In every area of life, our values shape our goals—and those goals give us direction. Whether it’s planning a vacation or training for a marathon, we’re not just chasing outcomes; we’re pursuing what matters most, like quality time with family or personal well-being.

But when it comes to money—something that touches every part of our lives—many people operate without a clear plan, reacting to market shifts or chasing returns without anchoring their decisions in purpose.

.png?width=400&height=400&name=values%20based%20planning%20(1).png) Traditional investing often floats at the surface, focusing on metrics like risk tolerance and time horizon. Goals-based planning dives a bit deeper, connecting financial strategies to personal objectives. Yet even that can leave the deeper “why” unanswered.

Traditional investing often floats at the surface, focusing on metrics like risk tolerance and time horizon. Goals-based planning dives a bit deeper, connecting financial strategies to personal objectives. Yet even that can leave the deeper “why” unanswered.

Instead of chasing returns or reacting emotionally to the market, values-based investing keeps your financial decisions grounded—like the submerged foundation of an iceberg—in what truly matters: your life, your family, your future. It’s a planning approach that aligns your money with your meaning.

Here are five powerful reasons to choose a values-based, goal-informed approach to your financial plan.

Your Priorities Define Your Financial Goals

Too often, financial “planning” starts with a product, like an investment strategy or a retirement account. Please know, product-based approaches do NOT result in holistic financial planning. A meaningful financial plan should begin with you.

A values-based, goal informed financial plan starts by identifying what matters to you most, who is impacted by your financial plan, and where you’d like to go, then builds a strategy to help you get there.

Whether your priorities include funding a college education, purchasing a vacation home, or retiring early, the plan centers around your personal goals and how they speak to your values, not arbitrary benchmarks.

Rather than focusing only on your net worth or a magic “retirement number,” values-based planning allows you to allocate resources toward multiple goals and objectives simultaneously:

- Saving for a new or second home, or for extended travel

- Growing retirement savings in tax-advantaged accounts

- Developing a hybrid tax strategy for investments to fund retirement income in a tax efficient manner

- Setting up a legacy plan through trusts or charitable giving

In short, your plan becomes as dynamic as your life.

Goals Become More Meaningful—and Attainable

Big financial goals can feel overwhelming no matter how good your financial footing, especially when you’re not sure how much money you’ll need in the long term for things like medical care.

Anyone can be thrown off course by life’s challenges, like caring for a loved one during an illness. A values-based financial plan focuses on prioritizing spending where it means the most and saving and investing where it can be most impactful.

For example, instead of vaguely saving for “the future,” a values-based approach helps you define the goals that align with your values. This helps to distill more exact amounts needed, but also to prioritize what comes first to you and your family.

It could be a choice of timing, for example, between a child or grandchild’s private high school tuition or a once-in-a-lifetime vacation for the entire multi-generational family (or yourself!)

Both of these targets become measurable and attainable, but maybe not at the same time. When digging deeper into your values, we can have a better conversation. Maybe both education and family experiences are your stated and shared values. Both values “win” in the end, but it informs the discussion of which comes first, and which is non-negotiable.

In this case, if I were the advisor I would offer that we should look at what IS negotiable about both goals. Is this private school versus a less expensive one important to you? Maybe – it depends on whether the value you are seeking might be compromised. Education might hold steady at both, but potential connections for the future might look different.

What about the vacation? Does it have to be an international trip? Does it need to be 2 weeks? If there isn’t a compromise on costs, then there will need to be one on timing, or other expenses in life (is grandpa willing to sell the boat that he hasn’t used in a year?).

Using this method, families can better balance the priorities of their goals and values with their long-term but dynamic financial plan, avoiding the trap of overcommitting to one at the expense of another.

Saving Doesn’t Feel Like Sacrifice—It's Planning

“Save more money” is a common resolution—but without purpose, it rarely sticks. Many have saved and run the race, but they don’t feel comfortable spending down what they sacrificed so much to build.

Believe it or not, we see many clients who struggle with spending. A values-based plan gives your savings, and your spending, meaning.

For those in savings mode, instead of saying, “I want to save 10% of my income,” imagine saying, “I want to set aside $5,000 this year to take my family on a national park adventure.” That’s a plan that’s much more motivating.

or those who are drawing on their hard-earned savings, spending an extra $5,000 a year for meaningful family experiences can be much more palatable.

