On average, Social Security replaces around 40% of income for retirees, and even less for high earners. So unless you’ve got a cushy pension lined up, that means the majority of your retirement income will be a result of your own planning and investing. Enter the glory of the 401(k).

These employer-sponsored plans have many incredible benefits, including tax advantages, high limits, and employer contributions. If your company has a 401(k), taking advantage of each and every benefit can help you gain control of your retirement and make real progress.

-

Save Money on Taxes

The U.S. government is personally invested in you saving for retirement, because they would prefer not to take care of you in your old age. So when you save into your 401(k), Uncle Sam will give you tax benefits on these dollars, and they’re a big deal.

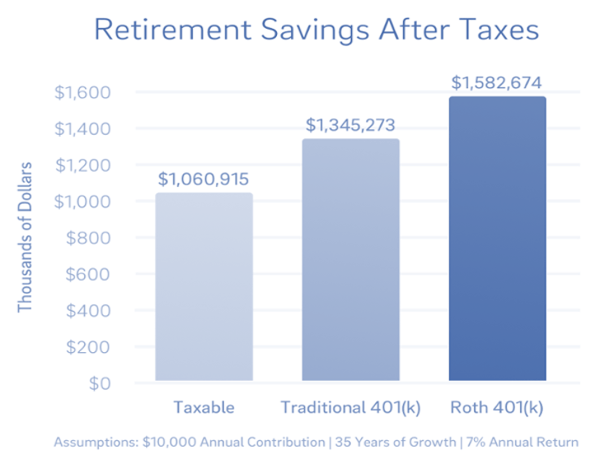

Each dollar you lose to taxes can’t fund your retirement, so it’s smart to take advantage of every opportunity to reduce taxes. Whether you choose to save Pre-Tax or Roth, you will have a tremendous benefit over other investment accounts.

See the illustration below to compare how saving $10,000 per year into different types of accounts affects your After-Tax wealth at retirement.(1)

-

Enjoy High Contribution Limits

In 2018, the most you can save into your 401(k) is $18,500 per year. If you have crossed the 50-year-old mark you can save an additional $6,000 in “catch-up contributions” bringing the total to nearly $25,000. Compare that to other retirement accounts, like Traditional or Roth IRAs, which have a limit of $5,500 and Catch-up of $1,000.

If you want to save more for retirement, the 401(k) is likely the easiest spot to do so. Most people aren’t saving anywhere close to the dollar limits, leaving an open opportunity to save. Work to Increase your savings rate every year until you reach the 401(k) maximum.

-

Earn A Lot? You Can Still Contribute

Traditional and Roth IRA’s are great accounts. But many high-income earners either can’t save into these accounts or lose the tax benefits. (See these tables from the IRS if you are unsure whether your income limits Traditional or Roth IRA eligibility.)

If your income phases you out of using these accounts, we’ve got good news. Anyone, regardless of income, who saves into a 401(k) receives the tax benefits. If income limits preclude you from using the Roth IRA or using the tax advantages of an IRA, the 401(k) could be the only tax-advantaged account you can save into.

-

Automate Investing for Retirement

I truly believe that most people want to save more. I hear it all the time during 401(k) seminars. It’s just difficult to follow through. That’s why we frequently celebrate the beauty of automation, which is a great advantage of 401(k)’s.

Once you decide how much to save and how to invest it turns into an automatic savings plan. Every paycheck, like clockwork, your contributions are automatically invested in the funds you selected. It takes no time, effort, or discipline. You may be able to take automation a step further with an automatic yearly increase to your savings rate. If you can, do it. This will ensure you save more as your career progresses.

Don’t get too comfortable though. Review your plan annually, I suggest January 5th, to check on your savings rate and investment choice.

-

Grow Your Nest Egg with Employer Contributions

Who doesn’t love more money. Potentially the most valuable feature of your 401(k) is the employer match. Whether your company directly contributes to your plan, or matches a percentage of your contributions, this benefit can supercharge your account.

I view employer match dollars as a company raise. If your employer matches the first 3% you contribute, but you don’t make the contributions required, you are missing out on money. So find out how much you need to save to get the maximum company match and make that your primary financial goal. Take the raise – you deserve it.

Get More from Your 401(k)

You knew 401(k)s were great, but hopefully now you love yours a little more. If you haven’t taken advantage of all these benefits, take the time now to sign in to your provider’s website and make the change. Typically it takes less than 10 minutes to make a seemingly small change that could have a huge impact on your retirement.

Next Steps:

If you’re ready to start making smart decisions with your money and build your wealth, take a brief financial wellness analysis, and learn in just 9 questions your biggest areas of opportunities you should be focusing on in your finances.

Disclosure:

This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own tax, legal and accounting advisors.

.png?width=266&name=Copy%20of%20blog%20featured%20image%20(2).png)