Financial Planning Guide

When it comes to reaching your financial goals, investing is just one piece of a much bigger puzzle. Comprehensive financial planning is where you can make a big impact. Let's cover what it is, why it’s important, and how financial planners can help.

Table of Contents

Like playing an instrument or mastering a trade, financial planning is a skill. A natural interest and aptitude helps, but there is no substitution for education, time, and experience.

In this guide, we’ll discuss what financial planning entails, the process we take with financial planning, and how professionals like financial advisors and wealth managers can help.

What is Financial Planning?

You don’t drive to a new location six states away without directions, right? Think of financial planning the same way. You have a destination in mind, but you need a list of directions to get there and a guide to alternate routes when there's a roadblock.

Financial planning starts with assessing where you are financially, pinpointing your ideal future state, and figuring out what milestones you need to reach to get there. You need to consider your savings, debts, benefits, investments, and anything else that could impact your financial state now or in the future, but you can't stop there.

Some talk about a financial plan as if it is a simple one-page document that you put together once and never need again. The reality is your financial plan is not a static document — just as your life changes, so too may your financial plan.

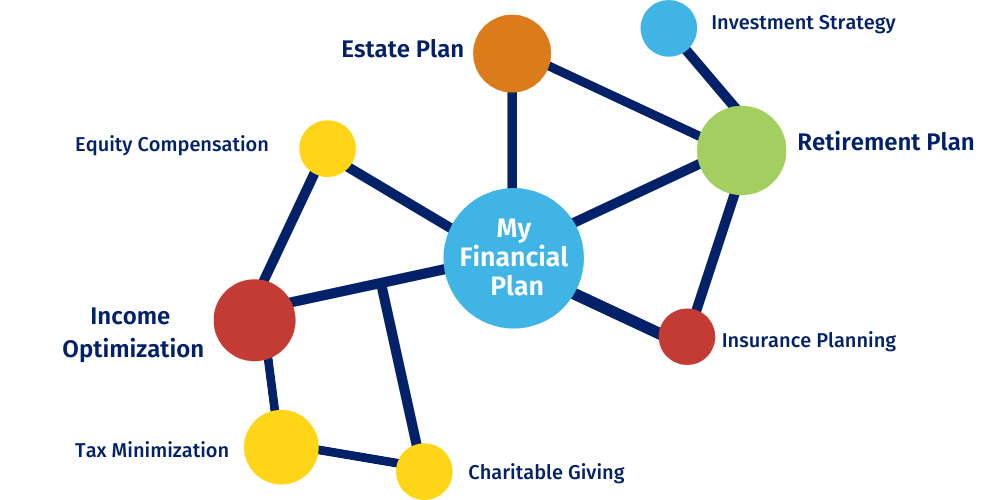

Along with unexpected detours or pivots, positive changes like career progression and starting a family are things your plan needs to take into account. All of these factors are related.

Your employee benefits may impact how you tax-optimize your income and what savings rate you can withstand. Your savings rate will influence your investment strategy and therefor your retirement plan, and so on and so forth.

In short, these are all inter-dependent factors that a simple one-time plan can miss. In fact, some will sell you a 'plan' but in reality it's a financial statement. It outlines what you have and where, but it's not actionable or able to help you make more complex decisions. For that, you'll want to create something with an advisor who can bring it to life.

Working with a good partner ensures your plan is comprehensive, appropriately matrixed, and regularly reviewed, increasing it's resiliency and therefore the likelihood you're able to do what you want with that wealth.

A point of clarification if this is sounding overwhelming: having a solid financial plan does not mean you’re planning every last detail of your life.

You can't predict the future, but a good financial plan can be used as a guide while making decisions to build confidence you aren't inadvertently putting big goals like retirement at risk while dealing with a short-term issue. A great financial plan does that while also helping you make the most of every opportunity along the way.

A great advisor will use the following to help you answer big financial questions with a bit more confidence:

- Knowledge of things like investments, tax strategy, insurance, estate planning, and more. Ideally, they’ll be certified in their understanding of financial planning with a CERTIFIED FINANCIAL PLANNER (CFP®) designation.

