“It’s the perfect opportunity to save taxes!” This is a statement that is typically only exclaimed by tax accountants, but as a CPA, this opportunity had me excited. I was able to proactively tax plan for two of my favorite people, my parents.

After a 30+ year career, my dad was planning to retire at the beginning of 2018. Thanks to the Tax Cuts and Jobs Act of 2017, individual tax rates were going to fall, and standard deductions were going to rise in 2018. This meant my parents had a fantastic opportunity to take advantage of the changing tax landscape and save money on their tax return.

We were able to set up a donor-advised fund at the end of 2017 and take advantage of the deductions in a year when tax rates were high, and my parents were in a higher tax bracket in the final year of my dad’s career. Ultimately, this would save my parents nearly $15,000 in taxes—and send them into retirement assured they could support their favorite charities for years to come.

The Mechanisms of a Donor-Advised Fund

A donor-advised fund is a fund that you can make tax-deductible donations to, the donations can grow tax free, and you can support your favorite charities now and in the future.

You receive the tax deduction when you place the assets in the donor-advised fund, not when the funds are distributed out to the charity of your choice. For more on the benefits of donor-advised funds and how they work, click here.

You can place many types of assets into a donor-advised fund including cash, stocks, and real estate. Most people donate appreciated stocks into the fund because of the added tax benefit. You can take a deduction* for the fair market value of the stock (as opposed to your purchase price) and never recognize the gain on the stock as you would if you sold it. You can donate appreciated stock directly to a qualifying charity; however, keep in mind some small charities don’t have the resources or experience to know how to handle a stock gift.

*Note: Stock (or other appreciated assets) should have been held for one year or more before donating. Otherwise, the deduction is limited to basis (i.e., purchase price) versus fair market value.

Timing for Tax Benefits

The ability to take a tax deduction when you place your assets in the donor-advised fund is a powerful tax mechanism. Timing the deduction to coincide with a year when you receive a large bonus, sell a company, or have another extraordinary income event is a great benefit. You can take the deduction in the year you are in a higher tax bracket, and front-load your donor-advised fund to make donations now and in the future.

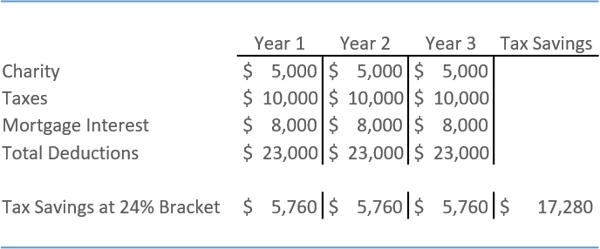

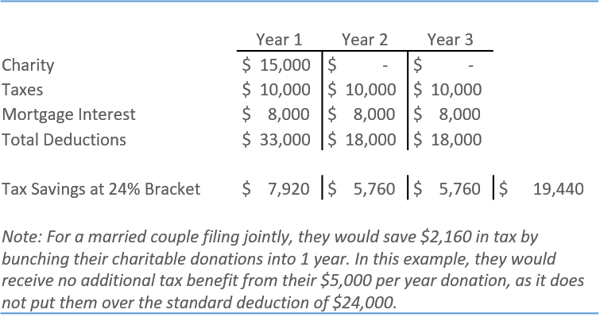

Even if you do not have a big income event, you may want to consider “bunching” your donations every couple of years. Many people who previously itemized their deductions will now be using the increased standard deduction. For example, if you don’t think you will be over the standard deduction with your normal yearly gifting, you may want to donate 3-5 years’ worth into the donor-advised fund in the current year. You can then take advantage of the itemized deduction in the high donation year, take the standard deduction in the subsequent years, and disburse the funds to charities over the next 3-5 years ratably as you typically would on a yearly basis.

There are a few things to remember when donating to a donor-advised fund.

-

Do not let the “tax tail wag the dog.”

This means you should not let the tax benefits be the deciding factor in donating to a donor-advised fund. Once you make the donation, you cannot get the assets back out of the fund for personal use.

-

Remember, you’re in control of the fund.

You decide the timing of the donations into the donor-advised fund and back out of fund to the charities of your choice. Donor-advised funds have been receiving some negative press as a black-hole that people use to receive a tax deduction, and then do not distribute the assets out to charity. The choice of when to distribute funds to charities is strictly up to you, the donor. You control your donor-advised fund, investments and the distribution of the assets.

-

Know the minimum requirements.

There are minimum donations required to establish a donor-advised fund, minimum subsequent donations, and minimum gifts to charity set in place by the major institutions which run donor-advised funds. There are also annual administrative fees charged to maintain the fund at the institution. This article compares minimums and fees of the three largest funds.

One year later, my parents are loving their donor-advised fund. It is simple for them to make donations to their favorite charities from the fund, and they don’t have to worry about the administrative headache of keeping track of their donations and donation letters from charities. My dad is enjoying the beginning of his retirement, which has been even sweeter thanks to the tax savings and the fulfillment of long-term, charitable goals provided by the donor-advised fund.

Next Steps:

If you’re ready to start making smart decisions with your money and build your wealth, here a few resources you may find helpful:

- Take a brief financial wellness analysis and learn in just 9 questions your biggest areas of opportunities you should be focusing on in your finances.

Disclosure:

This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own tax, legal and accounting advisors.