Instilling the value of money in our children is a difficult task for most anyone. There are so many questions to consider. What age do we start talking about money? How much of an allowance should we give our children? How should we encourage them to spend/save their money?

In honor of Father’s Day, this month’s InspireHer post features three of our Plancorp dads—and their experiences raising financially savvy daughters. I sat down with Leo Haas, Mike Dambach and Brian Wiedermann to learn more about their approaches and advice.

|

|

|

|

Leo Haas, AIF® Vice President |

Mike Dambach, C.P.A, AIF® Wealth Manager |

Brian Wiedermann, CFP®, AIF® Wealth Manager |

How early did you start teaching your daughter(s) about the value of money?

Mike: We began by giving my daughter an allowance while she was in grade school. She started saving in a piggy bank, and then eventually moved to a bank account. We encouraged her to save some and not spend it all!

Mike: We began by giving my daughter an allowance while she was in grade school. She started saving in a piggy bank, and then eventually moved to a bank account. We encouraged her to save some and not spend it all!

Leo: My wife, Nancy, and I started when my girls were teenagers. It was important to us they understood that spending money was an option—not a requirement.

Leo: My wife, Nancy, and I started when my girls were teenagers. It was important to us they understood that spending money was an option—not a requirement.

Brian: We started having serious conversations about money in high school, but I wish we’d started sooner.

Brian: We started having serious conversations about money in high school, but I wish we’d started sooner.

Leo Haas with his daughters.

What tricks did you use to teach your daughter(s) about financial responsibility?

Leo: We never gave our girls an allowance; they had to justify what they needed money for. They started babysitting around age 12 to earn their own money.

Leo: We never gave our girls an allowance; they had to justify what they needed money for. They started babysitting around age 12 to earn their own money.

Brian: No tricks. My daughter is starting her first job this summer, and my wife and I offered to match what she earns to put into a Roth IRA.

Brian: No tricks. My daughter is starting her first job this summer, and my wife and I offered to match what she earns to put into a Roth IRA.

What is an important tip for every young girl to know about money and saving?

Mike: To save correctly requires a disciplined approach.

Mike: To save correctly requires a disciplined approach.

Brian: Nowadays, kids are all about immediate gratification. It’s important for them to understand the difference between needs and wants.

Brian: Nowadays, kids are all about immediate gratification. It’s important for them to understand the difference between needs and wants.

Mike Dambach with his daughter.

How has your role in the financial industry impacted the way that you teach your children about money?

Leo: It’s shown me how poor financial literacy is across the industry. Financial wellness isn’t taught in schools, so if your children don’t get that education at home, they won’t get it at all.

Leo: It’s shown me how poor financial literacy is across the industry. Financial wellness isn’t taught in schools, so if your children don’t get that education at home, they won’t get it at all.

What financial mistakes have you encountered/experienced that you wanted to ensure you children did not?

Mike: Too often, people “follow the crowd” based on what their friends are doing or what they see on social media. I encouraged my daughter to do her homework and be diligent with her investments. Being alert to cybertheft is another big one in this day and age.

Mike: Too often, people “follow the crowd” based on what their friends are doing or what they see on social media. I encouraged my daughter to do her homework and be diligent with her investments. Being alert to cybertheft is another big one in this day and age. Leo: Nancy and I emphasized the importance of avoiding debt—whether it be student loans or credit card debt. We encourage our girls to pay off their credit cards every month and not carry a balance.

Leo: Nancy and I emphasized the importance of avoiding debt—whether it be student loans or credit card debt. We encourage our girls to pay off their credit cards every month and not carry a balance.

How has the way you were raised with money changed with respect to how you raise your children?

Brian: Growing up, my parents never talked with me about money. It made me want to be more proactive about those conversations—although, in hindsight, I would have started even sooner.

Brian: Growing up, my parents never talked with me about money. It made me want to be more proactive about those conversations—although, in hindsight, I would have started even sooner.

Leo: Coming from a family of six kids, I wanted to be able to give mine what they wanted. But, you can’t always do that, or they’ll start to feel entitled or spoiled. It was important to Nancy and me to teach them to be grateful for what they have.

Leo: Coming from a family of six kids, I wanted to be able to give mine what they wanted. But, you can’t always do that, or they’ll start to feel entitled or spoiled. It was important to Nancy and me to teach them to be grateful for what they have.

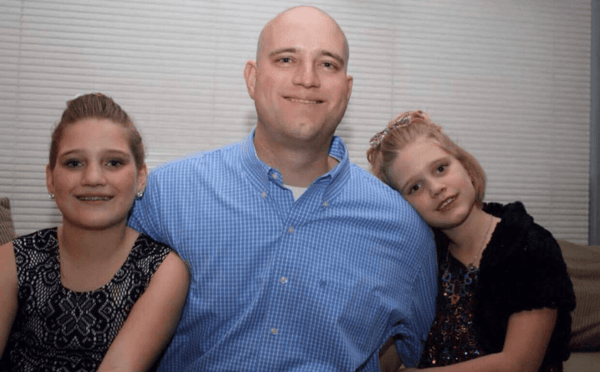

Brian Wiedermann with his daughters.

Brian Wiedermann with his daughters.

What are some key financial areas you wanted to be sure your child was aware of/prepared for? (debt, living expenses?)

![]() Brian: I tell my daughter it’s Important to know what you are saving for. We’ve talked about debt management, because credit card companies often target college students. I made sure she knows the difference between a debit and credit card, as well as how to budget.

Brian: I tell my daughter it’s Important to know what you are saving for. We’ve talked about debt management, because credit card companies often target college students. I made sure she knows the difference between a debit and credit card, as well as how to budget.

Why is it important to raise financially savvy (or financially independent) daughters?

![]() Leo: It’s important to raise ALL your kids to be financially independent, son or daughter.

Leo: It’s important to raise ALL your kids to be financially independent, son or daughter.

![]() Mike: It gives her the freedom to make choices about her career, marriage and life.

Mike: It gives her the freedom to make choices about her career, marriage and life.

Brian: It gets them off the payroll! In all seriousness, though, the goal is to start them off on the right track after college. You want them be able to do whatever they want —buy a house, pay their cell phone bills—without relying on anyone else for their success.

This post was written for InspireHer, Plancorp’s Women’s Initiative, which strives to advocate for clients and women in the community by addressing topics specific to their lives. For more information about InspireHer and how you can get involved, email inspireher@plancorp.com.

![Steph Wedding[1]](https://www.plancorp.com/hs-fs/hubfs/Steph%20Wedding%5B1%5D.jpeg?width=486&name=Steph%20Wedding%5B1%5D.jpeg)