- Data, not just on individual pieces of your plan like investment performance, but a comprehensive look at the likelihood you’ll be able to achieve your goals given what we know today, typically in the form of a financial independence analysis.

- Context from their experience with other clients and colleagues, working with your other professional service teams (CPA, Attorney, etc.), knowing who your stakeholders are, and larger market and economic trends.

- A deep understanding of your goals, preferences and vision for life. This is the key to moving from cookie cutter advice that AI could deliver to a truly bespoke plan that leaves your mind at ease.

The Importance of Financial Planning

Financial planning helps you prepare for anything that may come your way: sudden job loss, health issues, a big move, retirement, even car trouble (or when any of these issues impact your children).

When everything is in place, you know exactly what you have and how much you can use toward getting back on your feet without sacrificing your long-term goals.

Only 36% of U.S. households have a written financial plan.

(Source: Kiplinger)

Financial planning gives you an understanding of your current spending and budgeting habits to help you feel in control of your income, expenses, and investments. But once you reach a certain level of stability, your plan will start to elevate into long-term optimization.

That's where many get stuck in the basics, like never moving from planning for your next tax bill to minimizing your lifetime tax burden. A solid high-net-worth financial plan should:

- Give you a comprehensive look at everything you own, owe, and your average cash flow

- Outline your goals, big and small, and show your progress toward them

- Align your investment portfolio with your individual timelines and risk tolerance

- Minimize your tax liability for the next decade, not just the next year

- Incorporate any equity, business interests, and inheritance into your tax and investing strategy

- Increase confidence when you make big purchases or experience a big life change

- Define an action plan to achieve goals

- Establish a clear legacy that follows your wishes without undue risk

- Feel personalized to your preferences and leave you feeling confident, even when the market drops or something unexpected comes your way

If the plan you have in place now isn’t inspiring all of the above, it’s time to go back to the drawing board because you could be missing out on opportunities that cost you or your future generations.

Benefits of Financial Planning

The biggest benefit of building a financial plan is that you will be better prepared for whatever comes your way — from the smallest home repair to unexpected medical expenses, without sacrificing your long-term goals.

- Clarity and confidence in your financial future

- Tax-efficient wealth building

- Better decisions around debt, spending, and saving

- Preparedness for life's surprises

- A clear path to retirement or other major financial goals

- A legacy plan for your family

Setting goals

Finding motivation and commitment

Guiding actions and decision-making

Setting performance standards

Diversifying your portfolio

Providing emotional and mental health benefits

Can I DIY My Financial Plan?

Now that we have covered what factors into your plan and how it needs to evolve, the most common question we hear is "Can't I just DIY my financial plan?"

There is access to more information and great software individually than ever before meaning financial planning on your own is absolutely possible. Many choose to do this, especially early on.

But with a financial advisor or wealth manager as your co-pilot, your financial journey will be less stressful and time consuming, and you’ll have an unbiased third party to turn to when considering tough decisions even as your finances get more complex.

If you answer yes to any of the following questions, meeting with an advisor to learn more about their services might be a good option:

- You're within 10 years of retirement

- You are in one of the top income tax brackets

- You receive equity or stock options from your employer

- You are a business owner with many business assets

- You have a spouse and/or children

Even if you're in a different stage of life, consider this question: When the market drops, how confident are you that your plan is still on track?

If volatility is stressing you out or you're not entirely confident you're making the most of your opportunities, chatting with an advisor is more than worth your time.

Free Worksheet

Download our helpful tool to guide your advisor interviews and make the right choice.

>> How to Interview a Financial Advisor

Financial Planning Process

Creating a financial plan is a multistep process that starts with a discovery phase. This is where your financial advisor will ask you about your current situation, including questions such as:

- What is your monthly income?

- What are your expenses?

- What does your savings look like?

- Do you have any investments?

- What debts are you paying off?

- What are your short-term goals?

- What are your long-term goals?

- What large expenses are you anticipating? (college, new home, retirement, etc.)

