Your Guide to Early Retirement

Table of Contents

Still, it’s understandable if you feel anxious. After all, most Americans aren’t saving for early retirement. Others feel overwhelmed by uncertainty in the stock market, tax law, and global events.

There’s good news, though. If you have questions about whether there’s anything you can do to make sure your retirement stays on track, the shorter answer is: yes, there are steps you can take.

Below are ideas to ensure you make a smooth transition into retirement, whether it’s this year or in the next few years. Be sure to grab the checklist at the end, and use it to help you stay focused on the road ahead.

Thanks for reading! Want the full guide in your inbox?

Assess Your Situation

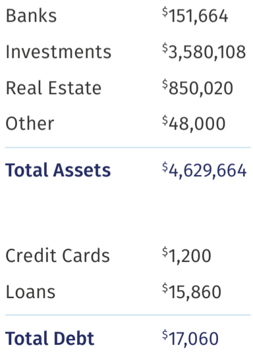

Before you do anything, you’ll want to have a clear picture of your financial status before you chart your retirement journey. The first step in creating an accurate picture of where you are today is to calculate your total net worth by subtracting what you owe (any debt, mortgage, and credit card balances) from what you own (your cash, retirement accounts, and assets).

Your net worth statement allows you to see the cumulative results of your financial decisions to date and can help facilitate productive financial conversations between partners. Once you have a grasp of your total net worth, you can begin thinking about the various inflows and outflows that will impact it in your retirement income planning.

Calculating Your Net Wealth

Your Personal Wealth

Evaluating Your Income Sources

Step 1: Take Stock of Your Income Sources

Next, take stock of all your income sources. This could include any pension benefits you’ll receive or accounts you used to save for retirement, like employer-sponsored retirement plans, IRAs, and taxable investment accounts. Estimate how much you could withdraw from each of these sources per month to add to your income (without overly depleting the balances that you may need for income in the future, too).

Step 2: Estimate What You Will Receive From Social Security

Next, estimate how much you can expect to receive from Social Security. You can create an account on the Social Security Administration website (www.ssa.gov) and obtain a detailed record of your earnings and estimates for retirement, survivor, and disability benefits.

You can claim Social Security benefits as early as 62, but your benefit increases 8% each year you delay collecting. It’s often best to wait to claim Social Security until age 70, assuming you don’t need the cash flow to boost your retirement income streams until then.

Own a business or rental property that you anticipate supporting your retirement? Will you continue to work part-time as a consultant or turn a hobby into an income source? Don’t forget to include those income sources, too.

Calculate Your Retirement Expenses

If you want to retire in the next few years, think about how your living expenses could or should change. Try estimating what your monthly expense budget will look like in the first few years after you stop working. You can continue to reassess this budget as your vision of retirement becomes reality.

When you build a mock budget, estimate on the high side for expenses and spending.

A majority of people believe that their annual spending during retirement will be 70% to 80% of their past expenditures, but that often isn’t the case.

Because you have more free time without work taking up the majority of your week, there is a lot more opportunity to spend money in retirement. With more flexibility, you may travel more or pick up new activities that you might not have spent money on in your working years.

Assuming higher expenses builds wiggle room into your plan so you can feel more confident the income sources you identified can support your new lifestyle.

Pro Tip

Anticipate your budget during retirement more accurately by keeping a close eye on your spending in the years leading up to your retirement date.

Get Your Healthcare Strategy in Place

Your budget should account for increased healthcare costs, too. The Employee Benefit Research Institute (EBRI) reports that the average 65- year-old married couple retiring in 2019, with average prescription drug expenses, would need about $301,000 in savings to have a 90% chance of meeting their insurance premiums and out-of-pocket healthcare costs in retirement.

Even if you’re healthy and don’t expect major medical bills, you might not have a choice about spending more on healthcare. Healthcare costs are projected to increase almost 5% per year through 2026. If you want to retire within the next few years, make sure to account for this in your planning.

Although Original Medicare (Parts A and B) will cover a portion of your costs, you'll still have deductibles, copayments, and coinsurance. Unless you're prepared to pay for these costs out of pocket, you may want to purchase a supplemental Medigap insurance policy.

Important Questions

Will you purchase supplemental insurance to cover costs Medicare does not (ie: deducibles, copayments, and coinsurance)?

If you purchase supplemental insurance, what coverage should you select?

How will you protect yourself in the case of needing home care, nursing home care or long-term assistance?

