One of our most important responsibilities is helping clients achieve financial independence. We love when we can tell them they have enough money to do whatever they want for the rest of their lives.

But that milestone is hardly the end of the wealth management process. The next question we like to ask is,

“What do you intend to do with the money you don’t need?”

Creating strategies to transfer wealth—whether to children, siblings or charities—isn’t just for families with estates larger than the $23 million estate tax exemption. And it’s not an activity that has to wait until after your death. You can use excess assets for things like:

- Helping your children afford a new home

- Covering the cost of grandchildren’s college education, or even

- Funding a family business—and get the satisfaction of watching the impact of those gifts.

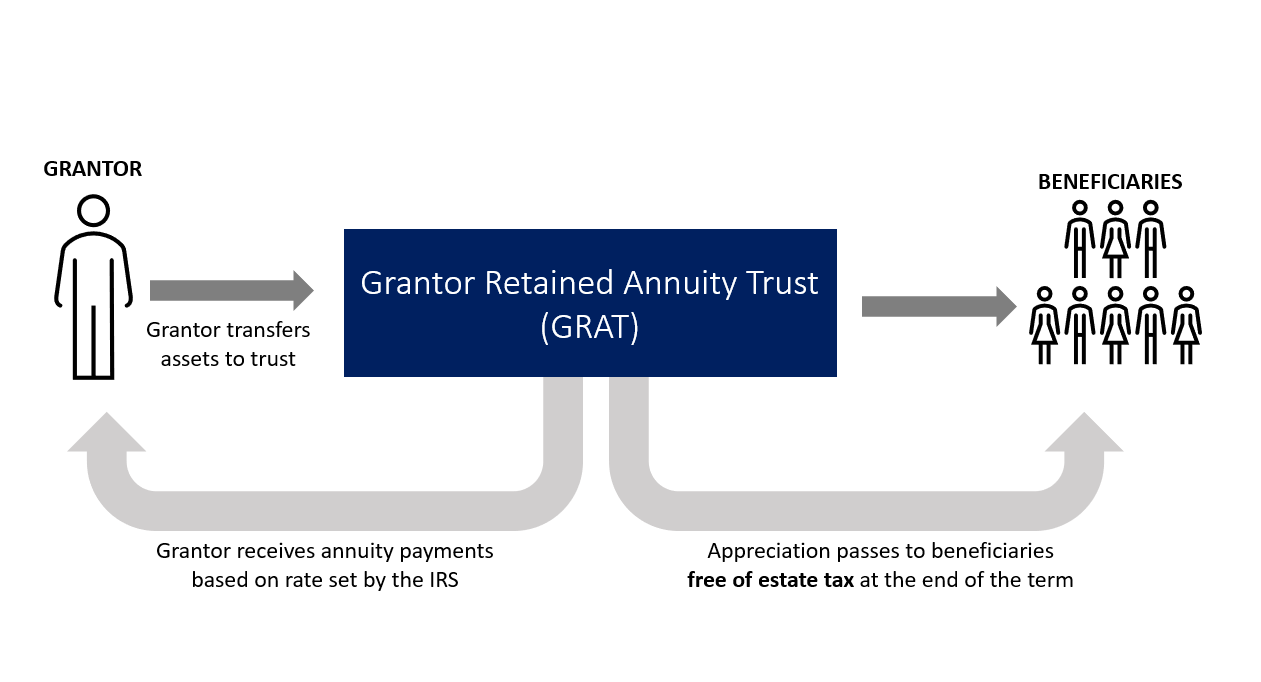

In cases like these, we often recommend a particular wealth transfer tool: A Grantor Retained Annuity Trust (GRAT). GRATs are temporary trusts created to hold assets that are likely to rise in value. During the term of the trust—typically a few years—the grantor (the individual who establishes a GRAT) receives regular annuity payments that transfer the value of the original contribution back to them, plus interest based on a rate of return set by the IRS. But when the term expires, any growth above that rate of return passes to the trust’s beneficiaries estate and gift tax-free.

One of the reasons we like GRATs so much is they essentially give away growth, while giving you back the original assets. We also like them because once you understand a few moving parts, GRATs are relatively simple—and have few downside risks.

The Basics of How GRATs Work

When setting up a GRAT, there are four key considerations:

- The length of the trust’s term

- The assets you want to place in it,

- Current rate of return the IRS uses to calculate the trust’s annuity payments

- The beneficiary of the remainder (an individual or another trust).

