Reading an equity compensation statement can feel like translating a foreign language, except with a mishmash of terms, figures, and dates. Unfortunately, these statements rarely come with any explanations or glossaries, which can leave even the savviest professionals wondering, “What on earth am I looking at?”

In this article, we’ll walk through sample statements for the most common types of equity compensation, including restricted stock units (RSUs), stock options, and employee stock purchase plans (ESPPs).

How to Read a Restricted Stock Unit (RSU) Statement

Before you can analyze your RSU statement, it’s important to understand how RSUs work (at least at a high level) as well as key terms.

One of the most common forms of equity compensation, RSUs are a contractual promise by your employer to pay you in stock at a future date — assuming certain conditions are met. These are usually time-based milestones, but they could also be tied to performance or liquidity events (like an IPO).

Unlike stock options, RSUs don’t require you to purchase shares. As your RSUs vest, they “unrestrict” and become actual shares.

Key Terms on Your RSU Statement

Your RSU statement provides a snapshot of your holdings, including granted shares, vesting schedules, and tax implications.

Generally, an RSU statement will include the following terms:

- Grant Date: The date your RSUs were awarded.

- Total Granted Shares: The total number of shares awarded to you.

- Vested Shares: The RSUs you now own outright.

- Unvested Shares: RSUs that are still subject to your company’s vesting schedule.

- Fair Market Value (FMV): The price per share at the time of reporting.

- Tax Withholding: The amount withheld to cover your tax liability upon vesting.

Next, we’ll walk through a sample RSU statement to break it down further.

Example RSU Statement

To make sense of your RSU statement, let’s explore a real-world example. Meet Alex, a software engineer at a public company, TechCo. Alex received an RSU grant of 4,000 shares on January 15, 2022, with a four-year graded vesting schedule (1,000 shares vest per year). It’s now January 15, 2025, and Alex’s RSU statement reflects the following:

TechCo

Restricted Stock Unit (RSU) Award Summary

Date: 01/15/2025

|

Participant Name |

Alex Smith |

|---|---|

|

Employee ID |

123456 |

|

Stock Award ID |

XXXXX |

|

Total Granted Shares |

4,000 |

|

Grant Date |

1/15/2022 |

|

Current Tax Election |

Sell for Taxes |

|

Tax Withholding |

22% |

|

Vest Date |

Vested Shares |

FMV Price at Vesting ($) |

Share Value |

Status |

|---|---|---|---|---|

|

January 15, 2023 |

1,000 |

$50 |

$50,000 |

Vested |

|

January 15, 2024 |

1,000 |

$75 |

$75,000 |

Vested |

|

January 15, 2025 |

1,000 |

$150 |

$150,000 |

Vested |

|

January 15, 2026 |

1,000 |

- |

- |

Unvested |

Now, let’s discuss a few key pieces of information.

- Vested RSUs: To date, Alex has 3,000 vested RSUs, meaning he now owns them outright.

- Forfeiture: The remaining 1,000 RSUs are still subject to the vesting schedule — if Alex leaves the company before January 15, 2026, he forfeits those shares.

- Tax Withholding: RSUs are taxed as ordinary income upon vesting, based on the FMV of the shares at that time. To cover taxes, companies typically sell a portion of vested shares automatically and remit the proceeds to the IRS.

- In Alex’s case, TechCo assumes a 22% withholding rate. However, this may not be sufficient if Alex falls into a higher tax bracket.

Speaking of tax brackets, the company has performed well since Alex joined — his vesting shares continue to increase in value as the company’s share price has appreciated. However, it’s very possible that this annual increase in taxable income could push him into a higher tax bracket and leave him with a sizable liability come tax season.

Naturally, tax planning is paramount to maximizing the value of RSUs. By understanding these components, you can track your equity compensation and plan for future tax implications.

How to Read a Stock Option Grant

Stock options give employees the right — but not the obligation — to purchase company stock at a predetermined price (known as the exercise price or strike price) within a specific timeframe. Unlike RSUs, stock options do not automatically convert into shares; you must actively exercise your options to buy actual stock.

Companies typically issue stock options to incentivize employees to stay with the company and contribute to long-term growth. If the stock price appreciates beyond your strike price, you can purchase shares at a discount and potentially realize a profit. However, just like RSUs, there are tax implications to account for, which vary depending on which type of stock options you’re granted.

ISOs vs NSOs

There are two main types of stock options: Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). The primary difference between them is their tax treatment:

- ISOs are typically reserved for employees and may offer preferential tax treatment. If certain holding period requirements are met, gains may be taxed at long-term capital gains rates rather than ordinary income tax rates. However, exercising ISOs could trigger the Alternative Minimum Tax (AMT) in certain cases.

- NSOs are more common and can be issued to employees, board members, and consultants. Unlike ISOs, NSOs are taxed as ordinary income upon exercise, based on the difference between the exercise price and the fair market value (FMV) at the time of exercise. Any additional gain when selling the shares is then subject to capital gains tax.

