An ESPP (short for Employer Stock Purchase Plan) is a super valuable benefit offered by your company that allow you to purchase your company stock at a discount.

With the recent drop in the US stock market however, you might find that the price of your company shares is now below even the discounted purchase price. That may have you wondering if it is worth continuing to participate in the ESPP.

How A Stock Market Decline Can Work in Your Favor With an Employee Stock Purchase Plan

This article explores why you will still benefit from participating in the ESPP and the tax treatment of a sale of shares acquired through an ESPP at a loss. Let’s look at an example.

Ali works for a company with an ESPP that allows her to purchase company stock at a 15% discount. Shares were trading at $100 when Ali entered the ESPP during the offering period, meaning she can purchase her company stock for $85 on the purchase date. If Ali contributes enough to buy 100 shares, that is a savings of $1,500!

With the recent decline in the stock market, however, her company shares are now trading at $80. If she were to purchase 100 shares at $85, that is an immediate loss of $500! Her participation in the ESPP does not seem so great anymore.

The good news is that most ESPPs come with a lookback provision. A lookback provision allows employees to purchase shares at a 15% discount on either the lower of the stock price at the offering date or purchase date. In this example, Ali would be able to purchase shares at a 15% discount off the current trading price of $80, so her ESPP purchase price is $68. With a look-back provision, employees are guaranteed a discount and will always come out ahead.

Your ESPP may also automatically reset the purchase price if the price of your company stock goes down. That means for Ali, the price she can purchase stocks is now set to $68 even if her company stock recovers and goes back up to $100 by the next purchase period. That’s a savings of $32 per share! If you can stay disciplined, a temporary decline in the stock price can actually work out to your advantage.

You have the option to sell shares acquired through an ESPP right away to lock-in the gain. You can alternatively hold the shares and benefit if your company stock prices goes up – of course, there is always the risk the stock price going down.

ESPP: When to Sell

With the recent market decline, your company's stock price may be lower than the price you paid through your ESPP. Let’s continue our example above.

Ali’s company shares are now trading at $60 and she would like to sell all 100 shares to fund her Roth IRA. She understands the benefit of contributing to a Roth IRA, but she is concerned about the tax ramifications from selling her ESPP shares.

ESPP Tax Strategy

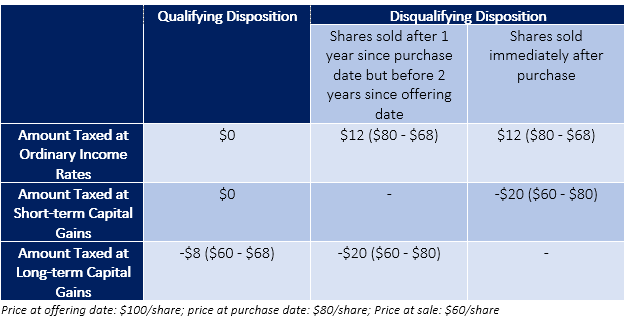

Ali purchased shares for $68, so selling them at $60 results in a loss of $8/share. When Ali decides to sell her ESPP stock, there are two tax scenarios depending on whether the sale is a qualifying disposition or disqualifying disposition.

If she has held the ESPP shares long enough for the sale to be a qualifying disposition, she has no income tax liability. Rather, the $800 loss ($8 x 100 shares) is treated as a capital loss and can be used to offset capital gains or up to $3,000 of earned income.

If Ali has not held the shares long enough, the sale is a disqualifying disposition. There are two components in this scenario.

First, the discount she received at the time of purchase ($80 - $68 = $12) is taxed as ordinary income. That means $1,200 ($12 discount x 100 shares) will be added to her W-2 and she will owe ordinary income tax on that amount.

Second, Ali will recognize a capital loss equal to the sale price minus the non-discounted price of the shares at the purchase date, or $20 per share ($60 - $80). To summarize, Ali has $1,200 of income taxed at ordinary income tax rates AND a $2,000 capital loss that can be used to offset capital gains or up to $3,000 of earned income.

You generally want to avoid being taxed at the ordinary income tax rate, so a qualifying disposition is preferred. But while a disqualifying disposition at a loss may not be ideal, it could be the right thing to do depending on your tax situation, concentration of your wealth in employer stock, and what you plan to do with the proceeds.

Your overall ESPP strategy, such as how much to contribute and how much to sell and when, should take into consideration your overall investment objectives and long-term financial goals. If you have questions on managing single-stock exposure, or establishing an overall investment objective and building a long-term financial plan, schedule a call with an advisor today.

Disclaimer: This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own tax, legal and accounting advisors.

1 To make a qualifying disposition, shares must be held at least 2 years from the offering date, and 1 year from the purchase date.

-4.png?width=266&name=Copy%20of%20blog%20featured%20image%20(1)-4.png)