A productive working relationship with an advisor begins with trust and transparency. Even before you dive into the details of the advisor’s services, you want to understand key issues that reflect how they define and uphold their commitment to clients. This is true for any advisor, and is especially true when it comes to your finances and managing your wealth and estate.

Here are six important questions you should ask a financial advisor. You can use these when you’re meeting for the first time or to help get clarity on topics you might not have explored with your current advisor.

Download eBook: Are You Getting What You Need From Your Financial Advisor?

1. Will you put your fiduciary commitment in writing?

Attorneys, accountants, and doctors put the needs of their patients above their own interests. Surprisingly, though, not all advisors put their clients’ needs first. In the financial services world, there’s something called the “suitability standard,” which allows advisors to make recommendations that are “suitable” for you, but that might benefit the advisor through additional compensation and aren’t truly in your best interests.

Fortunately, you don’t have to settle for an advisor who’s offering “suitable” advice. You can choose an advisor who adheres to the fiduciary standard, which legally requires advisors to put your interests first at all times. That means the recommendations they offer will benefit you alone—not themselves, their firm, or any other financial institution they might do business with.

If your advisor isn’t willing to put their fiduciary commitment in writing, then they can’t be held accountable for working in your best interest. Make sure this commitment covers the entirety of your relationship, some advisors may act as a fiduciary when developing a plan, but then use the suitability standard when implementing those recommendations.

2. How do you get paid?

No matter how much you like your advisor, how they make their money can affect the objectivity of their advice. Ultimately, you want no financial conflicts influencing the advice you receive. To ensure you’re getting objective guidance, look for a fee-only firm, rather than fee-based or commission-based services. Your advisor’s and the firm’s interests are more closely aligned with your own when they don’t receive direct compensation for the products they sell or transactions they make.

It’s also important to work with an advisor who’s salaried, not paid a percentage of how much revenue their clients generate for the firm, or who participate in sales contents, incentive programs, or referral awards.

Have a Question? Schedule a free consultation today.

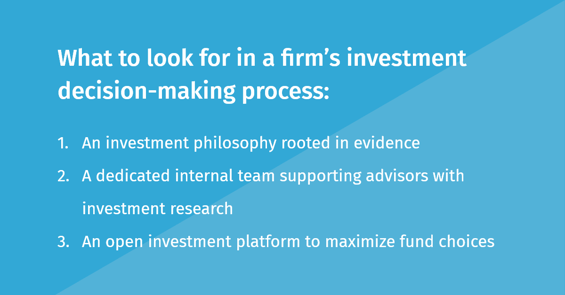

3. How do you make investment decisions?

Your advisor undoubtedly will have a practiced response to this question, but there are a few things you should be looking for. First, you want to know that their investment philosophy is rooted in evidence. Most investment success comes down to minimizing mistakes, so it’s important to understand how an advisor’s strategy could go wrong and what that would mean for you.

You also want to see an open investment platform, meaning that the advisor and advisory firm can use any fund company they choose. A fiduciary shouldn’t be restricted from any particular fund family—especially if those funds offer lower costs or are a better fit for your needs.

Finally, you want to ensure that your advisor isn’t the person responsible for scouring the more than 16,000 available investment funds to determine what’s best for you. No single advisor or advisor team has the capacity to manage clients, perform proper ongoing due diligence on investment options and perform underlying portfolio theory research. What you want instead is a firm with a dedicated team of experienced researchers who perform ongoing due diligence as part of their primary job function. You also want to know this team has access to research from all the world’s largest asset managers and doesn’t rely solely on recommendations from an internal home office team.

4. Will you run a tax projection?

Many people hand their financial documents over to an accountant every spring and trust that their taxes are squared away. And yet a good financial advisor wouldn’t let you go into tax season blind.

Financial advisors who run tax projections can give you clarity about your tax situation ahead of filing, so there are no surprises. They can also use tax projections to help you make more strategic financial decisions, such as when and how much to contribute to charity, the implications of doing partial Roth conversion, and whether to accelerate or delay income and expenses for business owners.

Tax projections are a rare offering for a standard financial advisor, but those who do can add tremendous immediate and long-term value by finding proactive planning opportunities that reduce tax liabilities today and far into the future.

5. Will you review my estate planning documents?

It’s common for people to get basic estate planning documents and then to leave them untouched for years. But estate laws, your finances, and your wishes change over time. Working with an advisor who regularly reviews your estate planning documents can help identify gaps and opportunities based on current estate tax law. The advisor will also be in a better position to make recommendations for your overall financial plan that support your estate-planning goals.

A wealth management plan for your family should include documentation that makes your estate plan perfectly clear, so it’s easy to see how your assets pass to your heirs and other beneficiaries. Not only does this give you peace of mind, but it also makes life easier on your heirs after your passing.

6. If something happens to you, who will take over my account?

Even in the best relationships, circumstances can change. Your advisor might move on because of a promotion, leave the firm for another opportunity, or retire. It’s important for an advisor to have a succession plan in case they need someone to take over your account.

In a collaborative firm, your advisor’s colleagues will be familiar with your family’s needs and plans. And you can have confidence that the advisor who takes over has the credentials and experience necessary to pick up where your former advisor left off.