After years of inflation readings well below 2%, financial markets expect to see higher inflation in 2021.

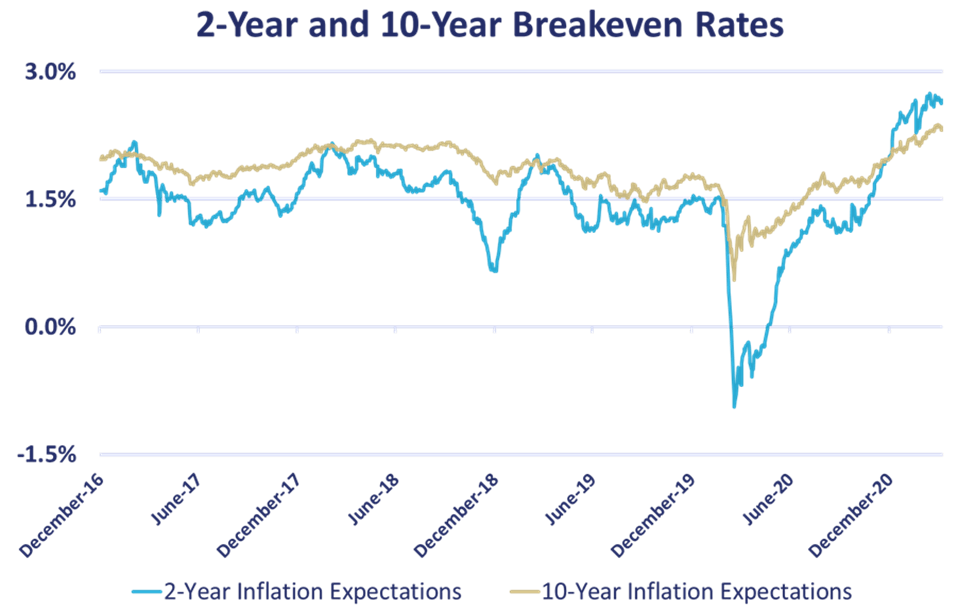

Below is a chart of the market’s inflation expectations using breakeven rates, which measures the difference in yield on Treasury notes and corresponding inflation-protected security.

Data Source: Bloomberg as of 4/8/2021

Inflation typically rises during periods of economic growth, so it’s no surprise inflation expectations are rising as the COVID-19 vaccination rollout accelerates and social distancing guidelines ease at a time that consumers are in a great position to start spending.

In fact, the personal savings rates for U.S. consumers jumped from a low of 8% prior to the pandemic to 20.5% in January 2021. That’s a lot of extra cash on most folks’ balance sheets that they will likely want to enjoy.

Meanwhile, the U.S. government just issued $1.9 trillion in additional stimulus, pushing the amount of fiscal life support to double what we lost in economic growth since the start of the pandemic. The government may not be done, either; another round of stimulus talks is in progress.

And while the Federal Reserve isn’t printing as much money as you think, they have made it clear that monetary policy will remain accommodative – even if the inflation rate goes above its 2% long-term target.

It’s often fiscal and monetary policy responses that get inflation hawks riled up the most, but such stimulus is necessary to aid recovery in the near-term and avoid the far worse scenario of deflation.

Ultimately, there is a very good chance we will see higher inflation readings in the coming months. But it also seems unlikely that inflation would spiral out of control or leave an extremely long-lasting impact.

Here’s what else you should know about inflation right now—and how to think about your investment portfolio as we consider the potential short-term impacts of an economy that’s heating up.

Understanding Inflation and How It Impacts You

Inflation occurs when there is more money circulating than there are goods and services to buy. Think of what happens if you try to attend a sold-out concert or sporting event at the last minute: there is more demand for tickets than tickets available, which results in higher prices.

The most widely quoted inflation measure is the Consumer Price Index (CPI), which tracks price changes from month to month for a basket of goods and services used by the average consumer. Using this measure, inflation has averaged roughly 3% since 1914.

This consistent rise in prices is one of the reasons people are surprised by how much they need to save for retirement. Thanks to the power of compounding, inflation of 3% cuts your purchasing power of your hard-earned savings in half about every 24 years.

That all sounds bad enough, but we’ve seen even worse inflation in the past.

In the 1910s, the U.S. suffered four back-to-back years of double-digit inflation toward the end of the decade. The worst was in 1918, when prices rose by an astounding 20.4%. More recently, inflation averaged 7.6% from 1968 to 1981. Such periods of hyperinflation are what raise concerns.

After several decades of relative prices, the question on some investors’ minds is whether the current economic conditions launch us into another period of inflation that runs well above the long-term average.

Will Inflation in 2021 Be a Head Fake or Something Worse?

Because prices collapsed in the spring of 2020, the reported year-over-year inflation numbers we see in the spring and summer are going to be high.

Even if inflation (as measured by CPI) rises through May at a rate consistent with 2% annual inflation, it will show a 3.2% year-over-year rise that would be the highest since 2011.

This is the kind of data that inspires alarmist, clickbait-style headlines that read something like, “Inflation Highest Since 2011.”

It’s easy to imagine how people looking to stoke fear might use such headline inflation numbers to create misleading narratives about the longer-term trajectory of prices. Such narratives are likely to be fueled by the even more extreme year-over-year comparisons expected in certain consumer goods, restaurants, entertainment, and tourism because we reasonably expect to see demand outpace supply.

As inflation data is reported, remember that such price spikes are a sign of economic healing from the 2020 pandemic – not a cause for inflationary panic.

If we go back to the chart showing the market’s expectations for inflation, we see the expectation for average inflation over the next two years is higher than the average inflation expected for the next decade.

