Nobody wants to see their portfolio balance drop in a down market. But if you invest for the long term, experiencing ups and downs along the way is inevitable. Tax loss harvesting is one way to use market volatility to your advantage and keep your financial plan moving in the right direction.

This process is underpinned by the standard that capital losses can be claimed on your taxes. By selling certain types of underperforming securities at a loss, you get a tax break when it’s time to settle up with the IRS. Here’s how it works.

What is Tax Loss Harvesting?

Tax loss harvesting allows you to reduce your tax bill by offsetting capital gains with capital losses while maintaining your exposure to the market so you don’t miss out on future gains or the magic of compounding.

When you sell a capital investment at a loss, you can use the loss to offset capital gains in other areas of your portfolio. From there, you reinvest the proceeds from the sale in a similar security that aligns with your investment strategy.

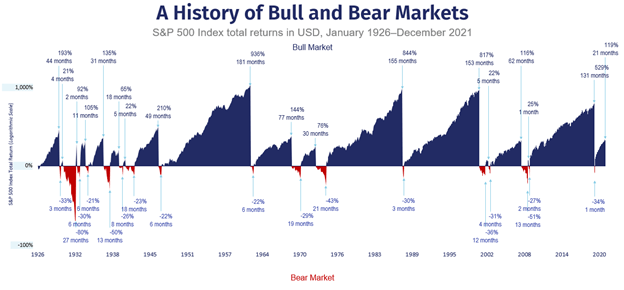

This piece is crucial because it keeps you invested in the market, allowing you to realize future gains during the next upswing, which we know statistically balances out losses.

What is the Wash Sale Rule?

What is the Wash Sale Rule?

If you want to harvest the losses from the sale of investments in your portfolio, you must abide by the IRS’s rule governing what securities you can buy to replace them.

You cannot repurchase the same or a “substantially similar” investment within 30 days of selling a security at a loss. If you do, you won’t be able to claim the loss on your taxes.

This rule also comes into effect if you purchase the same or a “substantially similar” investment in the 30 days leading up to the sale. It’s known as the wash sale rule.

And here’s the tricky part. The rule doesn’t just apply to one investment account. It applies to your entire portfolio. So, if you sell XYZ fund from investment account A and buy the same or a “substantially similar” fund in investment account B 15 days later, it will trigger a wash sale. And you won’t be able to claim the loss on your tax return.

While the concept of tax loss harvesting is simple, keeping track of individual investments and timing sales to avoid tax trouble can get complicated if you opt for a DIY approach.

A professional can help you avoid pitfalls like this. Registered Investment Advisors like Plancorp review client portfolios for opportunities to harvest tax losses strategically and in compliance with the most current tax laws.

How Does Tax Loss Harvesting Work?

Tax loss harvesting can be a powerful tool for reducing your tax exposure, but you can only use it in taxable accounts. You can’t use it with qualified accounts, such as 401(k)s, 403(b)s or IRAs because you can’t deduct losses from tax-deferred accounts.

If you choose to employ tax loss harvesting as part of your investment and tax reduction strategy in a given year, you must complete all harvesting by December 31. Here’s a brief overview of how it works.

1. Sell Investments at a Loss

To implement tax loss harvesting, you must have capital securities you can sell at a loss. There’s no minimum or maximum limit to what you can sell. But it might make sense to harvest at least $5,000 of losses to incur a meaningful return.

2. Reinvest the Proceeds

Use the proceeds from the sale of the investments to purchase new securities. To avoid a wash sale, you must choose funds that are not identical to the ones you sold at a loss. But you shouldn’t abandon an overarching allocation strategy for a one-time harvest

3. Offset Investment Gains With Investment Losses

Use your capital losses to offset taxable capital gains at the end of the year. You must first use short-term losses to offset short-term gains and long-term losses to offset long-term gains.

If there are losses remaining after that, you may use them to offset the remaining gains, no matter what type they are. If you offset all your capital gains and still have losses left, you can use them to reduce your taxable income by up to $3,000.

4. Carry Losses Forward

Based on the tax law at the time this article was written, you can carry capital losses forward into future years indefinitely if you don’t have enough gains to offset them during the current tax year. This can be critical to lessening the overall impact of market volatility on your financial independence analysis.