Medigap policies are sold by private health insurers and are standardized and regulated by both state and federal law. These plans offer different levels of coverage and may pay many of your out-of-pocket costs.

Another option is Medicare Advantage (also known as Medicare Part C), which is a bundled plan that includes Parts A and B, and usually Part D prescription coverage, and may offer additional benefits Original Medicare doesn't cover. If you enroll in Medicare Advantage, you cannot also purchase a Medigap policy.

For more information, you can visit Medicare.gov -- but know it’s easy to get lost in the Medicare maze. Start by prioritizing the elements of Medicare insurance coverage you think are most important. You can even try categorizing different features by affordability, flexibility, cost certainty, and worst-case protection.

Next, map the features of different healthcare plans you find most important to the strengths and weaknesses of different coverage types. Finally, once you know the best matches you can shop for specific policies and choose the best deal based on where you live. Finally, think about what would happen if you or your spouse needed home care, nursing home care, or other forms of long-term assistance, which Medicare and Medigap will not cover.

Long-term care costs vary substantially depending on where you live and can be extremely expensive. For this reason, people often consider buying long-term care insurance. Policy premiums may be tax-deductible, based on a number of different factors.

If you have a family history of debilitating illness such as Alzheimer's, have substantial assets you'd like to protect, or want to leave assets to heirs, a long-term care policy may be worth considering.

Health Savings Accounts (HSAs)

Did you know a Health Savings Account (HSA) can be considered a type of retirement plan? A (HSA) is a special account available to those participating in a High Deductible Insurance Plan that can be used to pay for medical expenses and other qualifying health-related costs.

As a savings vehicle, the HSA offers a triple tax-advantage unmatched by any other type of retirement savings accounts by offering:

- Contributions that are 100 percent tax-deductible

- Interest and earnings are tax-deferred

- Withdrawals used to pay for qualified medical expenses are tax-free and penalty-free

If you’re already maxing out contributions to a tax-deferred retirement plan like an IRA or 401(k) retirement plan, utilizing your HSA makes sense. You can contribute the maximum allowable yearly (if you’re able to), pay for medical expenses out of your normal cash flow (again, if you’re able to), and then leave your HSA contributions to compound. By investing for retirement in this way, you can build a tax-free fund dedicated to healthcare in retirement and use your other funds for other portions of your budget.

Manage Your Taxes

The years just before and after retirement are crucial because they offer unique opportunities to minimize the taxes you owe over the future decades of your life.

The Power of The Partial Roth Conversion

If a large portion of your nest egg resides in IRA accounts, for example, you’ll have significant required minimum distributions subject to income taxes that eat away at your hard-earned savings. In this case, you might consider using a partial Roth conversion strategy to manage some of your retirement nest egg. A partial Roth conversion moves money out of your traditional IRA so you can pay taxes on it upfront and have a tax-free source of income. And the good news? It’s not a “go big or go home” situation. You can convert smaller amounts over the years and get more aggressive as you near your retirement. If you time it correctly, you’ll also stay within your same tax bracket. At the end of the day, partial Roth conversions can give you a way to make smaller tax payments over time at a lower tax bracket – rather than paying a boatload of taxes later in retirement – and, hopefully, less taxes overall.

Leverage The Insights Of Tax Projections

A tax projection can help with retirement income planning by showing you what your financial future may look like based on certain assumptions. If you’re keen on retiring soon, you’ll want to have some sort of idea of what lies ahead. So, a tax projection can inform how to allocate your existing cash flow so you can minimize taxes today and during retirement. They also help eliminate surprises that you may not want when in your golden years. Whether it’s bundling charitable contributions using a donor-advised fund, avoiding costly partial Roth conversion mistakes, or spending from investments with the lowest tax rate, the years leading up to retirement are optimal for maximizing your tax planning.

Accelerate or Delay Income And Expenses

In addition, business owners may find they can accelerate or delay certain income and expenses to stay below net investment income tax thresholds. You can pre-pay certain expenses before your taxes are due to reduce your taxable income in the current year. However, tax laws are constantly changing, so this isn’t a one-time exercise, but more likely something you’ll need to do annually.

Finally, it’s important to think about the tax impact of your withdrawal strategy. As you think about when to tap your various accounts for retirement income, managing retirement income to the best possible tax scenario can be extremely complicated without guidance.

Pro Tip

Most people are familiar with tax loss harvesting, but there are times to consider tax gain harvesting. Running a tax projection can help identify opportunities to strategically harvest gains in certain tax years to reduce your lifetime tax liability, keep your portfolio in balance, or diversify your concentrated positions.

