If you’re like me, the wrap of last month’s Olympic games left you wondering: What do I watch on TV now? The global competition gave us all new respect for how much time and dedication Olympic athletes put in for the games, a sense of inspiration for the next generation, and a view into how global our world has become.

The 2018 Winter Games set a record for a total of 92 countries competing the in the Olympics, compared to just 14 in the first modern Olympic Games in 1986.1 But it was also a year of records in the investing world, with 2018 bringing a record low average expense ratio paid by fund investors—meaning you get to keep more of your money working for you over its investable life.

Just as the Olympics have grown and modernized over time, so should your investment strategy. Thankfully, it’s easier than ever to own a low-cost, globally diversified portfolio.

The Competition Is Fierce

Neither the Olympics nor your investing portfolio lacks competition. But in both, there’s only one gold medal.

In the Olympics, the gold medal eventually goes to one specific country; in investing, it goes to portfolios that minimize risk while maximizing returns. At Plancorp, we put our clients’ best interests first by investing you in a globally diversified portfolio, ensuring you don’t risk too much on a “hot investing trend,” but that you also don’t miss out on broader market returns.

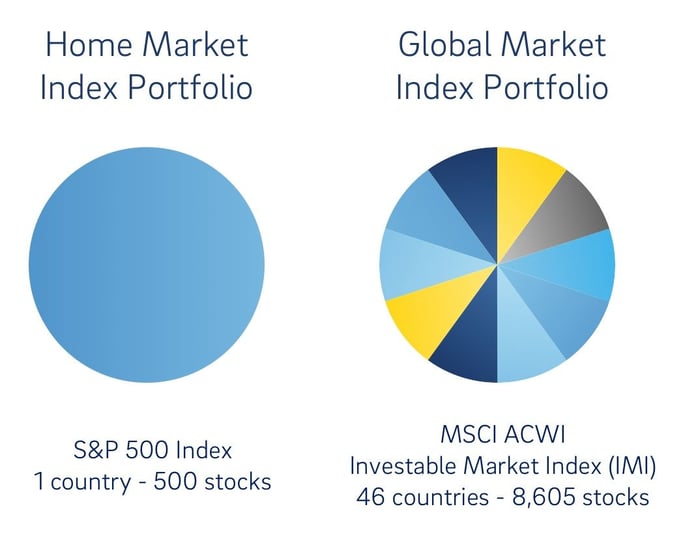

Just like the commercials we were forced to watch in anticipation of gold medal runs, we invest the U.S. Equity portion of our portfolio to include such advertising favorites as Coca-Cola, P&G, Visa. The international portion of the portfolio includes innovative companies like Samsung, Toyota, and Volkswagen. The chart below shows the world of opportunities for a Plancorp investor compared to only investing in the U.S.

Playing It Safe

Just as an Olympic athlete has to train carefully to avoid injury—but also work hard to bring her best—your goals as an investor is to reduce risk without sacrificing returns.

A globally diversified investment portfolio helps you do just that. While America is home to some of the best companies in the world, there are many great companies outside the U.S. Nearly three-quarters of the world’s companies are headquartered outside the U.S., and international investments make up about half of the global investment opportunities for your hard-earned money.

