strike prices or when to exercise.

No Upfront Purchase: Unlike stock options, RSUs don’t have to be purchased upfront. They are granted by the employer at no cost to the employee.

Value Retention: RSUs still hold value even if the company’s stock falls, whereas stock options only hold value if they’re “in the money” (current FMV is greater than strike price)

Disadvantages of Restricted Stock Units

Tax Liability: RSUs are taxed as ordinary income at their fair market value upon vesting, which can lead to a substantial tax burden if many shares vest simultaneously and you haven't planned ahead.

Portfolio Concentration: RSUs can lead to a significant concentration in your employer stock if you hold your shares, putting you at risk if the company runs into financial difficulties or the share price sags.

Private Market Illiquidity: For employees of private companies, RSUs depend on liquidity events to realize value, unlike public companies whose stock can be sold relatively freely.

How to Sell Restricted Stock Units

How you approach the sale of your RSUs can have a significant impact on your overall financial plan and tax obligations. Whether you're looking to minimize tax complexity, diversify your investment portfolio, or capitalize on your company's stock performance, understanding the different approaches to selling RSUs is essential.

In this section, we'll explore various strategies for selling your RSUs, including immediate selling, holding shares, and gradually selling shares, to help you make informed decisions that align with your financial goals.

Immediately Selling Shares: Selling upon vesting tends to minimize tax complexity and concentration or market risk

Holding Shares: You might hold shares if they are a deliberate facet of your overall portfolio strategy, you have information on the company that makes you bullish on its future, or you’re required to hold shares

Gradually Selling Shares: Gradually offloading your holdings can mitigate market timing risk and help remain mindful of tax rates

Tax Treatment of Restricted Stock Units

This section will guide you through the key tax considerations, including how RSUs are taxed upon vesting, the impact of selling your shares, and strategies to manage your tax liability effectively.

By being informed about the tax treatment of RSUs, you can make more strategic decisions and integrate them seamlessly into your overall financial plan.

Upon Vesting

When your RSUs vest, the fair market value (FMV) of the shares is treated as ordinary income and taxed as if you had received the same amount in cash compensation. This means that the value of the vested shares is subject to federal, payroll, and applicable state and local taxes for that year.

For Example:

If you have 500 RSUs vesting at a share price of $25, you will owe ordinary income tax on $12,500 (500 x $25) that year.

Most companies default to a sell-to-cover strategy upon vesting, where a certain number of your vested shares are immediately sold to cover the tax liability. This typically covers the federal, state, and payroll taxes.

However, some companies offer a withhold-to-cover option, where they retain shares and pay the tax amounts out of their own cash, decreasing share dilution. This can be beneficial as it avoids the under/overselling of shares due to market fluctuations.

Upon Sale

Once your RSUs have vested, you can sell the shares at your discretion, but be mindful of company-enforced selling restrictions, often referred to as blackout windows. Any change in value from the vesting price is considered a capital gain or loss for tax purposes.

If you sell the shares immediately after vesting at the same price, there is no capital gain or loss. However, if you hold the shares and sell them later at a different price, the difference between the sale price and the vesting price will be taxed as a capital gain or loss.

For Example:

If your shares vest at $25 per share and you sell them later at $30 per share, you will have a capital gain of $5 per share.

The tax rate on this gain will depend on how long you held the shares after vesting. If you held them for more than a year, the gain will be taxed at the long-term capital gains rate, which is typically lower than the short-term rate.

Conversely, if you sell the shares at a lower price than the vesting price, you will incur a capital loss, which can be used to offset other capital gains or up to $3,000 of ordinary income per year.

Restricted Stock Units Myths

The most common myth about Restricted Stock Units is that there is a one-size-fits-all solution. You might see advice with a blanket recommendation to always hold your position as long as possible or those who say you have to sell the second they vest no matter what. Some may even tell you that you can’t sell because of insider trading laws, but is that true?

The reality is the choice to hold or sell RSUs is unique to each individual plan as well as the stock. Factors like stock rapidly appreciating or how close you are to retirement can (and should) influence the decisions you make so you can optimize your RSUs potential for your goals.

Working with an advisor can help you navigate a plan to hold or sell your position in concert with the rest of your portfolio. Especially those who have received equity compensation for several years need to be aware of single stock concentration that can accumulate over time and put your plan at risk inadvertently.

Working with an advisor can also help you overcome normal but risky behavioral biases like the endowment effect where you over-emphasize the value of stock you earn through your own employer. Remaining objective and disciplined in your approach can prove difficult when it feels personal, but it can make the difference between your RSUs fueling the next level of your financial independence or serving as an anchor on your potential.