Reduce and Restructure Your Debt

.png?width=600&height=600&name=Untitled%20design%20(1).png)

What Type of Debt Do You Have?

If you have consumer debt, prioritize paying it off now. Start with high-interest debt, like credit card balances, personal loans, or mortgages. But don’t use a lump-sum withdrawal from your retirement accounts to pay it off—the taxes you’ll pay will likely be higher than any interest savings.

If you still have a home mortgage, consider refinancing before you retire to reduce the interest burden over the life of the loan. But don’t forget about closing costs – these can reduce how much money you actually save, or could extend the point at which you would need to stay in your home to hit the break-even mark.

Should You Refinance?

To evaluate whether refinancing makes sense, a good rule of thumb is to divide your closing costs by the monthly savings. If the answer is 24 or less, refinancing usually makes sense.

If your personal balance sheet is in rock-solid shape and you’re still earning an income, but you don’t have any emergency savings, you may even consider a cash-out refinancing to access some of the equity you’ve built up in your home.

When interest rates are low, you may also be at an advantage. But there are hidden costs (think: appraisal, loan origination fees, recording fees, taxes, and more) to be aware of with refinancing, so make sure the numbers make sense before you take a trip to the bank. If you’re not able to commit to keeping high-rate debt like a mortgage under control, this may not be a good fit for you.

4 Reasons to Refinance

.png?width=746&name=4%20Reasons%20to%20Refinance%20%20(1).png)

Also, if you can’t refinance your home for any reason, you still have options like a loan modification or, depending on your age or current situation, an intrafamily loan.

Pro Tip

A cash-out mortgage refinance offers the opportunity to borrow additional money against the value of your home to pay off high interest debt before retirement.

Plan Beyond Your Finances

Many people express surprise when they learn the first year of retirement is hard on a lot of people. You’ve spent your entire life working with a purpose, but suddenly, you need to find meaning from another source when your career comes to an end. Others struggle with the lack of structure and intellectual stimulation when they no longer have a work week routine or the challenges of their job.

This doesn’t have to be the case. By preparing for the transition now, it’s more likely you will be prepared to address the potential struggles and enjoy the opportunities retirement brings your way. The best way to do this is by having a written retirement life plan.

Just as we know writing down a financial goal increases the odds you will reach it, writing out some of the key elements of a satisfying retirement improves the chances you fulfill those desires in real life.

Great Questions to Start With

Asking yourself questions like these can prompt the kind of information that would be good to include on a retirement life plan so you feel not just financially prepared, but mentally and emotionally, too.

Pro Tip

As you sit down to write out the key elements of your retirement life plan, imagine you have complete freedom and answer the following question...

You are told you only have one year to live.

What would you do with your remaining time and why?

Ease The Transition

These are just some of the factors to consider as you prepare to transition into retirement.

Breaking the bigger picture into smaller categories and using the years ahead to plan accordingly may help make the process a little easier.

To help you out, here are eight categories you can work through to make sure everything is covered.

Your Pre-Retirement Checklist

The following is a list of items to consider if you are five to 10 years away from retirement.

If you don’t have the time, interest or knowledge to complete these items, consider hiring a CFP® to help.

How Will You Spend Your Time?

- Make a list of passions and dreams you’ve been putting off

- Create an average week with time blocks of how you plan to spend time

- How will you challenge yourself?

- What new skills do you want to learn?

How Will Annual Income Change? (Amount Of Money You’ll Need)

- Social Security Analysis – Delay or not? How does this integrate with other expected income?

- Pension – Run break even analysis on best choice (lump sum or annuity stream)

- Any Deferred Compensation plans?

- What percent of your retirement accounts will you need to withdraw each year?

- Opportunities for passive income – Rental property or business P/T work assumptions?

What Amount You Will Spend Each Year?

- Track a full 12 months of spending

- Plan for known potential large purchases (second homes, large home upgrades)

- Types of cars – amounts and how often?

- Travel plans – amounts and how often?

- Potential for family assistance?

- Use appropriate multi-year estimate for health insurance

Net Worth, Assets and Debt Inventory

- What accounts do you have? List all assets and debts in one sheet

- Clarify which accounts are best for long-term savings prior to retirement

- Pay down/off any remaining high interest debt

- Opportunity for refinancing mortgage at lower rate?

