There’s one more important detail to pay attention to when comparing advisors: The way they get paid. Unfortunately, not all advisors operate by the same methods, and how an advisory firm generates revenues and compensates its employees is a critical factor in the quality and type of advice you receive.

You want a firm that’s fee-only, rather than fee-based or commission-based. What’s the difference? A fee-only firm is paid only by you—and the other clients they serve. The firm will charge a fee based on a percentage of assets they’re managing, and that fee typically decreases with the size of your account.

A fee-based or commission-based firm, on the other hand, receives some or all its compensation based on the products they sell or the investment trades they make. In other words, the firm is receiving money from big financial institutions to recommend specific investments or is generating revenue by frequent buying and selling of stocks and bonds. Those sources of revenue can influence their advice: Instead of making unbiased recommendations that are solely in your interest, they may steer you toward specific products or financial moves that net the advisor, or the firm, a financial reward. For the same reason, it’s also important that your advisor is salaried and doesn’t receive compensation from sales competitions or referrals they make to outside providers.

An advisory firm should be transparent about fees, leaving no question about how they make money or hidden costs that will surprise you later. You’ll want to see a clear fee schedule, with fees based on percentage of assets, for example. The firm should also state clearly if it requires a minimum account size or charges fees for accounts under that minimum.

Understand the Impact of Investment Fees

While investors are increasingly paying attention to how advisors earn their money, many still overlook just how much high investment fees can impact their returns. For most people, mutual funds and ETFs will make up a big portion (if not all) of their investment portfolios. These professionally managed investment vehicles charge fees to cover the cost of the fund managers and analysts, as well as cost of recordkeeping, accounting, tax management, and other services. Those fees are passed on to shareholders and taken directly out of your fund returns.

The fees charged by different mutual fund and ETF providers vary widely. But working with an advisor who offers lower-cost investment options can help you achieve higher returns.

How Fund Expense Fees Can Hurt Your Progress

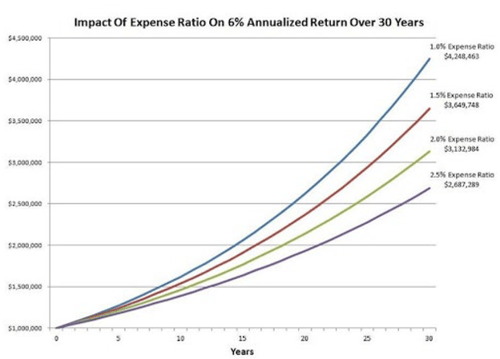

A fund’s expense ratio measures operating funds relative to the fund’s total value, and fund expenses can have a significant impact on your portfolio over time.

Consider what happens to $1 million invested in a fund with a 6% annualized return over 30 years: With an expense ratio of 1%, the portfolio grows to $4,248,463. But with an expense ratio of 2.5% the portfolio only reaches $2,687,289—a $1.5 million gap in your potential savings.

Disclosure: Past performance is not indicative of future results. This material is not intended to be used as a general guide to investing or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate strategies depend upon the client’s specific circumstances and investment objectives.

Choosing the Right Advisor is too Important to Leave to Chance

Comparing the approach and service offerings across different advisors might not be as intuitive as comparing the features of a car or a refrigerator but spending the time to find the right advisor can be a huge boost to your long-term financial success. And when you’re armed with a clear vision for what you want in an advisory team, you can look beyond marketing materials, ask the right questions, and compare your options critically.

Finding an advisor with the experience that fits your needs, and who’s backed by a strong team and expert information, helps ensure that you will cover the essential factors that make a real difference in managing your wealth. And you can rest easy knowing that you and your advisor share the same top priority: Achieving your family’s goals.

How to Ask an Advisor About Fees

- What is the overall cost of working with you?

- How does the firm generate revenue?

- How do advisors at the firm get paid?

- Do you take part in sales contests or receive incentives for referrals?

- What types of investment vehicles do you use, and what are their typical expense ratios?

Resource:

Are you ready to find a Financial Advisor that works for you? Download our eBook and begin evaluating your options today.

Disclosure:

This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own tax, legal and accounting advisors.

-4.png?width=266&name=Copy%20of%20blog%20featured%20image%20(1)-4.png)