Once your advisor better understands your life and your goals, they can start with goals-based financial planning. You’ll start to attach specifics to your goals — rather than saying, “I want to retire,” you’d say, “I want to retire at 55 with enough money to travel with my family every year.”

Other specific goals:

- I want my house to be paid off in 10 years.

- I want to retire early, and I want to travel for a year.

- I want to pay for my child’s college expenses and not worry about what’s in my bank account.

- I want to make sure healthcare as I age doesn’t impact my family.

- I want to make investments that will help me retire early.

- I want to pay off my student loans.

- I want my family to be cared for when I’m gone.

With current inputs, future goals, and data that takes a variety of situations into account, your financial planner can help assess the likelihood of success using planning software that can synthesize income, savings, taxes, and more.

From there, they can make recommendations of what to change (if necessary) or help you build confidence you can do something like fund an education, buy a second home, or retire early.

Curious about our process at Plancorp?

We strive to make it easy to set a plan, connect accounts, and enjoy the peace of mind that comes with hiring an advisor who specializes in high net worth clients. It all starts with your first call.

Schedule a private strategy session with Plancorp to find out if the money you’re setting aside is invested and protected appropriately.

Schedule a Call

What Does a Financial Plan Look Like?

As we mentioned above, your financial plan is not a static document. It's a compilation of multiple components like a net worth summary, investment reporting, estate plan summary, tax projections and more.

When you begin with a financial planner, they’ll likely conduct a financial independence analysis, which includes the following:

- Monthly cash flow (income, expenses, benefits etc.)

- Plan(s) to pay off debt

- Plan to build an emergency fund

- List of insurance coverage

- Savings breakdown (simple savings accounts, 401(k), IRA etc.)

- Investment portfolio

- Plan to pay taxes

- Retirement savings

- Estate planning

While we discuss what's included in a plan and what it looks like, it's also important to consider who the partners are that help make it happen. You may hire out a team of professional services without connecting them, and be missing out on possible synergies.

You might occasionally need a CPA, estate planner, broker, etc., but miss the opportunity to have one central financial advocate who understands you best and a team of experienced professionals behind them for added support.

A great financial planner (often called a wealth manager) will proactively connect all aspects of your goals and financial life together for a cohesive plan that reduces duplication.

So, what does a financial plan look like? It looks like a life led with confidence that you're making the most of your opportunity, avoiding unnecessary risk, and considering the legacy you'd like to leave.

Scenarios When Financial Planning Is Needed

You might be asking yourself when to start financial planning. You're not alone. The simplest answer is as soon as possible, but it can feel daunting to organize a plan or hire an advisor.

A more nuanced approach would be to consider hiring an advisor as you experience life events like getting married, starting a family, receiving a large inheritance, or finally digging in on your estate plan.

Here's why: life happens fast, and having your financial ducks in a row will help you pivot quickly when the time arrives. Here are a few life scenarios that help further illustrate the benefit of financial planning for you and your family.

Family Financial Planning

When starting a family, you need to incorporate these new factors into your plan. As they grow and get established, you'll also want to prepare for expenses like education so you can confidently support them without risking long-term goals like retirement.

Related Reading: Preserving Generational Wealth: What to Know About Family Trusts

Marriage

Starting life with your new partner involves financial decisions, from combining assets to combining bank accounts, signing prenups, and more. Don't let financial stress erode your stability, working with an advisor can build alignment.

Related Reading: How Does a Prenup Work and Should You Get One?

Estate Planning

How confident are you everything is in place to carry out your wishes? Make a plan for assets, investments, savings, and more in your estate plan. A financial planner can help you make sure all the pieces are in place.

Generational Wealth

Maintain family-owned businesses, develop financial literacy, and generate passive income for future family members through investments. Make the right steps to establishing generational wealth today.

Related Reading: How to Build Generational Wealth

Succession Planning

Are you a business owner? Ensure your business is in good hands and step away on your terms with a succession planning advisor. We’ll create an exit plan together that provides the best outcome for you and your business.