- Monitor credit history

- Own a business? How best to structure a sell while balancing tax liability

Tax Efficiency

- What is the best order for account withdrawals from your retirement accounts?

- Can you increase/Max 401k/403b Savings?

- Can you make Roth IRA or back-door Roth IRA contributions?

- After-tax contributions to 401k ability? (Above pre-tax max that later can be moved to Roth IRA)

- Donor-Advised Funds – high basis stock to charity in last higher years of income

- Giving low-basis stock to charity?

- Bunching charitable deductions in one year due to higher standard deduction?

- Begin saving and investing in a health savings account?

- Lower tax by shifting NUA (net unrealized appreciation) in an individual stock in 401k to brokerage

- Identify holdings for loss harvesting to offset large gains in taxable accounts

- Could you delay income to stay in lower brackets?

- Does a Roth IRA conversion make sense?

- Save in FSA for health care and dependent care

- Realize capital gains at 0% tax rate, if possible

- After 401k and HSA, begin saving in a Deferred Compensation Plan if an option

- Start a 529 college savings plan for a child or grandchild

- Have any variable annuities? Could you use a 1035 exchange for tax-free growth due to loss or surrender?

- What are the Pros/Cons of rolling over your 401(k)?

- How will any outstanding stock options/RSU/ ESPP vests affect tax brackets?

Investment Strategy Decisions

- Risk Capacity – when/how much will you need from investments?

- Are investments appropriately diversified for expected annual cash needs?

- What are your annual expected returns?

- How will return assumptions change during recessions/bear markets?

- How should asset allocation change with retirement X years away?

- How will risk tolerance change when paycheck stops? (ability to not sell when stocks are down)

- Any high concentration in an individual stock position?

Insurance

- Create a plan for health insurance pre 65 - COBRA (if retiring early)/ health insurance

- If an early retiree, could you qualify for the Healthcare PremiumTax Credit?

- If you are an early retiree, could you be added to your spouse’s plan?

- Disability Insurance – could become important income replacement before 65

- Still need life insurance?

- Need long-term care insurance?

Estate

- Review of estate plan results

- Assure beneficiaries are accurate (better tax distributions for heirs/ charities)

- Establish estate docs (Will, POA, HC POA)

- Assure guardian and children’s trust is set up if still under 18

- Analyze giving strategies while living to minimize estate

Next Steps

Thinking about retirement can be stressful even in the best of times. But the help of a financial advisor acting as a fiduciary at all times can make implementing any of these strategies more effective.

Your long-term financial success will be greatly impacted by the strategic decisions you make, so it’s important to get it right – particularly in the years and months leading up to your retirement.

If you take these steps listed above, you'll be in a better position to enjoy the retirement you always envisioned. For a fully integrated financial plan that takes into account your retirement goals and the changes in the market, you can work with the Plancorp team. Just reach out and schedule your complimentary 15-minute consultation here.

Download the PDF Version

If you like the above content you can download PDF version of it here.

Disclosure

For informational purposes only; should not be used as investment tax, legal or accounting advice. Plancorp LLC is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC. All investing involves risk, including the loss of principal. Past performance does not guarantee future results. Plancorp's marketing material should not be construed by any existing or prospective client as a guarantee that they will experience a certain level of results if they engage our services, and may include lists or rankings published by magazines and other sources which are generally based exclusively on information prepared and submitted by the recognized advisor. Plancorp is a registered trademark of Plancorp LLC, registered in the U.S. Patent and Trademark Office.

Like What You’re Reading? Get Insights to Your Inbox. Unsubscribe Anytime.

Schedule a Call With a Wealth Manager to Get Started

Let Plancorp help so you can focus on making the most of your wealth

- Personal & Business Solutions

- Popular Resources

- Free Financial Analysis Tool

- Money Match Quiz

- Fee & Value Calculator

- Early Retirement Guide

- Equity Compensation Guide

- Estate Planning Guide

- Employee Stock Purchase Plan (ESPP) Guide

- Restricted Stock Units Guide

- Invest by Age Series

- Glossary of Financial Terms

- Client Guide

- What to Expect During an Advisor Transition

St. Louis, MO | Nashville, TN | Sarasota, FL | San Francisco, CA

Direct: 636-532-7824 | Toll Free: 888-220-1163

- Legal Notices

- Privacy Policy

- ADV Part 2A

- View Cefex Certificate

- Form CRS

- Press Room

- Cyber Security Policies

- © 2026 Plancorp, LLC.

© 2026 Plancorp, LLC. All Rights Reserved.