Common Mistakes to Avoid with Restricted Stock Units

Surprise Tax Bills and Underpayment Penalties

Once they vest, RSUs are income that you must report. Just because it isn’t hitting your normal paycheck with withholdings doesn’t mean it can’t change your tax bill and failing to plan ahead can leave you overextended.

This most commonly occurs in one of two ways:

- The individual doesn’t set a withholding plan with their employer at all, and owes a large tax bill the following year. Although it is uncommon to work with an employer who withholds zero, it can happen.

- The recipient assumes their employer will withhold the appropriate amount not realizing that varies by your individual tax bracket. Employers will commonly withhold a standard 22% (unless you’re pulling in a seven-figure amount) but if you are in a higher tax bracket, that can leave an amount that you need to personally cover the following April. Work with your employer and financial advisor to set the appropriate withholding amount and strategy that works for you. For more on setting a withholding strategy for RSUs, check out this blog.

Tax Return Errors

When your RSUs vest, taxes are withheld, and the income is reported on your W-2. However, when you sell your shares, the IRS receives a 1099-B from your brokerage, which may not include the cost basis. If the cost basis is not reported, the IRS assumes the entire amount is a taxable gain, which can lead to a higher tax liability.

For Example:

If you have 1,000 RSUs that vest at $50 per share, $50,000 is reported as income on your W-2. If you sell those shares at $60 per share, your brokerage reports $60,000 in proceeds on a 1099-B without listing the cost basis. If you don't report the $50,000 FMV as your cost basis on Schedule D, the IRS assumes you owe taxes on the full $60,000, rather than the actual $10,000 gain.

To avoid filing errors and potential tax issues, ensure your tax return accurately captures your RSUs, including the correct cost basis and sale values. Consider working with a CPA or financial advisor experienced in equity compensation to help run tax projections and confirm accurate reporting on tax forms, reducing the risk of an amended return and overpaying taxes.

RSU tax return errors can reduce the potential of your vesting shares, so be sure to understand them and work with an advisor who can run tax projections to help you avoid surprises.

Single Stock Concentration

Diversification is a core tenant of evidence-based investing. Most understand this in theory but forget to factor it into their accumulation of stock from their employer. It’s easy to mentally think of what’s in your 401k or brokerage account as different from your RSUs, but they are comparable and need to work well together. After years of equity compensation you could easily find yourself with 20, 30, or even 50% of your investments in one company.

Here’s a question that can help break this mindset: If you received this amount in cash, would you purchase only your company’s stock off the market? If you’re properly diversifying, the answer is likely no and as such you should thoughtfully consider how to handle your vesting shares to avoid the risks of a single stock concentration.

Insider Trading

This is where things get interesting! If you’re successful at your company and receiving large equity grants, you’re also likely aware of what would be considered material nonpublic information (MNPI). These are details about performance or upcoming initiatives that could influence the stock price, and therefore give you the inside scoop on whether to buy or sell.

This ties into a key myth that you just have to keep your RSUs until you retire. The truth is there are ways to thoughtfully manage your company stock and sell all or a portion to diversify while avoiding insider trading concerns. With the help of an advisor, you can confidently manage without fear of breaking the law.

Key aspects include knowing your trading window and consulting with your legal or compliance team at work, but it’s also a time to discuss the possibility of a 10b5-1 plan with your advisor. You can read full detail in this blog, but the abbreviated version is you set a plan to sell a pre-determined number of shares, allowing you to diversify even outside of trading windows.

Key Questions to Know About Your Restricted Stock Units

Top questions you should ask now that you've been granted RSUs:

- Are these restricted stock units or some other form of equity compensation?

May sound simple but the first question to ask is what type of equity you’ve been awarded. Beyond restricted stock units there are also restricted stock awards, employee stock purchase plans (ESPPs), NSOs/ISOs (“stock options”), and other forms of deferred compensation.

Each come with unique grant, vest, and tax implications so it’s important to know exactly what you’ve been given up front. Not sure? We'd love to chat.

- What is your grant date?

This in-depth piece goes into more detail but in short, RSU grants are compensation of equity in your company that pays out over time per what is known as a vesting schedule. Vesting can be based on time, hitting specific goals, or a mix of factors.

No matter your vesting schedule, you’ll want to know what the grant date is because it will impact when the vesting kicks off, starting the timer until your shares become unrestricted. Be sure to keep all of your paperwork so key information isn’t lost as the vesting may take anywhere from 1-5 years. - What type of vesting schedule do you have?