Related Reading: The Information You Need For Every Type of Succession Plan

Retirement Planning

Retirement is likely the largest goal incorporated in every financial plan. Saving money isn’t enough — a financial advisor can guide you on the path to saving and investing enough to make your retirement dreams come true.

Equity Compensation and Employee Stock

Employee stock plans and equity compensation often go under-utilized because of their complexity. You can maximize your earnings with an investment advisor.

Investment Planning

Your investments should empower your goals, not constantly stress you out. Diversify and optimize your investment portfolio to achieve your goals. Avoid tax implications and grow your savings with an investment advisor.

Related Reading: 3 Best Investment Strategies to Consider to Meet Your Finance Goals

Types of Financial Advisors

Choosing someone to help you with your finances can feel overwhelming. There are many types to choose from, and while some titles may seem interchangeable, there are a few key differences.

- Financial Planner/Advisor: A planner may be the one helping put your plan to paper, and an advisor may be answering questions along the way.

- Registered Representative: Works for a client-facing financial firm like a brokerage company and helps clients with trading investment products and securities

- Financial Consultant: Works with corporations to provide financial advice

- Wealth Manager: Handles complex financial situations with a holistic approach, similar to an advisor, but more proactive.

- Investment/Portfolio/Asset Advisors: An individual or company that is paid to provide financial investment advice

- Brokers: A person or company that buys and sells stocks or other investments on an investor’s behalf

- Financial coach: Teaches clients money management skills but may not be allowed to offer investment advice

- Robo-advisor: Provides digital investment services based on algorithms

How to Find an Advisor

As you begin your search for an advisor, there are two important designations to keep in mind: CERTIFIED FINANCIAL PLANNERS (CFP®) and fiduciaries. If you want to go the extra mile, look for a CEFEX-certified firm, meaning they are certified in their their dedication to always do what is right for their client.

Fiduciary advisors are tasked with working in their client’s best interest rather than the firm’s. Not all financial planners are fiduciaries. A fiduciary financial advisor is legally required to operate in your best interests, not theirs. They are typically compensated in a fee-based way and will charge you a fee and act based on your needs, regardless of where you invest your money.

On the other hand, brokers and some investment advisors may make commissions if they sell certain products to their clients, presenting a conflict of interest. Some see this brokerage model as tainted because it de-incentivizes the client relationship.

CERTIFIED FINANCIAL PLANNERS (CFP®) are required to complete courses in topics such as investment planning, saving for retirement, and education planning. Then, they must pass a two-day board exam and complete three years of related professional experience or two years of apprenticeship. To maintain CFP status, they regularly refresh and update their skills to make sure they’re staying up to date to best serve your needs in a rapidly changing world.

What Should a Financial Planner Do for You?

The most important thing is to make sure whoever you hire is always acting in your best interest, free of any conflicts of interest.

From there, it's important to evaluate credentials, experience, and any reviews available to ensure you're choosing someone you can trust. This is also a great time to make sure they are experienced with whatever your key interest may be. If your main focus is retirement, ask how many clients they've helped successfully retire. Curious about equity or stock options? Ask how many executives they work with today and if they're experienced with a plan like yours.

As you search for a planner, here are some questions you could ask in the interview process:

- Will you put your fiduciary commitment in writing? Do you have a certification?

- Will you run a tax projection to support your recommendations?

- Will you review my estate planning documents?

- If something happens to you, who will take over my account?

- How are you paid?

How Do Financial Planners Get Paid?

Knowing how your financial planner gets paid can be crucial to the hiring process. After all, you want someone who works for YOU and in your best interests, not their own.

Commission planners: May charge a commission based on transactions, trades, or for purchasing annuities, mutual funds, or insurance policies within your larger financial plan. Because they earn a cut, the potential for bias is ever-present.

Flat, hourly, or service-based planners: Charges a set level of service for a flat fee, no matter what. This service is perfect for one-off projects like creating an estate plan. Because the fee is set, everyone receives the same level of service.