Knowing why you’re saving and why you’re spending not only improves your motivation but also helps control overspending. Instead of feeling restricted, you feel empowered—because every dollar saved moves you closer to a goal that matters and reflects your values.

You Avoid Overshooting—or Undershooting—Your Targets

One of the biggest risks in financial planning is misalignment. Some people save too little, which jeopardizes their financial future. Others save more than necessary, sacrificing enjoyment today for uncertainty tomorrow.

A values-based plan with aligned goals helps you optimize your strategy, not just maximize it.

For example:

- Are you still maxing out your retirement plan contributions when you’ve already hit your long-term target?

- Are you spending far less than you could from your portfolio, but wishing that you could be doing more for your kids, traveling more, remodeling the house, giving more?

- Could you afford to redirect excess cash flow toward experiences, gifting, or charitable giving?

One of the most liberating things we do for clients is help them to figure out what they’ll need for their long-term goals. That gives them permission to strategically splurge—whether it’s on a family trip, generous gifting, or house upgrades they’ve been dreaming of.

Your financial goals should be customized and revisited regularly. A clear plan gives you permission to live fully now while still building the future you want. That means knowing when you’ve saved “enough money” for one goal so you can reallocate resources to another.

You Match Each Value Aligned Goal to the Right Financial Tools

One of the most practical benefits of a goals-based approach is ensuring that each goal is funded in the right type of account. Different financial objectives require different tools.

Here are some examples of financial goals and accounts that match:

|

Goal |

Recommended Account Type |

|

Retirement |

Traditional IRA, Roth IRA, 401(k) |

|

Emergency Fund |

High-yield savings account |

|

529 plan or taxable brokerage |

|

|

Down payment on a home |

High-yield savings or short-term bonds |

|

Philanthropy or Legacy |

Donor-advised funds, trusts |

|

Large purchases (3-5 years out) |

Taxable brokerage with conservative allocation |

Using the wrong account, like saving a home down payment in a 401(k) or putting your emergency fund in a brokerage or CD, can create unnecessary taxes, penalties, or delays. Matching your short-term, intermediate, and long-term goals to the right strategy ensures you get the most out of your money.

It also helps you benefit from compound interest where appropriate and avoid unnecessary risk when time horizons are short.

Takeaways: A Better Way to Build, and Use, Your Wealth

Values-based, goal informed financial planning is more than just a budgeting tool—it’s a strategic framework to align your wealth with your values.

By starting with your values, making your goals measurable and prioritized, and using the right accounts for each objective, you can:

- Clarify your path to retirement, education, supporting generations of family, and more

- Balance paying off debt with investing for the future

- Feel confident you’re saving enough money for what matters

- Reduce the anxiety of "splurge" expenses by preparing in advance

- Enjoy your money today while still building or maintaining long-term financial health

No matter your net worth or stage in life, a values-based approach is one of the most effective ways to ensure your financial decisions support the life you want.

Ready to Take Control of Your Financial Future?

Plancorp’s experienced financial advisors specialize in helping high-net-worth individuals and families align their financial plan with their life goals. Whether you want to grow your assets, minimize taxes, or see if you’re maximizing your money for your best life, our team can help you find clarity.

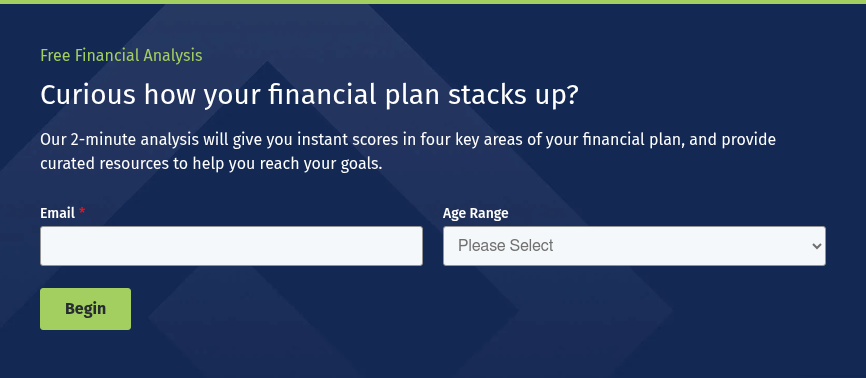

Not sure where to start? Take our free financial analysis to understand how your current financial situation aligns with your values—and where there may be room to improve. In just 2 minutes, we’ll deliver scores in 4 key areas of your finances along with curated resources for what comes next.