As people across the globe are being told to stay put in their homes, it’s not surprising to see some companies suffering more than others. Our normal routines are turned upside down, and so are our normal consumer spending habits.

At the end of the first quarter, brick and mortar retail stocks such as Nordstrom and Macy’s were down off their highs by 77.26% and 88.26%, respectively. Many well-known travel stocks like American Airlines (-79.15%), Hertz (-71.99%), and Carnival (-81.69%) have experienced catastrophic losses, too.

Meanwhile, investors have sold off shares of oil stalwarts like ExxonMobil (-57.37%) or ConocoPhillips (-61.45%) in response to a variety of market dynamics that pushed the cost of a barrel of oil down to nearly the same cost as a case of beer.

You may look at these familiar companies with steep declines and think to yourself, “There’s no way those companies are going out of business. This dip is temporary and it’s inevitable that they’ll bounce back.”

But any time you start making investment predictions like these, you’re in dangerous waters.

The Problem with Betting on Single Stocks (Even If They’re “on Sale”)

From a starting point of feeling certain that some companies will obviously withstand the current economic shockwaves, it’s not a large mental leap to thinking about the potential upside of betting on a few stocks or sectors. Plus it sounds relatively easy: buy in when shares are discounted and then ride the wave back up to the top.

That idea of having your wealth explode from capitalizing on these opportunities is seductive, no doubt. But it’s also unrealistic.

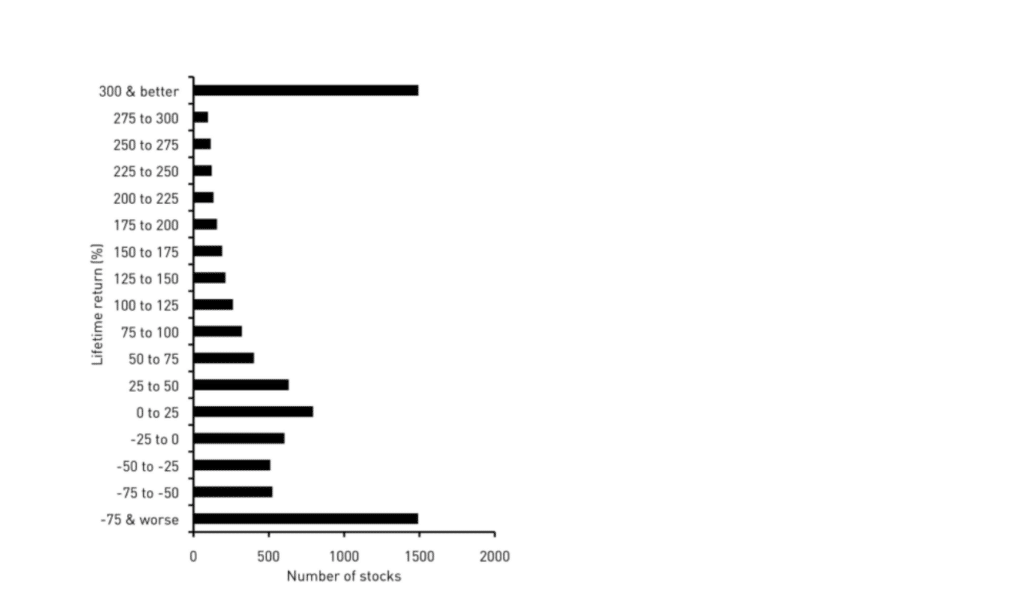

Consider the chart below from Daniel Crosby’s The Laws of Wealth:

Crosby uses the chart to make the point of the risks you take with concentrated positions. As he explains, “History tells us that the odds are twice as great that you’ll go broke on a single stock as you will hit it big.”

