This is the second installment in a series of posts on how to properly factor your crypto holdings into a financial plan. The purpose of this article is not to debate the investment merits of crypto — there’s enough of that on the internet already — but instead, it will focus on how to incorporate crypto into your existing investment portfolio.

As a wealth manager, I frequently see individuals with concentrated risk in a single position or those who let one piece of their portfolio overwhelm the rest. Like an Enron employee in 2001 who only owned their company stock, the last place you want to be is holding a singular asset that makes up a large bucket of your net worth.

No one knows what the future of crypto holds.

Along with the stories of immense sums of wealth created by Bitcoin, Ethereum, etc., there are thousands of more stories of those who have seen their retirement, emergency, home down payment, and/or other savings wiped out with the large daily swings this market sees. The risks are certainly there.

On the flip side, Bitcoin provides an example of explosive growth over the last five years. If you were an early investor and held on for the ride up, how do you manage that exposure going forward to ensure it doesn’t introduce unnecessary risk to your portfolio?

To achieve this, see the three key tips below.

Make Sure Your Advisor is Aware of Your Investments in Crypto

Working with clients who hold material amounts of crypto, we’ve noticed that they don’t always disclose these assets to their advisors. Whether clients simply forget to mention these holdings or are worried they won’t fit within their traditional portfolio, withholding this information is detrimental to the planning process.

Having your advisor in the loop on your holdings allows them to properly incorporate the volatility of this asset class into your financial plan and accurately measure the risk you are taking as an investor in this space.

Put Allocation Rules in Place and Stick to Them!

Asset allocation is the most important decision a long-term investor makes, and it’s one of the few things in the world of investing that is fully in your control.

It’s important to set a targeted mix of asset classes that are aligned with your investment objectives and constraints. A good starting point in setting a target percentage for cryptocurrency in your portfolio is using its relative size to the global public stock and bond markets, which is 1%.

Perhaps you adjust that long-term target based on your objectives and the current strength of your financial plan. Regardless of the target you choose, it’s important to regularly review your overall asset allocation to ensure the risk and return characteristics of your holdings are aligned with your financial plan.

Should your crypto holdings outperform the rest of your portfolio and grow beyond the target percentage of the portfolio that makes sense for your financial plan, it may be time to sell some of your crypto holdings and reinvest into the underweight areas of your portfolio. Conversely, if crypto is underperforming the rest of your portfolio, that might represent an opportunity to sell asset classes that have been doing well and reinvest the proceeds into the crypto portion of your portfolio.

At Plancorp, we typically review client portfolios at least once a month to check them against the agreed asset allocation. Tax loss harvesting in a down market can help offset potential capital gain costs incurred with selling to rebalance your holdings.

Understand Your Ability and Willingness to Tolerate Risk

Understanding your personality and how you react in a time of prolonged negative performance is important to managing your crypto holdings.

Understanding your ability to take risk in your investments without damaging your long-term goals is just as important as understanding your willingness to tolerate market swings. After all, meeting with a financial advisor and determining what risk you can take from a mathematical perspective is not the only piece at play if you are losing sleep at night during a market correction.

