Don’t put all your eggs in one basket. We’re taught this from a young age as a basic way to understand that failing to diversify in a variety of scenarios increases risk of a negative outcome, and your finances are no different. The future is not predictable, and even seemingly rock-solid stocks can face unforeseen downturns when you least expect them. That's why diversification has been an essential principle in the investing world for decades. It's an effective investment strategy that’s easy to understand.

That said, the definition of what asset allocation, but diversification goes beyond a high-level allocation, and should emphasize diversity across all asset types as well as within them (meaning a 60/40 portfolio isn’t actually diversified if the 60% stocks are all one company, industry, or company size).

Generally, a properly diversified portfolio will contain dozens of stocks across various industries, or exchange-traded funds (ETFs) that serve the same purpose, but it will also have bonds, cash, and other types of investments.

A word of caution when it comes to building a diversified portfolio: In the face of investment commoditization and robo-advisors, a one-size-fits-all approach to portfolio management is forgetting one major factor: You. Your retirement time horizon, your tolerance for risk, your investment goals, and the size of your retirement funds will all affect your asset allocation decisions and the ways in which your portfolio is diversified throughout your life. If you thought your financial plan or investment strategy was a set it and forget it activity, you’re missing out.

So how can you make sure your portfolio is properly diversified?

What is Portfolio Diversification?

Investors can diversify their portfolios in many ways, but at its core, diversification generally means that the portfolio is not concentrated in one area. In a simple scenario, you might understand not wanting to own all one stock, but you’d be surprised how many folks have a concentration like this from stocks that were gifted or earned through an employee benefit like equity compensation. For most investors, though, diversification typically means across asset classes.

The main asset class that investors think of is equities (synonym for stocks). Stocks are typically viewed as riskier but offer a higher return. Investors add equities to their portfolio when they want or are able to take on more risk for a higher return. Investors can diversify within the equities part of their portfolio through Mutual Funds, ETFs, and other tools, allowing you to truly move toward owning the market. This helps reduce the volatility of the equity portion of the portfolio by diversifying against a drop in a certain company, industry, or sector.

Fixed income is the other tool used in diversification. Fixed income, or bonds, treasuries, etc., offer the ability to reduce the volatility or risk of a portfolio. The asset class offers lower returns for a more stable risk level. In fixed income, there are different assets you can diversify with. Government and Corporate bonds can be used to further diversify.

Intertwining the two asset classes and diversifying within them helps reduce or increase the risk in a portfolio to different levels.

Why is Portfolio Diversification Important?

To put it bluntly, diversification is important because it is a tenant of what will make your investments and your overall financial plan something you can actually rely on to plan your life. You may look to reduce the downside potential and volatility risk depending on multiple aspects affecting your life, meaning the appropriate amount of diversification depends on the personal investor.

For most investors, your portfolio will be the sole source of income when you retire. It will also be a significant part of the estate you pass on to your heirs. Failure to diversify puts those goals at risk.

What is the Benefit of Diversification?

Portfolio diversification offers distinct advantages that have been well-documented. Here are some of the benefits of proper asset allocation:

- Reduces risk in your portfolio.

- Optimizes asset allocation.

- Protects capital for retirees.

- When you portfolio is properly diversified and researched, better investments can be discovered.

- Increases peace of mind.

While there are significant benefits to diversifying your portfolio, it's important to be aware that there are some potential drawbacks. Disadvantages of diversification include:

- Too much diversification to lower risk could lead to lower overall returns. (It’s a balancing act).

- Takes more time to research and manage your investments.

- Takes a higher level of financial literacy to understand investment vehicles.

- Does not eliminate risk completely.

Diversification is a trade-off, but the protection it offers often far outweighs the risks. The most common risk to diversification is that in a year where a single stock, fund, or asset does incredibly well, you won’t see as much benefit as those who’s portfolio is made up completely of it. In those situations, it’s important to remember that you aren’t investing to gamble, you’re investing to reliably grow and fund your future.

How Diversification Reduces Risk

Diversification reduces risk by distributing your investments across multiple asset classes, but the amount of risk reduction you need will depend on your situation. If you’re retiring in a few years, you’re likely to have a lower tolerance for risk.

Every situation is different. If you’re retiring soon but have a large amount of investible assets, you may be fine with aggressively investing a portion of your portfolio that you’re planning on passing to your heirs.

Alternatively, if you’re decades from retirement, you’re likely to invest more in stocks because you have time to overcome market downturns. This is where your personal risk tolerance comes into play, because if you can’t stand to see your investments ebb and flow in the ever-changing market, you may still want to increase your bond allocation.

How Can You Measure Diversification in a Portfolio

Before uncovering how to measure diversification, you need to understand what risk and volatility are. While many think of “downturns” as volatility, the reality is that volatility is defined as any change in the market as measured by how varied returns are across the entire market (known as dispersion of returns). When the market isn’t volatile, most things are performing similarly, so when we think of volatility increasing risk, it’s because it decreases predictability, not just returns.

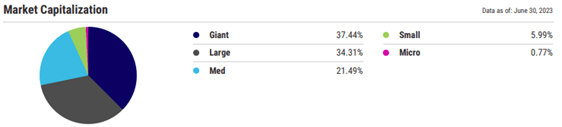

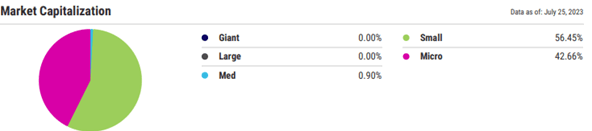

Unlike volatility, there is no set way to measure the amount of diversification in a portfolio, because you can diversify against many different things. For example, you might wonder how much of the portfolio is spread across company sizes or market sectors? In this scenario, you’re evaluating your exposure to a single asset class, like seeing all large or small cap.

Let’s look at two different portfolios to draw a clear distinction:

- VT (Vanguard Total Stock Market) encompasses the entire market of US investable securities.

2. IJR (iShares Core S&P Small-Cap ETF) tracks the S&P SmallCap 600 Index

At the highest level, these are funds made up 100% of stocks, but these two portfolios are completely different in their composition. The first is more diversified over market capitalization (company size) than the second, which focuses on smaller companies, or “small caps”. This is one easy way to observe diversification, but it might not always look this clear cut, and when we think back to what adequately diversified means, it’s a balance across several factors, not just asset type or company size.

In a portfolio, you can diversify in multiple ways. You can diversify based on geographic location (are you investing in US-based companies, internationally, or from emerging markets?), market size, value, growth, etc. A well-diversified portfolio is designed in such a way that the potential impact of an individual asset hypothetically “going to zero” is mitigated, minimizing its adverse effect on the overall portfolio's performance.

A Financial Advisor's Role in Portfolio Diversification

Diversification is one of the most important principles in investing, and allocating your assets correctly will protect your investments and give you the best opportunity for long-term growth.

Choosing the right asset allocation and rebalancing appropriately over time takes time, knowledge, and hard work, particularly in the modern era when the entirety of “the market” has become so complex and fast moving. That’s why more investors are turning to financial advisors.

Financial advisors can analyze your investment portfolio, provide guidance on the correct way to diversify for your risk tolerance and life stage, as well as make sure your investment strategy plugs into a more comprehensive financial plan with tax strategy, estate planning, and insurance or benefits. If you’re not sure if your portfolio is properly diversified or you don’t have the time to rebalance, reach out to a financial advisor to see how they can help.