Every crisis has one thing in common: it eventually ends.

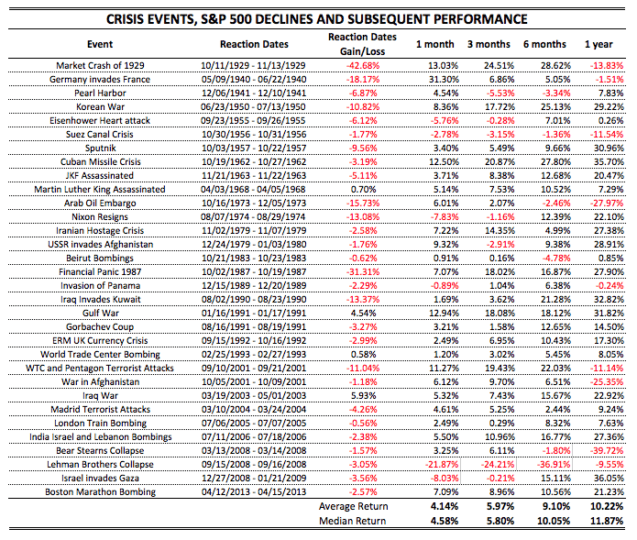

Britain’s decision to leave the European Union (EU), cleverly described as “Brexit,” was just another one of the many historical crisis events that temporarily eats away market returns. The table below lists past crisis events, the market return during those crisis events and the subsequent returns after the event. As you can see, panicking in response to a crisis rarely pays off.

What we witnessed in the weeks surrounding Brexit was simply the market at work. Millions of participants used available information and expectations of the future to drive asset prices to a very close estimate of the present value of future cash flows. Leading up to the vote, markets were on the rise as participants priced in a very low likelihood that Britain would leave the EU. The dramatic downturn in prices on the days following the Brexit vote was simply the market incorporating this new information into prices.

I expect the UK/EU divorce to be messy, drawn out and costly. As such, I expect volatility to remain elevated as the market sorts through the implications for the global economy. The future is unknowable and there are risks inherent to that. Your success in managing those risks will determine how successful we are financially. I believe in building portfolios that will rise and fall with the overall market, but are designed to weather volatility on the way to meeting your longer-term financial planning goals.

In times of greater market volatility, it is important to remember that stock investors are compensated for assuming the uncertainty of short to intermediate stock returns. In order to receive a rational premium for owning stocks over bonds and cash, stocks occasionally need to lose value.

Stay invested during the down markets and time will reward you for your patience.

Related Reading

Sources and Disclosures

Chart data from Bloomberg and compiled by Plancorp.