How Important is Tax Loss Harvesting?

Tax loss harvesting is an effective tax planning strategy that can lower your tax bill today and in the future—if you have losses to carry forward. It can also be used as part of a rebalancing strategy.

If you’re overly invested in a particular individual stock and that investment is currently trading at a loss, you can sell it to realize a loss. Then, reinvest the proceeds to realign your asset allocation with your investment goals.

Is Tax Loss Harvesting Worth It?

The best investment strategies vary by age, life priorities and financial goals. While tax loss harvesting can provide tax savings to any investor, it benefits individuals in higher tax brackets who are subject to significant capital gains taxes the most.

Since the point of the strategy is to lower your tax bill now and in the future, investors with higher tax rates can save more by harvesting losses to offset gains. Because you’re reinvesting and not cashing out of the market when you sell, there’s little downside to using this strategy.

Tax Loss Harvesting Examples

We’ve seen the impact of effective tax loss harvesting in action over our decades of experience. Here are two examples of how tax loss harvesting can minimize your tax burden while keeping your investment strategy aligned with your goals.

Current Year Losses

Let’s say you’re overly invested in the U.S. stock market, so you decide to sell a portion of your U.S. stock holdings. In doing so, you realize a gain of $80,000 on a stock you bought less than a year ago. Since you held the stock for less than a year, you have to pay short-term capital gains tax on it at your ordinary income rate. That rate is higher than the long-term capital gains tax charged on gains from investments held for more than a year.

To help offset these gains, you sell shares of Company Y stock for a short-term capital loss of $90,000. When you file your tax return, the $80,000 short-term gain is offset by the $90,000 short-term loss, meaning you owe no taxes on the capital gain.

After offsetting the capital gain, you’re left with $10,000 in capital losses. You can use up to $3,000 of it to offset your ordinary income and carry the remaining $7,000 forward to offset capital income in future tax years. If you have a 37% marginal tax rate, the overall tax benefit of harvesting the losses could be as much as $30,710. Here’s how it breaks down:

By offsetting the capital gains of Company X with your capital loss of Company Y, you could potentially save $29,600 on Federal taxes alone ($80,000 × 37%). Because you lost $10,000 more than you gained ($80,000 – $90,000), you can reduce your ordinary income by $3,000. This lowers your tax liability an additional $1,110 ($3,000 × 37%) for a total savings of $30,710. And that doesn’t include potential savings you may achieve on your state income tax.

But what happens if you don’t have any capital gains to offset? Let’s look at another example.

Future Losses

Let’s say you’re a single-income tax filer holding Company Y stock. You purchased it for $30,000, and it's now worth $10,000. You sell it and recognize a $20,000 capital loss. Because you want to maintain your exposure to the market, you use the proceeds to immediately buy shares of Company X stock after determining it meets your overall investment goals.

You use the $20,000 capital loss from Company Y to offset $3,000 of ordinary income for the current year. If your marginal tax rate is 37%, your tax benefit would be $1,110 ($3,000 × 37%). You don’t have any capital gains to offset, so you “bank” the remaining $17,000 of losses as a capital loss carryforward to use to offset capital gains you incur in the future (under the tax law at the time of this article)

Conversations With an Advisor About Tax Loss Harvesting

Tax loss harvesting can be a silver lining in a volatile market. If your current financial advisor hasn’t spoken to you about using tax loss harvesting to your advantage through market volatility, it may be a sign that it’s time to work with a new advisor.

Proactive tax planning can help protect your family’s finances and preserve future wealth. Tax loss harvesting is only one of many strategies you can use to minimize your taxes and save more of your hard-earned money.

At Plancorp, we use comprehensive tax planning, including harvesting losses, as part of a holistic approach to managing your finances. Our services go beyond basic investment management and include estate planning, insurance analysis, entitlement strategies and more.

Working with an advisor can help you avoid mistakes that may lead to worse after-tax performance and reduce the stress that comes with managing your finances on your own.

Contact us today to find out how we can work with you to create a comprehensive plan to achieve your financial goals.