For many people, the question “How much can I save into my 401(k)?” has a simple answer. If you are under age 50 in 2024 you can save $23,000 into your 401(k). If you are over 50 you can save $30,500.

But for business owners, the answer is more complicated. Business owners can save around $75,000 into their own 401(k) every year, but that requires some commitments to their employees. Let’s walk through the buckets of money owners can use to save about $75,000 and what commitments come with each.

Bucket #1 – Paycheck Deferrals

Like most employees, the most an owner can save from their own paycheck is $23,000, plus an additional $7,500 if they are over age 50. Sometimes owners can’t save to this limit because they are failing the ADP test, which I discuss more in detail here. There may also be other test failures, such as the top-heavy test, that limit owners savings in this bucket.

Commitment: If a business is failing DOL/IRS testing that is limiting this bucket, owners should put effort to increasing savings rates of employees or implementing a Safe Harbor contribution. Safe Harbor contributions would ensure the ADP test is automatically passed.

Bucket #2 – Employer Match/Safe Harbor Contribution

There are a multitude of ways a business can structure an employee match, but Safe Harbor contributions are the simplest way owners can ensure they are able to save up to IRS limits from their paycheck. There are two main formulas for Safe Harbor contributions. Either a 3% contribution to everyone or a match formula that maxes out with a 4% employer match contribution.

Commitment: Safe Harbor contributions are declared in advance of the plan year. They must be made for the whole plan year and must immediately vest.

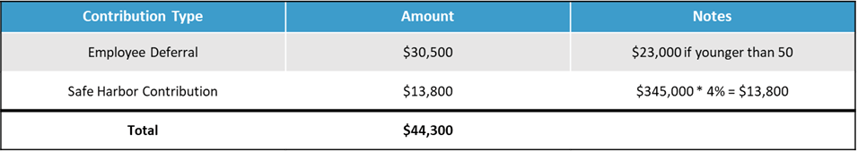

Assuming a business owner is 50 years old, uses a Safe Harbor match formula, and makes $345,000 a year, so far their savings looks like this:

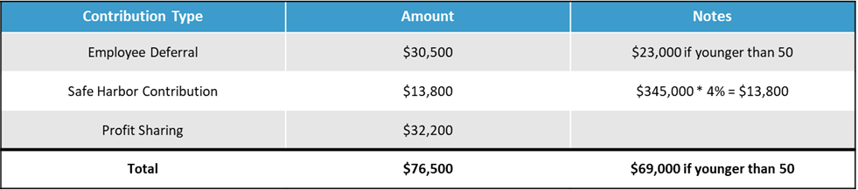

Bucket #3 – Profit Sharing

Profit sharing is the last bucket of money an owner uses to maximize their 401(k) savings. Profit sharing is up to the owner’s discretion, it is not required. And unlike its name suggests, profit sharing does not have to be related to the profit metrics of the business. For this example, our owner must make a $32,200 profit sharing deposit in order to maximize their 401(k) at $76,500. In order to contribute to their own account, the DOL requires contributions on behalf of employees as well. How much, and to which employees, depends on a lot of factors, and profit-sharing decisions should be reviewed with your Third Party Administrator every year.

Commitment: Contributing profit sharing to employees is necessary to pass testing if an owner wants to make deposits to their own account.

As you can see, there are ways for owners to save significant money in their 401(k) if they make certain commitments. If you are a business owner and want to review how you can update your 401(k) to ensure you’re able to save about $75,000 into your 401(k), please set up some time with me. We’d love to see if we could help you.

Next Steps...

There are many complex decisions to make when it comes to finances. Take a moment to take our financial wellness analysis, and discover your biggest areas of opportunity to improve your finances.

Disclosure:

This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own tax, legal and accounting advisors.

.png?width=266&name=Copy%20of%20blog%20featured%20image%20(3).png)