Advisory fee: Often charged based on the percentage of assets under management with a tiered fee schedule, similar to a retainer fee. These advisors aren’t paid to recommend specific products, so their advice is less prone to conflicts of interest and therefore likely independent.

Commission planners: May charge a commission based on transactions, trades, or for purchasing annuities, mutual funds, or insurance policies within your larger financial plan. Because they earn a cut, the potential for bias is ever-present.

Financial Freedom. Financial Independence. Wealth Alignment.

Achieving financial freedom is defined as having enough savings, investments, and cash on hand to afford your ideal lifestyle on your own. It’s a buzzword, for sure, but ultimately it symbolizes reaching a point in your life where you aren’t motivated by having to earn a certain amount of money each year.

To determine what financial freedom looks like for you, answer these three questions:

- What does your lifestyle require?

- How much do you need in your bank account to make it possible?

- What age is the deadline to save that amount?

Next, create a plan that will help you stay on track to achieving financial freedom:

- Set financial goals, both short- and long-term

- Create a budget that aligns with your goals (tools like Mint and Brightplan can help)

- Create a Cash Flow Worksheet to organize your finances and build a financial plan

Bring these goals to your financial planner. They will set the wheels in motion to achieve them and also hold you accountable should you start to stray from your path.

Although freedom is a popular term, at Plancorp, we prefer to think about this state as absolute wealth alignment. Our clients are successful, but they often come to us skeptically content, unsure if the level of service they're receiving is really making the most of their opportunities.

We've crafted our process based on more than 40 years of experience bringing our clients' wealth into full alignment with their goals and values, allowing them to focus on pursuing their dreams without financial constraint.

If you'd like to learn more about our unique process, click here.

Stages of Financial Freedom

There are seven stages of financial freedom:

- Dependence: Relying on someone else to pay your living expenses

- Solvency: Meeting your financial obligations on your own (even if you live with a partner)

- Stability: Solvency plus an emergency fund and the ability to still live within your means

- Security: You’re eliminating debt regularly, have a nest egg, and could comfortably navigate a period of unemployment

- Independence: You can retire at any time without worrying about the cost of living

- Freedom: You have more than enough money to cover your needs, and you can begin making riskier investments with money you’re willing to lose

70% of wealthy families lose their wealth by the next generation, and 90% lose it the generation after that.

(Source: NASDAQ)

How to Hire a Professional

Financial planning is important to secure the future you envision for you and your family. Your roadmap is a blank canvas waiting for your direction. Schedule a meeting with a financial planner who will be your advocate through life’s hills and valleys.

Advisors don't have the best reputation, and that's for good reason. Decades of seemingly random investment strategies or those who work on commission can make it easy to feel like it's better to go it alone. Thankfully, in recent years, independent advice has started to become more normal. Although you still find plenty of broker-dealers or dual-registered advisors, the independent Registered Investment Advisor (RIA) model is rapidly growing in popularity.

We find it's best to organize your questions up front so you can equally compare advisors, their services, and most importantly what incentivizes them. You can download our free "How to Interview a Financial Advisor" guide here.

Frequently Asked Questions

This may be an unsatisfying answer, but "it depends." Your stage in life, complexity of your financial life, and ultimate goals will dictate some of the specifics, but highlights include:

- A net worth statement

- Cash flow analysis

- Investment Portfolio Overview

- Investment Policy Statement

- A Financial Independence Analysis

- Tax projections

- Estate Plan memo or diagram

- Overview of benefits and insurance

Additional components may include equity diversification plans, donor advised fund overviews, trust outlines and more.

There is a balance between making sure your plan evolves as your life changes and editing your plan so often it no longer serves as your north star.

When you work with an advisor, they can set a regular cadence for evaluating components of your plan over time so things remain manageable for you but nothing lapses. They can also help elevate which components you should prioritize updating based on your life stage. For example, if you're starting a family you might want to prioritize updating your estate plan. If you've set a retirement date, you may need to evaluate your investment policy statement to align your risk tolerance with your transition to generating your own income.

In short, if you set a plan once and your advisor hasn't revisited updating at least one component in the last year, it might be time to look at your options.

