Picture yourself holding a $100 bill in your hand. What sounds more appealing:

- Putting that $100 safely into a bank account, knowing it will be there when you need it? OR

- Investing it, leaving it to fluctuate in a volatile market?

Chances are you chose the first, safer option. As women, we tend to be more conservative than men in our decision making. We want to have all of the facts before we execute. That conservatism can work in our favor, but not when it comes to investing our money. Though we’re great savers, typically saving more of each paycheck than our male counterparts, we often stop there.

Unfortunately, whether our cash is in a sock drawer or savings account, it doesn’t do us much good if it’s not working for us.

What’s the Big Deal?

In one word: inflation. Have you ever heard your grandma complain that it only took a nickel to buy a soda or candy bar “back in her day”? Simply put, that’s inflation at work. Goods and services naturally increase in price over time.

So, it follows that if you put $100 away now, the purchasing power of that money will be worth less in 50 years (just like your grandma’s nickel). It’s important to ensure that as inflation rises, your money grows too, so that your $100 can still purchase the same (or more) as it did in the past.

Investing by the Numbers

Since 1926, the average annual return of the U.S. stock market has been 10%. This includes some of the darkest days in the markets, such as the Great Depression and 2008 Financial Crisis.

The average return you can earn on a savings account right now is around 1%. While your savings account balance won’t fluctuate when the market moves, it also doesn’t keep up with inflation. Average inflation has been about 3% going back to 1926. That means your money is worth less when you take it out.

Inflation plays a role in saving for all your financial goals, big or small.

Let’s apply the concept to something that matters to almost all of us: coffee. If you set a goal to buy a cup of coffee every day of your 30-year retirement, how much money would you need for this goal when you retire?

To keep it simple, let’s say the price off your coffee doesn’t change over time. If you spend $4 a day, that’s $1,460 a year, so $43,800 total for 30 years, right? Not quite.

We all know it is not realistic to expect our favorite cup of coffee to be the same price in 30 years as it is today (due to—you guessed it—inflation). At an inflation rate of 2.5% a year, you’d actually need $91,875—more than double your first estimate.

The Power of Time – Beating Inflation, with Smart Investing

All investing involves risk. By managing the amount of risk, based on the timeline for whatever goal you are trying to achieve, you’ll also have the potential for greater rewards in the long run.

Over time, the stock market has historically provided a larger return compared to keeping your money in cash (e.g., that low-interest bank account or sock drawer). When your money is in the market, it keeps growing, making “gains.” If you keep those gains in your portfolio, they will eventually grow, too—creating even more gains.

And so, the cycle continues. Your money starts snowballing into a giant nest egg, rather than melting away in your sock drawer. That’s the magic of compounding.

Let Compounding Work for You

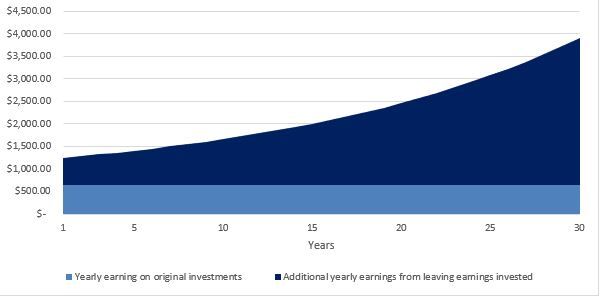

The graph below shows how much you could earn each year with an initial investment of $10,000 and an annual return of 6%. Every year, you would earn $600 on your original investment, and if you leave those earnings in the account, they will continue to grow in addition to your original $10,000. After 30 years, the compounding effect on your earnings would give you an additional $3,400 a year, for a total of about $4,000 during that year.

You may not have $10,000 to invest right now, but the concept applies to any amount—even that $100 bill you pictured earlier. The more you invest, the more gains you make, giving you more money to invest.

To get started, all you need are your goals. You just have to recognize that investing toward them is the best way to reach them. You work hard for your money, so why not make it work for you?

—

This post was written by a member of the Plancorp Women’s Initiative, which strives to advocate for clients and women in the community by addressing topics specific to their financial lives. For more information about the Women’s Initiative and how you can get involved, email womensinitiative@plancorp.com or visit the Plancorp Women’s Initiative page.

-4.png?width=266&name=Copy%20of%20blog%20featured%20image%20(1)-4.png)