GRATs are irrevocable trusts that last for a specific period of time of at least two years. The term you choose depends on your goals and expectations for asset growth potential, but we typically recommend a term between two and five years.

One reason to stick with a shorter period: If you die during the GRAT’s term, the tax-free wealth transfer you hoped to achieve would be reduced or potentially eliminated.

When choosing assets, we consider the amount of money you hope to give away, and the growth potential of those assets. Stocks, interest in a family business, and other assets with high appreciation potential are good candidates for use in a GRAT.

But the choice also depends on the IRS rate of return for GRAT annuity payments, commonly called the “hurdle rate,” because any growth above this rate is money that passes to beneficiaries tax free.

When the hurdle rate is relatively low, GRATs become especially attractive. Asset growth in the GRAT is likely to clear that hurdle rate—and clear it by quite a bit, meaning an even bigger payout for your loved ones. In June of 2020, in the wake of the coronavirus pandemic, the GRAT hurdle rate reached an all-time low of 0.6%.

Here’s an example of how this adds up to a powerful gifting strategy.

Say you transfer assets worth $1 million into a GRAT with a two-year term in June 2020. Let’s also assume that those assets grow by 8% each year. On the first anniversary of the GRAT it would make a payment of $504,515.40 back to the grantor. This is half of the original amount contributed plus the required return (the “hurdle rate”). At the end of the two-ear term, the grantor receives a second, equal payment. After this final payment is made, there would be $117,007.97 left in the GRAT—and that amount would pass to the remainder beneficiary tax-free.

Beginning Principle

8% Growth

Required Payments

Remainder

Year 1

$1,000,000

$80,000

$504,515.40

$575,484.60

Year 2

$575,484.60

$46,038.77

$504,515.40

$117,007.97

Summary

$1,000,000

$126,038.77

$1,009,030.80

$117,007.97

The tax-free gift would be smaller if the assets grew less than 8%. But if the assets don’t grow above the hurdle rate—or if the value of the assets decline—you still get them back, minus the cost to set up and administer the GRAT, which can be about $2,000 to $5,000 in legal fees.

Flexibility for Advanced GRAT Strategies

Beyond their basic benefits, GRATs also offer flexibility that allows you to adjust your strategy in response to changing life or market conditions.

For example, at any point during the trust’s term you can swap the GRAT’s existing assets for new ones of equal value. This feature can come in handy if the assets’ growth rate wildly exceeds, or falls short, of your expectations.

For example, if you placed stocks in a GRAT just before a big market downturn and it looked like there was no chance they’d recover by the end of the term, you could swap those stocks for a promissory note of equal value. Then, you could start a new GRAT with the same stocks at their depressed price, and a possibly a lower hurdle rate.

On the other hand, you can freeze the upside on a GRAT if its assets have performed phenomenally well. Say you were only hoping to transfer $1 million to your kids, but the stocks in the GRAT have grown beyond that target mid-way through the GRAT’s term. In that case, you can remove the appreciated stocks and swap in slow-growing assets with an equal current value—keeping the final gift close to your original intention.

As clients get more comfortable with GRATs, we can get even more creative with our strategies.

For example, we often help clients set up rolling GRAT strategies that use the annuity payments from one GRAT to fund another, which removes the future growth on GRAT annuity payments from the grantor’s estate. We also can help business owners fund a GRAT with their interest in the family business and then cover its annuity payments with annual cash flow—allowing the business shares to pass to beneficiaries tax free.

Grantor Retained Annuity Trusts (GRATs) are Just the Beginning

Getting creative with GRATs can itself inspire our clients to pursue even more sophisticated wealth transfer strategies as their needs evolve. Many of these strategies offer more potential upside than GRATs, but also come with greater downside risk. That said, for all their benefits, we don’t recommend GRATs until clients are at least covering the basics—like maximizing regular gifts to family members under the annual gift tax exclusion.

But assuming you’ve already taken full advantage of annual gifting and are ready to do more, GRATs are often the first place we turn. You’re not permanently giving away anything you have today—you’re only sharing growth with your loved ones. And besides temporarily giving up some liquidity during the trust’s term, the biggest risk is that you won’t actually get the tax benefit you expected due to falling asset values or your death before the end of the term. It’s a “heads you win, tails you don’t lose” scenario, which is why we love GRATs as a gateway wealth planning strategy.

Disclaimer: This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own tax, legal and accounting advisors.