While the Tax Cuts and Jobs Act impacted both individuals and businesses, changes to the business tax scheme were comparatively more comprehensive and permanent.

As a business owner, the magnitude of the changes may seem overwhelming. Instead of getting caught up in the details of every business-related change, I’d recommend you primarily focus on two key considerations:

1) Consider how you can take advantage of the new, temporary 20% Qualified Business Income (QBI) deduction and

2) Reassess your business entity structure under the new tax legislation.

1) Strategically manage your taxable income around the new 20% QBI phaseout ranges that may apply.

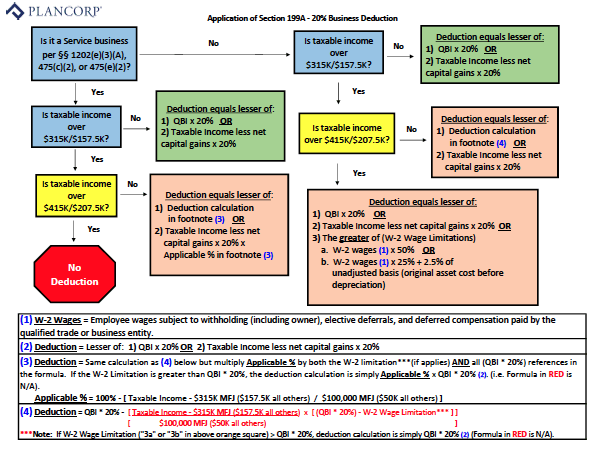

How you plan around the new QBI deduction depends on your type of business, income level, proximity to retirement and other variables. Click below to view a larger version of our “decision tree” tool.

• Are you in a “specified” service business (e.g., doctor, physician, etc.)?

You may consider making a large contribution to a Defined Benefit Plan in order to reduce your taxable income below the phaseout range that applies for specified service-type business owners ($315,000 – $415,000 range for joint filers and $157,500 – $205,500 range for all other filers). You could also take advantage of the new 100% bonus depreciation by replacing old equipment and immediately expensing the newly acquired equipment in the current year as another strategy to reduce taxable income.

As a reminder, the phaseout ranges are based on taxable income at the “individual level.” Therefore, 50/50 partners in a partnership could have a different QBI deduction result at their individual level depending on other items impacting their individual taxable income.

• Are you near retirement?

If your taxable income is below the start of the applicable phaseout ranges ($315,000/$157,500), you may consider foregoing a contribution to a retirement plan. Since the tax rate on a near future withdrawal may be higher (100% of the ordinary tax rate), it could work in your favor to keep the money which will be taxed at 80% of the ordinary tax rate due to the benefit of the QBI deduction.

Note: Younger taxpayers that are not above $315,000/$157,500 will still want to contribute to a retirement plan for ERISA protection and the deferral benefit (longer time horizon).

• Are you charitably inclined?

Consider using a Charitable Remainder Trust (CRT) as a strategy to smooth income and manage gains to keep you below the taxable income phaseout ranges.

• Do you own rental real estate?

The QBI deduction is calculated on an entity-by-entity basis. So, managing the capital structure and leverage by entity (spread and/or lower interest expense by entity) can increase your overall aggregated deduction.

• Are you selling one of your businesses?

Consider using an installment sale as another strategy to smooth income and manage gains to keep you below the taxable income phaseout ranges.

2) Reassess your business entity structure.

Under the new tax law, the tax rate for a C Corporation is permanently reduced to a flat 21%. That, coupled with the removal of the personal service corporation special tax rate, may make it worth taking another look at your entity selection (e.g., LLC, C corporation, S corporation, etc.). Consider your intentions, run the numbers, and remember that the 20% QBI deduction for pass-through entities is currently temporary (will expire after 2025).

Start with your intention. Do you want to grow your business (reinvest earnings) and ultimately sell in the future or keep the business in the family and distribute earnings annually for cash flow?

If you’re planning to grow and ultimately sell in the future, you may consider a C corporation. Since you’ll reinvest earnings annually, you will only incur one layer of tax at the Corporate level. The Section 1202 gain exclusion could also provide huge savings on a future sale if your C Corporation stock qualifies as “Qualified Small Business Stock” held at least five years. C Corporations can also deduct fringe benefits that are tax-free benefits to the shareholders. Just be aware of the Accumulated Earnings Tax and Personal Holding Company rules that could potentially apply to corporate earnings not distributed as a dividend to the shareholders.

If you’d rather distribute earnings annually for cash-flow and don’t intend to sell in the future, a pass-through entity may be the favorable option. At a high level, the top overall effective federal tax rate for utilizing a C corporation is still higher than the 37% top tax rate for a pass-through entity.*

*Assumes C Corporation dividend distributions, no QBI deduction, and the individual taxpayer has already reached the $10,000 SALT cap limit.

3) Take other business-related changes into account.

Finally, be sure to talk to your accountant or financial advisor about other changes that may affect your business. For example, the new tax reform rules have expanded the bonus depreciation rules to allow for a 100% deduction of the cost of qualified new and used personal property acquisitions. Therefore, it could be advantageous to consider a cost segregation study on larger building acquisitions to substantiate and identify the tangible personal property components eligible for the 100% bonus depreciation deduction. This study can be applied for new or previously acquired buildings. For purposes of a future sale or exchange of the building, just be aware that the deferral benefit attributable to like-kind exchanges now only applies to real property (does not apply to tangible personal property).

Another example is to consider a change to the cash method of accounting. Many more businesses will now qualify to utilize this method of accounting under the new tax legislation. The cash method provides a more convenient match for paying tax on the net cash income received vs. paying tax on income accrued but net yet received (e.g. accounts receivable) under the accrual method.

It may seem overwhelming to review these options, but there are significant tax savings if you take the time to re-run your numbers. It’s especially worth your while, knowing the perpetuity of some of the business changes.

If you would like to discuss further with one of our Wealth Managers, please don’t hesitate to submit the form below or give us a call.

-3.png?width=266&name=Copy%20of%20blog%20featured%20image%20(2)-3.png)