Synthetic equity. Phantom stock. Stealth securities.

Okay, that last one isn’t real, but these terms could be mistaken for shady business practices when, in reality, they’re not only legitimate compensation plans but also testaments to your hard work and contributions to your company.

Nevertheless, while synthetic equity may resemble its (actual) equity counterpart, it’s nuanced. Maximizing the potential benefits of this award requires a deep understanding of those nuances—specifically, how synthetic equity plans work, how they differ from traditional equity compensation, their advantages and disadvantages, and the inevitable tax implications.

What Is Synthetic Equity?

Think of synthetic equity as a communal garden. You don’t own the plot, and you don’t necessarily have a say in what’s planted, but you're guaranteed a share of the crops that are harvested.

Synthetic equity is a form of deferred compensation that mirrors some of the benefits of real stock ownership without granting actual shares. It’s a contractual agreement between you and your employer that entitles you to a payout upon certain events—such as an IPO, acquisition, or surpassing earnings milestones.

Companies use synthetic equity plans to motivate their personnel through growth-related incentives. In other words, it grants employees a sense of ownership without issuing shares or altering the business’s ownership structure. As the company succeeds and appreciates in value, so does your potential payout. Although you don’t own actual shares of company stock, you are compensated as if you did.

That begs the question though: Why would a company offer synthetic equity instead of actual equity?

Typically, synthetic equity is offered to incentivize and retain key talent without diluting the pool of existing shares. This approach also sidesteps potential issues with voting rights, avoids the need for complex legal documentation, and can be used to prevent former employees from retaining stock ownership after their departure.

How Synthetic Equity Works

If you’ve been offered synthetic equity, congratulations! That tends to be a strong indication that you’re integral to your company’s operations.

Your synthetic equity plan is unique to your company—they set the rights, terms, vesting schedule, and so on. This employee compensation package is not limited to private companies with illiquid or rigid capital structures. Partnerships, LLCs, startups, and major public enterprises are all capable of facilitating a phantom equity plan.

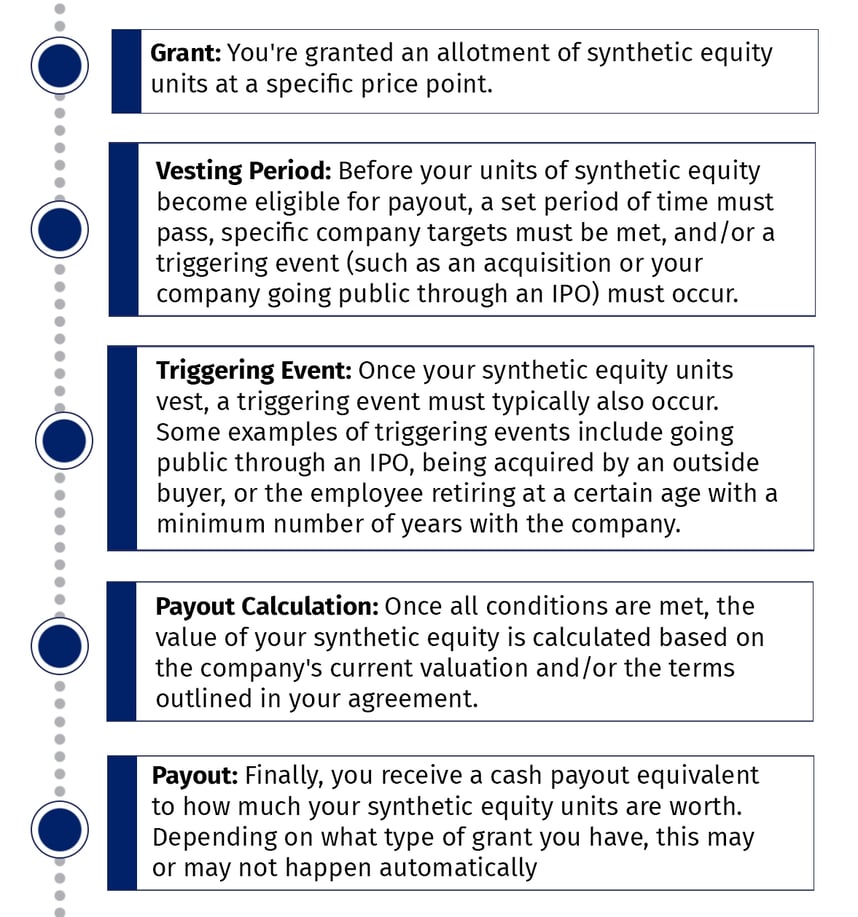

Here’s what the typical lifecycle of a synthetic equity plan might look like:

Keep in mind, your plan could include a provision that requires a discount or complete forfeiture of value if you leave the company prior to a qualified triggering event.

If you violate a non-compete or certain conditions of your employment agreement, awards that have previously been paid out may also be subject to clawback, so read your documents carefully!

Types of Synthetic Equity

Synthetic equity can be very flexible, allowing companies to tailor their plans to align with their specific circumstances and objectives. Generally though, these types of arrangements take one of two forms.

Phantom Stock

Employees that are awarded phantom stock will receive a cash payout equal to the value of an equivalent number of company stock shares upon vesting.