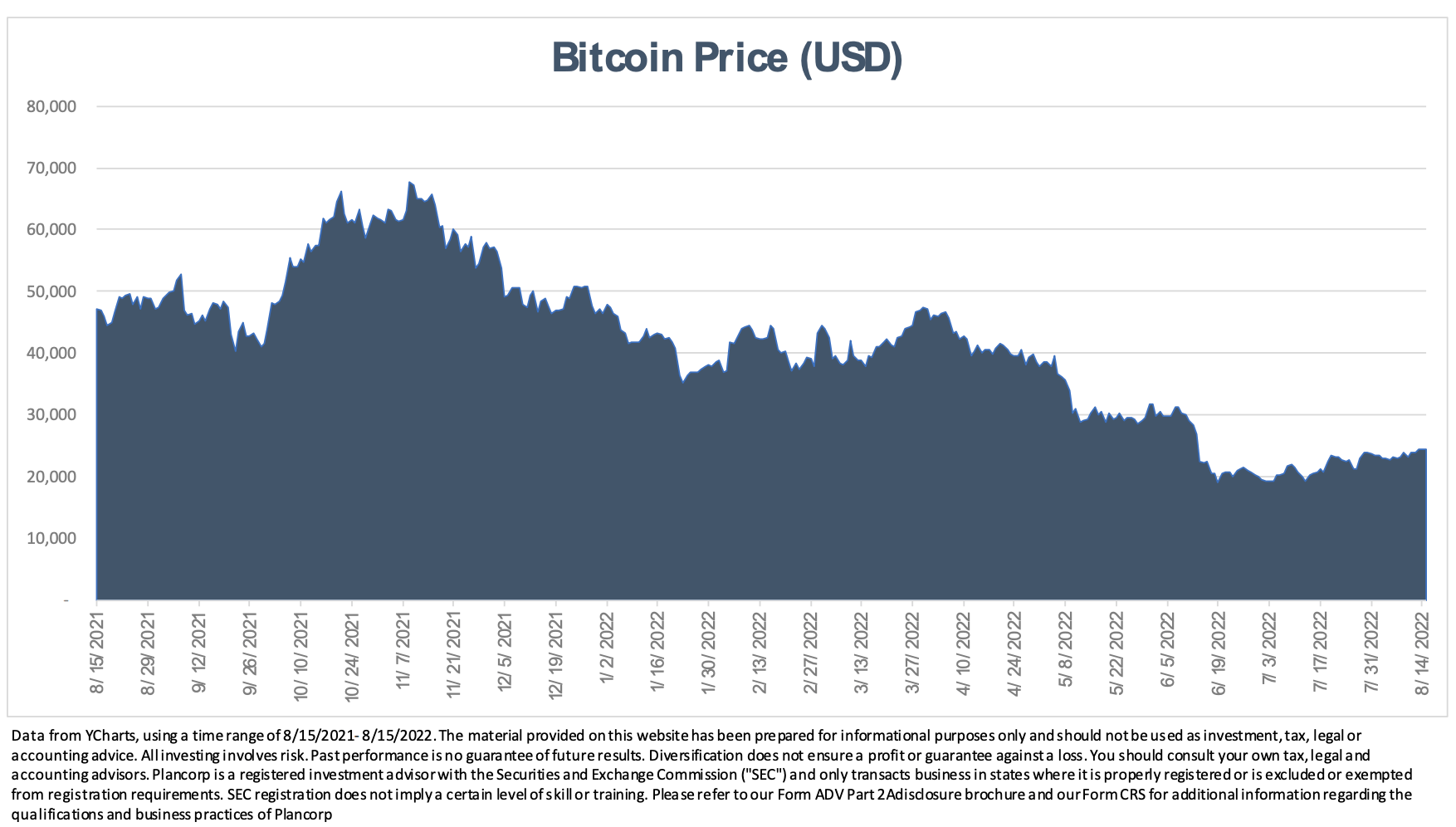

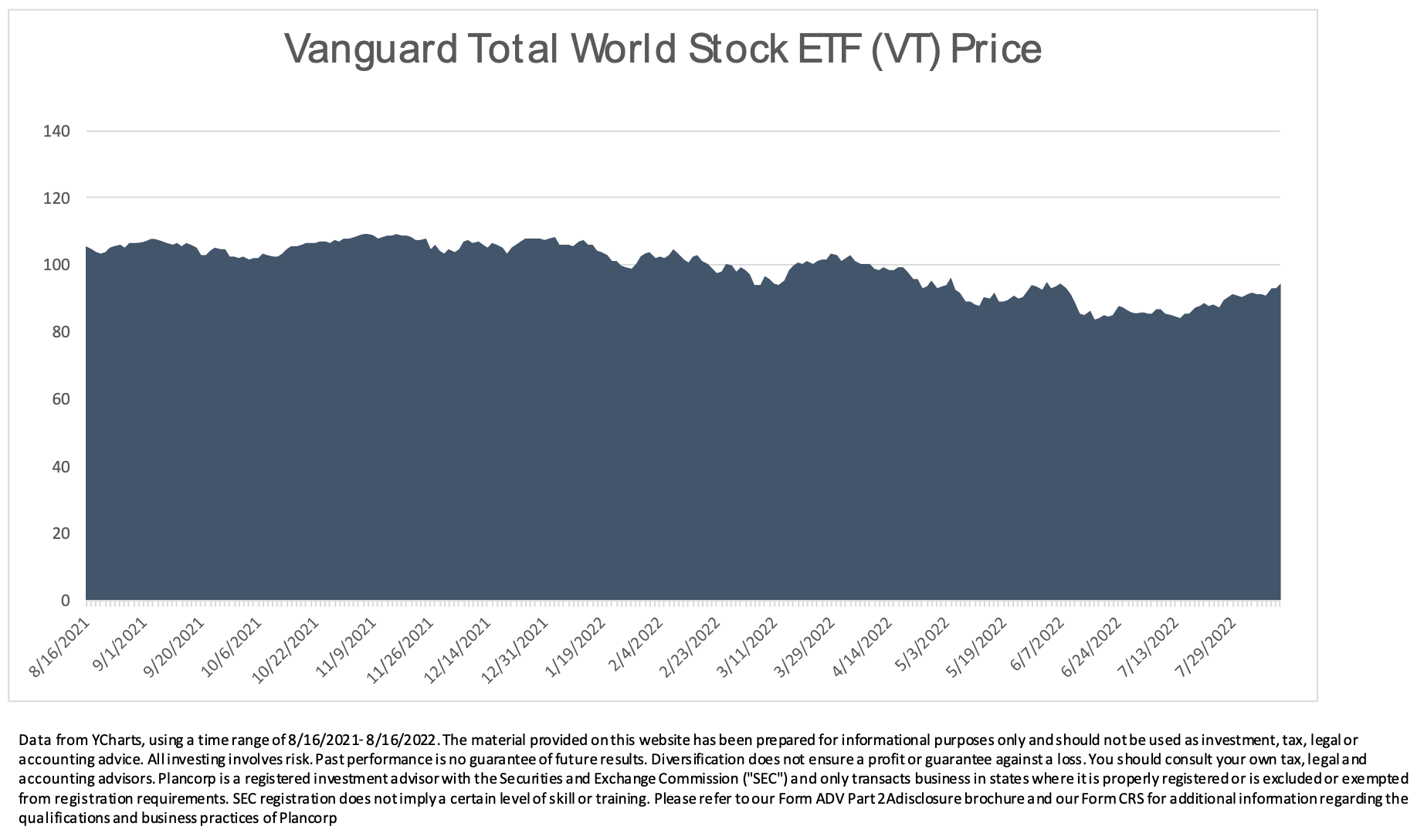

As of August 15, 2022, Bitcoin is down 48% from one year ago. For illustration purposes, you can compare this to the Vanguard Total World Stock ETF one-year return of - -8.9%. This comparison is not meant to disparage one asset over the other, but to simply highlight the heightened volatility crypto can have over a diversified portfolio in a short period of time.

It is crucial to work with an advisor to determine the ability of your financial plan to handle the volatility and your willingness to stomach another 30% fall in price.

Whether you are a passionate crypto investor with a sizeable stake or someone still learning about the asset, the tips above will keep you diversified and managing your risk.

Not sure where to start? We can help. Click here to schedule a quick 15-minute consultation with our team to learn how we help people make these decisions with confidence.

Read Estate Planning for Cryptocurrency here.

-4.png?width=266&name=Copy%20of%20blog%20featured%20image%20(1)-4.png)