In other words, the market sees any transitory increases in inflation are related to the reopening of the economy and not something that will lead to hyperinflation.

Expecting Some Inflation Is Different Than Fearing Runaway Inflation

If you are concerned about hyperinflation, consider that the economy is still a long way from operating at full capacity, and the thinking goes that getting fully “back to normal” would be the point at which inflation pressures could become problematic.

Inflation is a slow-moving process, and the economy would have to run hot for a long time to push inflation significantly higher. The most recent period of double-digit inflation in the late 1970s didn’t just happen overnight.

It took a series of events from the guns-and-butter spending of the Vietnam War and Lyndon Johnson’s Great Society program to kick things off. The Nixon administration continued to run the economy hot with wage and price controls. After that came two big oil price shocks.

But the period following this period of high inflation showed us that the Fed had the ability and willingness to the tools at their disposal to curb high inflation. There is no reason to think they would not do the same today.

Inflation – like many other things in financial markets – is a mix of calculus and psychology.

The psychology involved with inflation expectations is important because when people are accustomed to low inflation, it takes a lot to change those expectations. Workers and businesses would need to see inflation remain elevated for a prolonged period before they start expecting higher wages and charge higher prices, thus setting off the self-reinforcing upward spiral.

What to Think About When Investing to Protect Against Inflation

With the risk of higher inflation on the way, one might wonder how to invest in such a scenario. After all, growing your hard-earned savings at a rate greater than inflation is the primary reason to be an investor.

Stocks

In the long-run, stocks are the best hedge against inflation. Historically, average global equities returns are nearly 7% more than the rate of inflation.

A big reason stocks handily beat inflation over time is that corporate earnings and dividends tend to grow faster than inflation. Going back to 1928, both U.S. dividends and earnings have grown roughly 5% a year while inflation has averaged about 3% a year.

It’s true that stocks have historically experienced below-average returns during periods of higher inflation, but ultimately corporations pass on higher prices (wages and input costs) to consumers, which in turn boost revenue and earnings in the long run.

Short-Duration Bonds and Cash

While stocks are your best bet for beating inflation in the long-term, short-duration bonds (and even cash) are the best bet to combat inflation in the near- to intermediate-term.

Short duration bonds perform well in periods of inflation because higher inflation leads to increases in interest rates. Rising rates are a good thing for bonds because you can reinvest interest and principal payments at higher rates.

And although rising rates result in immediate bond price declines, the impact is relatively muted for short-term bonds since their prices are less sensitive to interest rate fluctuations. Unlike other inflation hedges, short duration bonds (and cash) experience far less volatility.

Treasury Inflation Protected Securities (TIPS)

TIPS are bonds issued by the U.S. Treasury in which the principal value rises and falls with changes in the Consumer Price Index (CPI). The coupon payment on TIPS is also continually recalculated off this adjusted principal amount.

The problem with TIPS is that current expected inflation is already baked into prices and yields. That means you only win if inflation is higher than expected. Using the 10-year breakeven rate in the chart above tells us that the market expects inflation to average 2.3% over the next ten years. If average inflation over the next decade is higher than that market expectation, then a bet on TIPS will pay off.

To me, using TIPS this way is an active bet that you are smarter than the overall bond market. And remember that the bond market is driven by massive institutional traders that collectively know more than any one person.

Gold, Commodities, and Bitcoin

Tactically investing in any of these assets to hedge against inflation is a form of market timing; something we all know conclusively doesn’t work. Even so, they aren’t very good inflation hedges anyways.

Gold has been an awful inflation hedge since gold futures began trading in 1975, in part because they tend to rise in anticipation of inflation (rightly or wrongly) rather than with inflation. That explains why there isn’t a strong correlation (stat speak for the relationship between two or more variables) between gold and inflation.

Perhaps even worse is that gold is highly volatile, which makes it a poor hedge for something like inflation that is relatively stable. Extreme volatility creates similar problems for using a broad basket of commodities to hedge inflation.

Since I last wrote about Bitcoin at the end of 2017, there has been wider institutional acceptance of the digital currency, which has created a floor of sorts in terms of value.

There are several prominent theories that lay out the case for owning Bitcoin, but the closest one to an inflation hedge is that Bitcoin is a form of digital gold. But we’ve already established that gold is a lousy inflation hedge, so the merits of using Bitcoin as an explicit inflation hedge shares the same weaknesses.

Even with Inflation, the End Goal Remains the Same

The primary goal of investing is growing your assets at a rate greater than inflation without taking undue risk. That hasn’t changed.

While there are a number of factors contributing to rising inflation, the risk of runaway inflation is very low.

If you still feel concerned and wonder what to do with your investment portfolio in the face of potential inflation, you could try a number of tactical bets. But as outlined above, these don’t always provide the solution investors really want.

The best option for beating inflation remains a mix of bonds and cash. Meanwhile, stocks are easily the best long-term position to hedge inflation, even if one might expect below average returns in years with above average rates of inflation.

Next Steps…

Do you want to make smart decisions with your money? Discover your biggest opportunities in just 9 questions with our Financial Wellness Analysis. Click here to start your analysis.

Disclosures:

Disclaimer: This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own tax, legal and accounting advisors.

Sources of Information. We derive our information from a variety of sources we consider reliable, including historical data from fund managers, exchange data, published research, industry digests, news media, and from research provided by our principals and employees, which is proprietary, but we do not guarantee that the information is accurate or complete.

-4.png?width=266&name=Copy%20of%20blog%20featured%20image%20(1)-4.png)