As an example, let’s say you are awarded 3,000 units of phantom stock when a share of company stock is worth $50. If the price of company stock has increased to $70 when your phantom stock award vests, you would receive a cash payout of $70 per unit, equal to $210,000 before taxes.

Equity Appreciation Rights

Instead of receiving compensation equal to the number of units awarded times the price of company stock at vesting, employees that hold equity appreciation rights will only benefit from an increase in the value of company stock since the grant date.

Using a similar example as above, say you receive 9,000 units of equity appreciation rights when company stock is valued at $50 per share. If, at the time you exercise your equity appreciation rights, the share price has increased to $70, you would receive $20 per unit for a cash payment of $180,000 before taxes. If the share price decreases to $49, the units awarded will have no value.

This highlights a key advantage of phantom stock over equity appreciation rights. Phantom stock will always have some value upon redemption unless the price of company stock drops to $0. For equity appreciation rights to have value, the price of your company’s stock must have increased from the grant date.

Because of this feature, an award of equity appreciation rights would typically have 3-4 times the number of units as an equivalent award of phantom stock. And while the risk of equity appreciation rights being worth $0 upon redemption is much higher than with phantom stock, being awarded additional units means the upside potential can be much higher as well.

Sticking with the same example, assume the price of company stock increased from $50 to $90. While 3,000 units of phantom stock would be worth $270,000, an equivalent award of equity appreciation rights with 9,000 units would be worth a whopping $360,000. As it goes with all things investing, risk and return are related.

Synthetic Equity vs. Equity Compensation

If you’re familiar with equity compensation, you may have picked up on some similarities between synthetic equity and other forms of compensation like Restricted Stock Units (RSUs) and Nonqualified Stock Options (NSOs). So, what are the actual differences?

Both equity and synthetic equity compensation plans allow the opportunity for employees to benefit from the success of the company they work for. Phantom stock is most similar to RSUs. Equity appreciation rights are most similar to nonqualified stock options.

The following table compares key differences between these plan types.

| Stock Appreciation Rights | Nonqualified Stock Options | Phantom Stock | Restricted Stock Units | |

| Ownership of Shares | Not typically | Yes, upon vesting and exercise | No | Yes, upon vesting |

| Cost of Purchase | None | Strike price of options, if exercised and shares held | None | None |

| Tax Implications | Taxable upon exercise as compensation income | Taxable upon payout as compensation income | Taxable upon payout as compensation income | Taxable upon vesting as compensation income |

| Dividends | No, but possible dividend equivalents | Yes, but only after exercise | No, but possible dividend equivalents | Yes, after vesting; possible dividend equivalents prior to vesting |

| Vesting Schedule | Time-based and/or performance-based; also requires a triggering event | Time-based and/or performance-based | Time-based and/or performance-based; also requires a triggering event | Time-based and/or performance-based; may require a triggering event |

The Pros and Cons of Synthetic Equity

Pros: Easy Incentive Plan for Key Employees

Simplified Financial Reward: Synthetic equity offers a more straightforward way to benefit from your company's success. It’s less complicated than traditional equity compensation. There are fewer decisions to make and there is never an out-of-pocket cost required to participate.

Potential for Dividends: Synthetic equity plans could be structured to include cash payouts that mirror dividend distributions.

Cons: Tax Liability and Risk of Static Market Value

Lack of Ownership: With synthetic equity, you don't own part of the company, so you miss out on the benefits of stock ownership such as voting rights.

Tax Implications: Payouts are taxed as ordinary income, often with little to no control over when that income is recognized. There’s also no potential for more preferential long-term capital gain treatment, which is available for any gain after shares are acquired with RSUs or NSOs, so long as they are sold more than 12 months after purchase.

Dependence on Company Performance: The value of your synthetic equity is directly tied to the value of your company’s shares. Unlike with a straight cash bonus, the value of your award could decrease in value substantially or, in the case of equity appreciation rights, have no value at all.

Tax Planning for Synthetic Equity

When it comes to taxes, synthetic equity functions much like a cash bonus. It’s considered a deferred compensation plan, meaning these plans must comply with IRS Section 409A and payouts are taxed as ordinary income.

Proactive tax planning with synthetic equity compensation is essential. Although you may have limited control over when or how your phantom equity grants will be taxed, there may be ways to accelerate other sources of income or tax deductions as needed to put you in a more favorable position as income from synthetic equity grants hits your tax return.

Given the complexities of this employee benefit relative to traditional cash compensation, you may want to consult an experienced financial advisor and tax professional that’s familiar with synthetic equity plans. They can provide personalized advice to help you navigate the nuances of your company’s specific plan and ensure your tax strategy aligns with your overall financial goals.

Unsure if you need guidance? Try our Money Match Quiz to evaluate your financial profile and get matched with the right type of support—it only takes two minutes.

This article was co-written by Larry Guess, Director of Business Succession Planning. Learn more about Larry here and discover how the Business Succession Planning team can help you achieve your personal financial goals and set your business up for long-term success.

-4.png?width=266&name=Copy%20of%20blog%20featured%20image%20(1)-4.png)