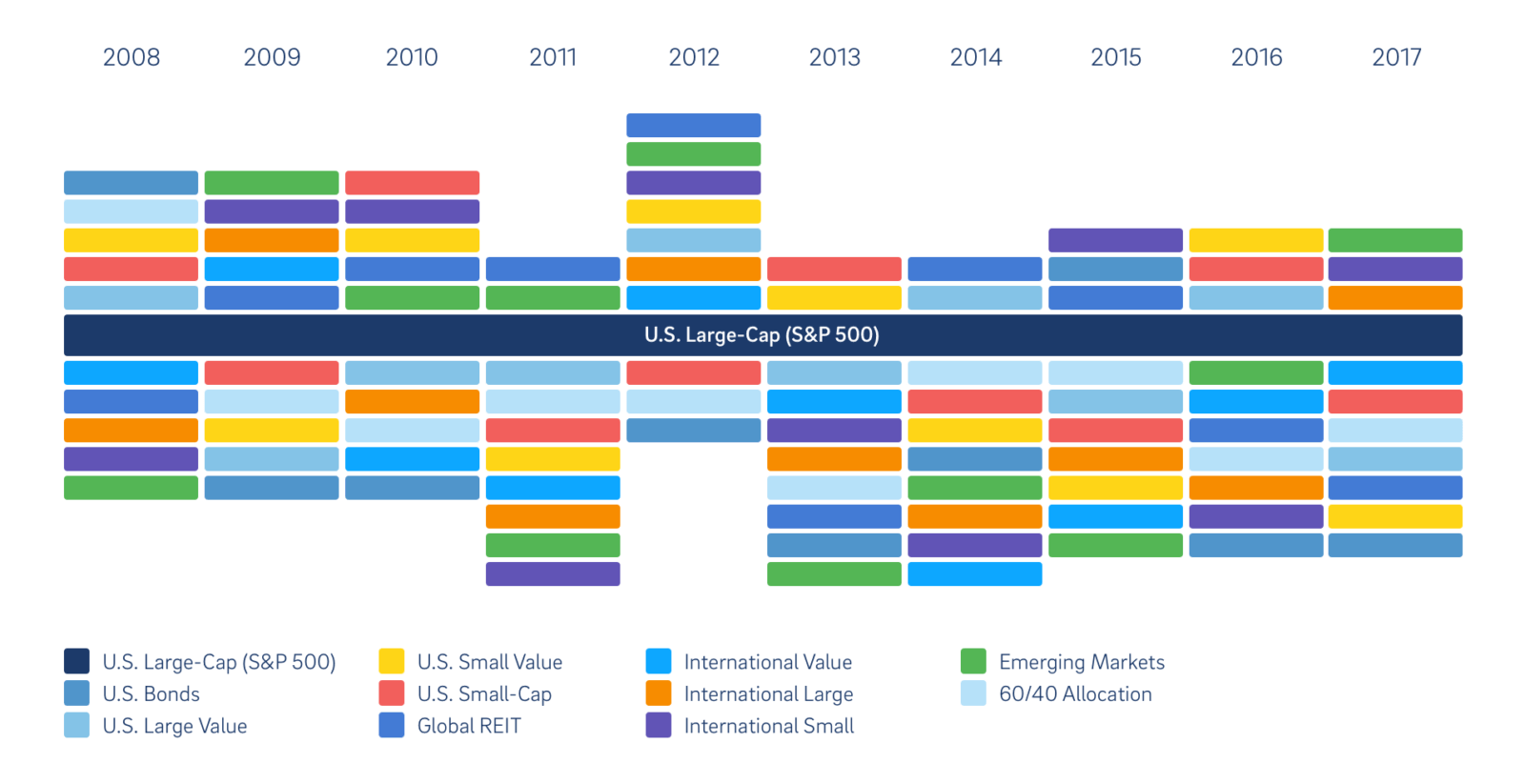

As the chart below shows, it’s impossible to know which country will outperform on any given year. But the good news is to we don’t have to predict correctly to still profit.

Imagine this same chart could show the performance of each country in Women’s Ice Skating from year to year. You might use it to predict which country will win next year—but then be very wrong when their routine doesn’t go as planned. Fortunately, you don’t have anything to lose, because you’re not betting on that specific country (or, in the case of your portfolio, on a specific stock).

Attempting to identify the next big winner is a guessing game, but diversification improves your odds of owning the best performers.

By expanding your investment opportunities beyond the U.S. markets, it can help increase the consistency of the investor outcomes. A globally diversified portfolio positions you well to pursue returns wherever they might occur.

American Pride

While it’s fun to cheer for Olympic athletes from all over the globe, most of us favor the U.S. athletes and their stories to success. It’s OK to favor your home country in investments, too, as long as you are globally diversified overall. U.S. Stock Markets are very efficient and liquid. That means they’re cost effective to invest within. U.S. Government Bonds are backed by the strength of our government and economy, and have tax advantages to boot.

Finally, we live in a global economy. Technology and globalization have shrunk borders, so even a person invested “only in U.S. stocks” will have a global portfolio, because today’s largest companies are finding customers all over the world. In fact, nearly half (44.3%) of the sales of S&P 500 companies come from overseas. These reasons, plus the slightly higher price tag on investing outside the U.S., lead us to have a little bit of “home bias” in our portfolios.

You might have to wait another four years to see which country will be the fastest down the mountain. But the good news is you don’t have to wait another four years to benefit from a globally diversified portfolio; we have a great one built to help you go for global today.

1 https://www.history.com/this-day-in-history/first-modern-olympics-is-held

—

This post was written by a member of InspireHer, Plancorp’s Women’s Initiative, which strives to advocate for clients and women in the community by addressing topics specific to their financial lives. For more information about InspireHer and how you can get involved, email inspireher@plancorp.com.

-4.png?width=266&name=Copy%20of%20blog%20featured%20image%20(1)-4.png)