We look to measure success in different ways throughout our lives: report card in school, GPA in college, performance reports in our careers. In order to do well at something, we have to know how we’re being measured.

The same goes for building your credit, as measured by your credit score. Among other things, this metric can help you:

- Qualify for a loan to buy a home, car or start a business.

- Save thousands of dollars by getting a lower interest rate on your loans.

- Impress a potential landlord or employer with your financial responsibility.

To build great credit, you first have to understand your credit score (grading system) and credit report (report card).

Credit Score: Your Cover Letter

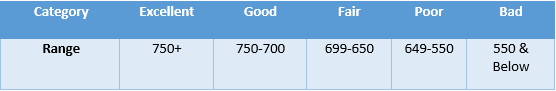

This number helps lending agencies, such as banks or credit card companies, quickly determine your likelihood of repaying the credit/loan you take out (or, “creditworthiness”). The level of your creditworthiness is based on a score range from 350-850, which can be found below:

When you have an excellent credit score, lenders love you. A good credit score increases your likelihood of being approved for a loan and getting the best interest rate possible.

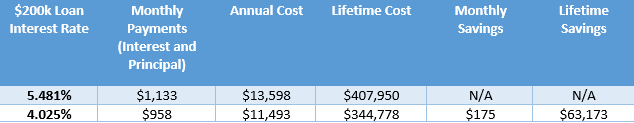

Consider this example to see why you want a lower interest rate. Let’s say Joe decides to buy a home for $200,000 to be paid off over 30 years. But when the mortgage company pulls his credit history, they find that his score is a 620. Since this score reflects a high-risk borrower, the company will not offer him the prime rate (the average rate being given out in today’s market for low-risk borrowers). Instead, the company gives him an interest rate 1.456% higher at 5.481%. This may not seem like a lot, but look at the table below:

Over the course of 30 years, Joe could have saved $63,173 if he had cared about his credit score and attained a score of 740 or better. That is why your credit score is so important. It could save you tens of thousands of dollars over a lifetime.

Finally, a good credit score can also signal that you are financially responsible to landlords or future employers, which could be the defining factor in getting your dream apartment or job. If you want to check your credit score for free follow this link and create an account.

Credit Report: Your Resume

A credit report is essentially your credit “resume” (which makes your credit score your “cover letter”). It contains your holistic financial background, including:

- Where you live

- Where you work

- A detailed summary of every line of credit that has been opened associated with your name (credit cards, student loans, mortgages, auto loans, etc.)

- Payment history (on-time or late payments/default)

- How much debt you have accumulated

- Whether you have filed bankruptcy

There is no number associated with your credit report (it’s more of a comprehensive summary), but lenders, employers and insurers still use it to decide whether to approve you for credit cards, loans, housing and jobs.

How to Check Your Credit Score

You can request a free report at www.annualcreditreport.com. You can get a free report once a year from each of three reporting companies: Experian, TransUnion and Equifax. Ideally, you would want to request your credit report once every four months to ensure it is accurate. A sample schedule would look like this, January = Equifax, May = Experian, and September = Trans Union.

When reviewing your reports, make sure to check that:

- Your name and address are spelled correctly.

- You opened all of the accounts associated with your name.

- There are no random accounts you don’t recognize.

- There are no falsified derogatory marks, such as bankruptcy, foreclosure or auto repossession.

If You Find a Mistake

If you find a mistake in your report, you’ll have to reach out to the specific credit reporting agency you saw the error on (Equifax, Experian or Trans Union) using this sample dispute letter. Explain what is inaccurate in the letter, and provide proof as to why it is inaccurate.

The bureau will investigate your dispute and should get back to you within 30 days. Next, you will need to reach out to that specific company or organization that is reporting the incorrect information. Use the same sample dispute letter and provide the same details you gave to the credit reporting agency. Once the dispute is settled, your score should move higher and you will be on your way to better loan options.

All in all, whether you’re a freshman in college or 10 years removed, it’s never too late to start fixing/building your credit report.