I wrote an article at the beginning of the summer titled Volatility is Not the Enemy. I remember thinking it would be the perfect article for whenever the market had a correction. Since it had been nearly four years since the last correction, I figured it should be published and referred back to during the next correction.

Well, here we are two months later and the S&P 500 has finally declined by more than 10% from its previous high so check out the article if you missed it. In addition, here are few thoughts regarding the most recent stock decline.

We’ve been waiting a long time for this, so don’t be frightened.

For several months, we’ve been cautioning about the possibility of a pullback. In our April newsletter article on valuations and return expectations, we had this to say about market valuations:

“When the market has been steadily climbing for such a long period of time, valuations tend to expand and it’s important to keep expectations in check…Current valuations suggest that stock prices are vulnerable to unexpected shocks and long-term returns have an increased probability of trailing historical average returns.”

We never know when the next correction will happen, but we manage our portfolios knowing that downturns happen regularly. Historically, the S&P 500 has experienced a correction of 10% or more once every 357 trading days. Until today, it had been 1,041 trading days since the last correction.

It may feel scary at the moment because it is so long since we’ve had a correction, but this is completely normal and exactly how we expect a correction to feel. The value of your portfolio may fall in the short-term, but a long-term focus allows you to participate in the eventual recovery.

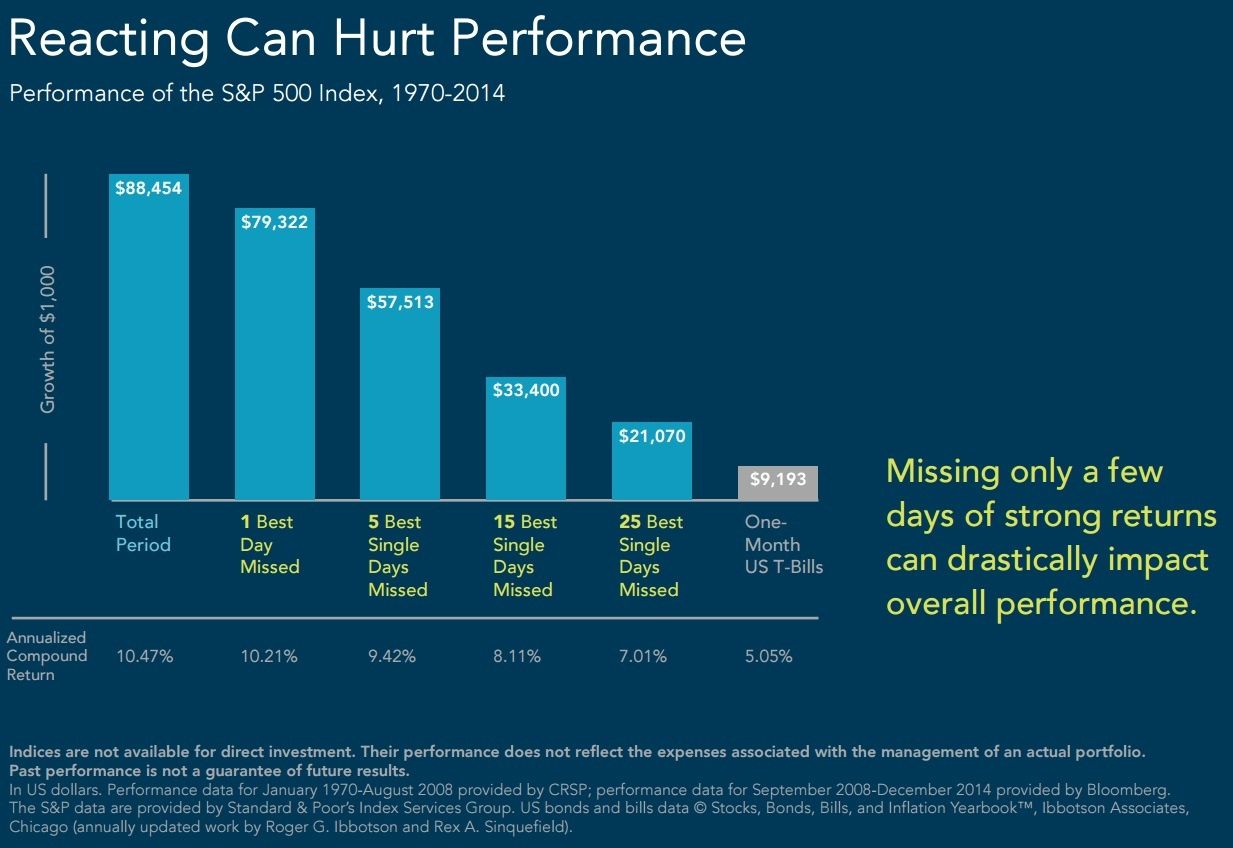

Reacting can hurt performance if you miss the best days.

Our human instinct to react when faced with danger was very important to our species’ survival from an evolutionary standpoint. Unfortunately, good investing requires that we ignore those instincts and the desire to do something in response to losses.

The best days in the market usually follow the worst days in the market, so jumping out of the market now would mean that you realize losses and drastically increase (to the point of near certainty) that you will miss the best days that help you recover portfolio value.

The chart below from Dimensional Fund Advisors shows the impact of missing the best trading days over the past 44 years.

When the market is down, you’ve essentially paid for the return in the form of negative volatility. You might as well stick around for the reward of stock ownership and capture the good days that follow.

Your portfolio is more than just stocks, bonds are doing their job as the volatility reducer.

Newspaper headlines and TV outlets are focused solely on stock market losses, but it’s likely your portfolio also holds bonds.

The primary purpose of bonds is to decrease the volatility of the portfolio. As part of a balanced portfolio, bonds provide diversification and capital preservation benefits, while stocks are the main source of risk and return over the long run.

As we would expect, bonds are doing their job quite well. During the period in which the S&P 500 has declined 11.15%, the Barclays Aggregate Bond Index has actually remained relatively flat with a small loss of 0.11%.

Not only do bonds reduce volatility, they also provide ammunition for buying equities on the cheap through the process of rebalancing.

The media is not there to help you.

The media is in heaven. Nothing generates more viewers and clicks than a down market, so they sensationalize short-term moves and leave out long-term perspective.

If the media were to give out good advice such as, “stay the course, rebalance, view stock investing with a long time horizon” they would have a lot of airtime to fill and people wouldn’t need to tune in. So instead they trot out different people with incredibly detailed and exact forecasts of the future.

Here is what the media doesn’t want you to know: there is no way to predict the stock market’s moves. You are far better off focusing on the things you can control such as risk exposure, costs, taxes, and investment behavior.

Losses could be bigger, and one day they will be.

5-10% corrections happen all the time, usually on an annual basis. The S&P 500 averages a 20% drop roughly every three and a half years. 30-50% drops happen less frequently, but they are going to happen. We believe in building a portfolio that accepts these declines, but doesn’t try to predict when they will start and end. Our portfolios are designed to lose value in down markets, but our discipline allows us to recover and then some.

Corrections are temporary and short-term events by nature. Longer lasting bear markets (typically considered a decline of at least 20%) are usually associated with recessions. At this point, economic and market indicators don’t show evidence of a recession in the near term, so we view this pullback to be temporary and provide some good rebalancing opportunities.

-4.png?width=266&name=Copy%20of%20blog%20featured%20image%20(1)-4.png)