For a more detailed explanation of these two stock options and their tax consequences, we have another resource for you: Know Your (Stock) Options: Understanding ISOs and NSOs.

Key Terms on Your Stock Option Grant

Your stock option grant will likely contain some combination of the below terms. If you read through the previous section about RSUs, some of these will look familiar.

- Grant Date: The date your options were issued.

- Total Granted Options: The number of stock options you received.

- Vested Options: The options you can currently exercise.

- Unvested Options: The options that will become available at later dates.

- Exercise (Strike) Price: The fixed price at which you can buy shares.

- Fair Market Value: The current market price of the stock.

- Expiration Date: The deadline to exercise your options before they expire.

Your grant statement may or may not reference exercise methods. This is how you choose to exercise and purchase your options, which could include:

- Cash Exercise: Paying out of pocket to buy the shares.

- Cashless Exercise: Selling a portion of the shares to cover the cost of exercising.

- Same-Day Sale: Immediately selling all shares after exercise.

An example stock option grant should help illustrate this transaction.

Example Stock Option Grant

We’ll revisit our example, but this time assuming Alex is granted 4,000 NSOs instead of RSUs. Like before, Alex is three years into his vesting period, with 1,000 options vesting per year.

Here’s an example of what Alex’s employee stock option statement may look like:

TechCo

Non-Qualified Stock Options Statement

Date: 01/15/2025

|

Participant Name |

Alex Smith |

|---|---|

|

Employee ID |

123456 |

|

Award ID |

XXXXX |

|

Total Granted Options |

4,000 |

|

Grant Date |

1/15/2022 |

|

Exercise Method |

Sell to Cover |

Summary of Options (NQ)

|

Grant Number |

Exercise Price Per Share |

Options Granted |

Vested Options |

Unvested Options |

Options Exercised |

Expire / Cancel Date |

|---|---|---|---|---|---|---|

|

001 |

$50 |

4,000 |

3,000 |

1,000 |

0 |

1/15/2032 |

Alex’s stock option statement highlights several key pieces of information, including:

- Grant Number: This identifies a specific stock option grant. If Alex is allotted more NSOs down the road, he would receive separate grant numbers.

- Exercise Price: Alex can purchase TechCo shares for $50 per share, regardless of the stock’s current market price.

- Expire / Cancel Date: Generally, stock options have a lifespan of 10 years. In this case, Alex must exercise any vested options before January 15, 2032, or they will expire.

To date, Alex hasn’t exercised any options. However, if he were to exercise, his current election is “Sell to Cover,” a cashless exercise that would involve selling a portion of his 3,000 vested options to cover the associated cost of purchasing them. For example, let’s assume TechCo is trading at $75 per share and Alex decides to exercise all 3,000 vested options.

|

Step |

Calculation |

Amount |

|---|---|---|

|

Total Cost to Exercise |

3,000 options x $50 strike price |

$150,000 |

|

Market Value of the Shares |

3,000 options x $75 share price |

$225,000 |

|

Net Value (Pre-Tax) |

$225,000 - $150,000 |

$75,000 |

Alex avoids a hefty $150,000 out-of-pocket payment, netting a gain of $75,000. However, this doesn’t account for the ensuing tax liability — the gain would be taxed as ordinary income in the year of exercise. Moreover, unless Alex sells his shares right away, he’ll also owe either short-term capital gains taxes or long-term capital gains taxes (depending on how long he holds) on any profits he realizes later on.

How to Read an Employee Stock Purchase Plan (ESPP) Statement

Employee Stock Purchase Plans (ESPPs) allow employees to buy shares of company stock at a discount, typically between 5% and 15% off the FMV. These plans are designed to help employees participate in company growth while benefiting from preferential pricing.

Like stock options, ESPP purchases are optional — you decide whether or not to contribute a portion of your paycheck to buy shares at the discounted rate. For a basic ESPP, these purchases occur at predetermined intervals (e.g., every six months). Some plans offer a lookback provision that allows employees to purchase stock at the lower of two prices: the start of the offering period or the purchase date.

Key Terms on Your ESPP Statement

Your ESPP statement provides a summary of the shares you’ve purchased, likely including contribution details and purchase calculations. Here are key terms you’ll typically see:

- Current Contributions: The total amount deducted from your paycheck to buy ESPP shares.

- Contribution Limit: This is an annual cap on your purchase of discounted shares, which is based on the stock's pre-discount price. While your statement may not mention this information, a common contribution limit is $25,000 (or $21,250 if your discount is 15%).

- Carry Forward: The amount of unused payroll contributions that were not applied toward share purchases during the current purchase period. This typically happens when contributions exceed the total cost of shares purchased (due to plan limits or rounding).

- Grant Date: The date your ESPP offering period begins.

- Grant Date Market Value: The stock’s price on the grant date (before applying any discount).

- Purchase Period: The time frame when your payroll deductions accumulate.