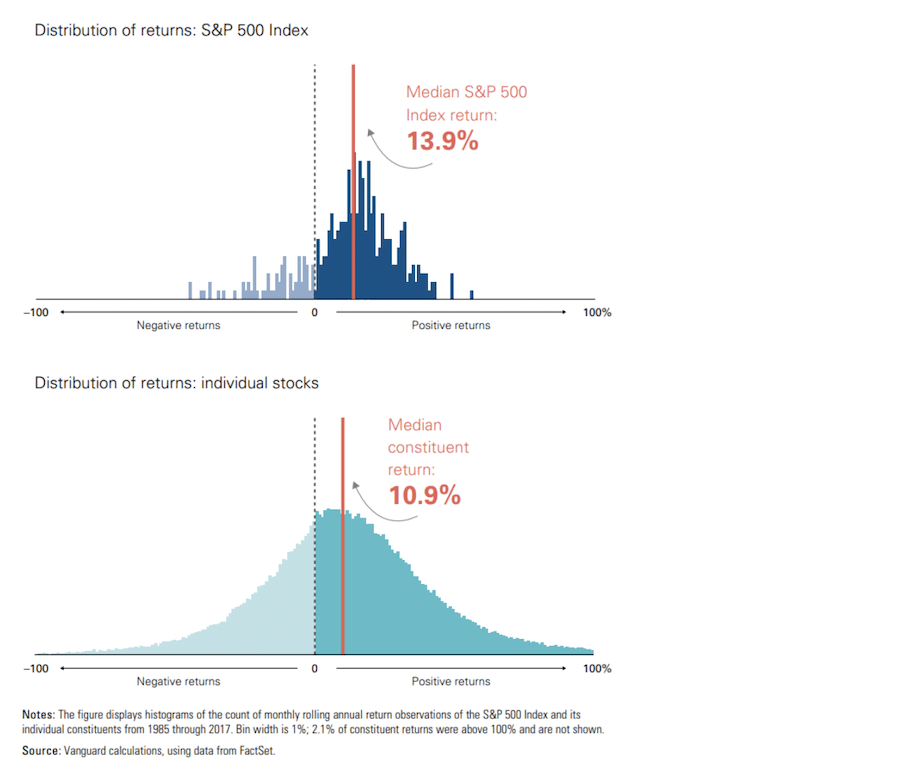

Research from Vanguard agrees. The charts below plot the distribution of monthly rolling annual returns of the S&P 500 Index (top chart in dark below) and its individual constituents (bottom chart in teal):

Not only is the range of returns for the stock market narrower, but 75% of the time the return of the S&P 500 was greater than the median individual constituent return.

Meanwhile, the range of outcomes in the bottom half of the distribution for individual stocks shows how painful holding the wrong individual stock can be.

Yes, There’s Opportunity — But That Doesn’t Mitigate the Risk

Successful long-term investors understand the importance of staying the course when broad markets fall. Those with a sound understanding of market history and meaningful degree of courage often see these periods of time as a buying opportunity.

While adding broad market exposure opportunistically during times like these might make sense, buying individual stock investments is riskier than most people realize.

In fact, a study by J.P. Morgan found that about 40% of all stocks suffered a permanent decline from their peak value of 70% or more. Some of the stocks I randomly selected at the onset of this article are down roughly that much from their highs.

What’s to say the losses aren’t permanent? What’s to say there isn’t more pain to come? The fact is, there is no way to know with certainty how things will shake out for any particular company.

When Feeling Tempted, Consider Your Personal Benchmark for Success: Ability to Achieve Goals

Where we lack certainty, we can turn to probability. Probabilities give us a rational way to make decisions about a completely unknown future. And the probabilities in this situation suggest it’s best to stay away from stock-picking.

But even if you were to ignore those probabilities and gamble on an individual stock or two, how would it change your life if you happened to pick a massive winner? Would you retire early? Buy a yacht?

My guess is it wouldn’t change anything. The only way it could change your lifestyle (currently or in the future) is if you bet an outsized portion of your net worth on individual securities or specific sectors.

Given the probabilities, I think you would agree betting a large percentage of your net worth in this manner is simply irresponsible. If you guess wrong and have a large amount of your wealth wiped out, can you afford to start over from scratch — only this time, without the benefit of the longer time horizon you enjoyed when you first began investing?

If you still want to buy individual stocks or sector-specific funds in an effort to hit a home run, and you know it won’t change your lifestyle if you’re right – then I’d ask the most important question: What’s the goal?

If the goal is to provide yourself entertainment, I actually understand that and even sympathize with it. If your financial house is in rock-solid shape – and I mean ROCK solid – then here is a suggestion:

Put a small amount of money in a separate taxable account from your primary investments. In my opinion, this amount of money should represent 1% or less of your net worth because, remember, we know the odds say you are likely to trail the overall market and even experience a permanent loss of capital. Plus, even if you do a good job it’s unlikely to change your life.

Then make your bets. Go crazy. Have fun. But leave your core long-term investments alone.

Meanwhile, remember: a good financial plan doesn’t require you to hit home runs. It merely requires you to earn a decent return that compounds its way into exponential wealth growth.

Good investing is boring. If you’re having more fun watching your portfolio than watching paint dry, you’re probably doing it wrong.

This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own investment, tax, legal and accounting advisors.

Price declines shown as percentage of previous highs as of 3/31/2020.

-4.png?width=266&name=Copy%20of%20blog%20featured%20image%20(1)-4.png)