Completion of this schedule will dictate when your shares vest or become ‘unrestricted.’ From a tax perspective this is when your shares will be recognized as income, but also when you gain any benefits that come with the vested shares (like dividends or voting rights).

Be sure you fully understand your vesting date(s) to know how to plan for the value to hit your income. These are the three most common types of vesting schedules:

- Cliff Vesting: All granted shares are delivered at once after qualifying needs are met.

- Graded Vesting: A portion of shares are delivered over a set vesting period (i.e. 25% of granted shares each year for 4 years).

- Hybrid Vesting: A mix of time-based or metric-based vesting. For example, you may get 50% of the vested shares after 4 years and the other 50% when a certain sales goal is met.

Incorporating Restricted Stock Units into Your Financial Plan

If you’ve made it this far, you’re more informed than the average person about the potential benefit and pitfalls of your restricted stock, but the missing link is connecting it into your specific financial plan.

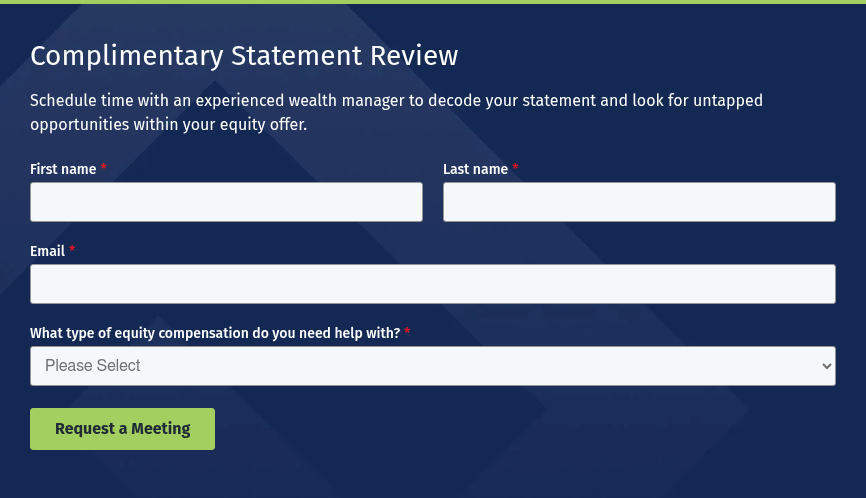

The best first step is setting up a call with an advisor who specializes in equity compensation to discuss your plan, your goals, and whether you’re leaving opportunity on the table.

Derek Jess, a Senior Wealth Manager at Plancorp has worked with many corporate executives to decode Employee Stock Purchase Plans, RSUs, deferred compensation plans and stock options like ISOs or NSOs.

He has also developed several equity calculators to set up effective sell strategies for clients. Curious to learn more, you can schedule a quick chat online using this scheduler.

Disclosure

For informational purposes only; should not be used as investment tax, legal or accounting advice. Plancorp LLC is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC. All investing involves risk, including the loss of principal. Past performance does not guarantee future results. Plancorp's marketing material should not be construed by any existing or prospective client as a guarantee that they will experience a certain level of results if they engage our services, and may include lists or rankings published by magazines and other sources which are generally based exclusively on information prepared and submitted by the recognized advisor. Plancorp is a registered trademark of Plancorp LLC, registered in the U.S. Patent and Trademark Office.

Like What You’re Reading? Get Insights to Your Inbox. Unsubscribe Anytime.

Schedule a Call With a Wealth Manager to Get Started

Let Plancorp help so you can focus on making the most of your wealth

- Personal & Business Solutions

- Popular Resources

- Free Financial Analysis Tool

- Money Match Quiz

- Fee & Value Calculator

- Early Retirement Guide

- Equity Compensation Guide

- Estate Planning Guide

- Employee Stock Purchase Plan (ESPP) Guide

- Restricted Stock Units Guide

- Invest by Age Series

- Glossary of Financial Terms

- Client Guide

- What to Expect During an Advisor Transition

St. Louis, MO | Nashville, TN | Sarasota, FL | San Francisco, CA

Direct: 636-532-7824 | Toll Free: 888-220-1163

- Legal Notices

- Privacy Policy

- ADV Part 2A

- View Cefex Certificate

- Form CRS

- Press Room

- Cyber Security Policies

- © 2026 Plancorp, LLC.

© 2026 Plancorp, LLC. All Rights Reserved.