- Purchase Date: The date shares are bought on your behalf using payroll deductions.

- Purchase Value (or FMV): The stock’s price on the purchase date (before applying any discount).

- Purchase Price: The discounted price you pay per share on the purchase date.

- Discount: The percentage discount applied to your ESPP purchase. This may not be explicitly listed but can usually be inferred from the purchase price calculation.

- Lookback Provision: If applicable, this allows employees to buy shares at the lower of the stock price on the grant date or purchase date. You can figure out whether your ESPP includes this feature if your statement shows both values and bases your purchase on the lower of the two.

Example ESPP Statement

Your ESPP statement should provide a summary of how many shares you acquired, at what price, and any remaining contributions that carry forward. Note that your statement may also share contribution details, listing the amounts taken from each of your paychecks and deposited into the ESPP during the purchase period.

TechCo

Employee Stock Purchase Plan Statement

Purchase Summary

|

Participant Name |

Alex Smith |

|---|---|

|

Employee ID |

123456 |

|

Account Number |

XXXX-XXXX |

|

Grant Date |

1/1/2024 |

|

Purchase Period |

1/1/2024 to 7/1/2024 |

Shares Purchase to Date

|

Beginning Balance |

0.00 |

|---|---|

|

Shares Purchased |

235.00 |

|

Shares Deposited in Brokerage Account |

235.00 |

Contributions

|

Previous Carry Forward |

$0.00 |

|---|---|

|

Current Contributions |

$10,000.00 |

|

Total Contributions |

$10,000.00 |

|

Total Price |

$9,987.50 |

|

New Carry Forward |

$12.50 |

Calculation of Shares Purchased

|

Grant Date Market Value |

$50.00 |

|---|---|

|

Purchase Value Per Share |

$60.00 |

|

Purchase Price Per Share (85% of $50.00) |

$42.50 |

|

Total Price (Shares Purchased x Purchase Price) |

$9,987.50 |

- Lookback Provision: Since TechCo offers a lookback provision, Alex's shares are purchased at 85% of the lower FMV between the grant date ($50) and purchase date ($60), resulting in a discounted purchase price of $42.50 per share.

- Total Contributions: Alex contributed $10,000 during this purchase period, but only $9,987.50 was used to purchase shares. The remaining $12.50 carries forward for the next period.

- Unrealized Gain: Since TechCo stock is worth $60.00 per share at purchase, Alex currently has a $4,113 unrealized gain.

Fortunately, there are no tax consequences to purchasing shares through an ESPP. Selling shares is another story.

If Alex decides to sell his ESPP shares immediately, the discount is treated as ordinary income for tax purposes. However, if he holds the shares for at least one year from the purchase date (7/1/2025) and two years from the grant date (1/1/2026), he may qualify for more favorable tax treatment. We developed an easy-to-use ESPP Calculator that helps you understand the tax implications of selling your shares.

For an in-depth explanation of ESPPs and tax advice, check out this resource: Employee Stock Purchase Plans 101.

Making Sense of Your Stock Compensation

Whether you’re planning for long-term wealth, managing taxes, or simply trying to maximize the value of your compensation package, there’s no way to avoid it — you have to understand the fine print. That said, making informed decisions about your equity compensation is difficult when your statements read like hieroglyphics.

By breaking them down term by term, we hope this guide has made it easier to track and manage your holdings. If you’re unsure how to integrate your equity compensation into your broader financial goals, consider reaching out to a financial advisor.

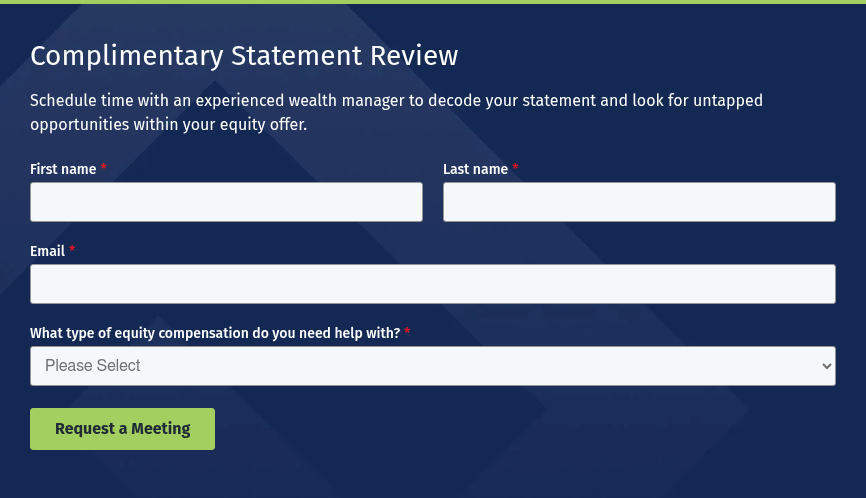

Contact Plancorp today to start developing a strategy that caters to your situation.