There are a few common fee models for financial planning:

- Flat Fee: This is usually for a one time plan or individual project. Depending on the complexity, it could range anywhere from a few thousand dollars to 5-figure number if you start to engage with lawyers or CPAs.

- Hourly Rates: You may also find some hourly rate options. To get an hour of a qualified individual like a Certified Financial Planner will usually run you several hundred dollars an hour and may sound appealing but can leave you feeling pressed for more time or unable to dig in on what they find.

- Asset Fees (AUM): There are two commonly conflated but very different models when it comes to charging a percentage of the assets you invest.

- There are investment management fees that may be a percentage of the assets you put in or trade. These are usually anywhere from .2% to .5% (20 to 50 bps). Although they may tout some planning support, don't expect a dedicated proactive advisor at this level.

- Firms like Plancorp charge a percentage of your assets under management for access to our full suite of integrated services. Across the industry this starting rate is usually between 1 and 1.25%, with a graduated model that lessens the more you have. While this may sound steep, consider the value of those integrated services and having a proactive advisor on your side.

Be aware of any minimum or ancillary fees that may come into play. For example, Plancorp has a minimum fee of $1,000/month, but does not charge any hidden fees or commissions because we are fully independent.

While these terms are fairly synonymous across the industry and each firm may have slightly different definitions, an advisor will typically be there to guide you proactively through decisions and changes while a planner will likely be more tactical in helping you make changes to the documents that make up your plan.

Similarly, you may find that working with advisors puts the work of bringing up opportunities on your plate, while working with a proactive wealth manager is a fully delegated option.

Because exact titles may vary, it's important to interview potential advisors or wealth managers with questions that dig into their services, fees, and qualifications to identify the best fit.

As covered above, DIY'ing your financial plan is more achievable than ever before with access to information and affordable investment options online. That said, the limitations of these platforms, your knowledge, and your time or bandwidth may easily be outpaced by the increasing complexity of your financial life as you mature.

If you're planning for your whole family's future, have started receiving equity at work, or are approaching retirement in the next 10 years, it's a good time to consider looking for a fiduciary financial advisor.

Meet Your Money Match

Take our money match quiz to understand where you land on the scale of DIY planning to comprehensive wealth management to avoid risking your financial future with too little support or over-paying for advice you don’t need yet.

Take the Quiz

Plancorp is a registered investment advisor with the Securities and Exchange Commission ("SEC") and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. SEC registration does not imply a certain level of skill or training. Please refer to our Form ADV Part 2A disclosure brochure and our Form CRS for additional information regarding the qualifications and business practices of Plancorp.

Disclosure

For informational purposes only; should not be used as investment tax, legal or accounting advice. Plancorp LLC is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC. All investing involves risk, including the loss of principal. Past performance does not guarantee future results. Plancorp's marketing material should not be construed by any existing or prospective client as a guarantee that they will experience a certain level of results if they engage our services, and may include lists or rankings published by magazines and other sources which are generally based exclusively on information prepared and submitted by the recognized advisor. Plancorp is a registered trademark of Plancorp LLC, registered in the U.S. Patent and Trademark Office.

Like What You’re Reading? Get Insights to Your Inbox. Unsubscribe Anytime.

Schedule a Call With a Wealth Manager to Get Started

Let Plancorp help so you can focus on making the most of your wealth

- Personal & Business Solutions

- Popular Resources

- Free Financial Analysis Tool

- Money Match Quiz

- Fee & Value Calculator

- Early Retirement Guide

- Equity Compensation Guide

- Estate Planning Guide

- Employee Stock Purchase Plan (ESPP) Guide

- Restricted Stock Units Guide

- Invest by Age Series

- Glossary of Financial Terms

- Client Guide

- What to Expect During an Advisor Transition

St. Louis, MO | Nashville, TN | Sarasota, FL | San Francisco, CA

Direct: 636-532-7824 | Toll Free: 888-220-1163

- Legal Notices

- Privacy Policy

- ADV Part 2A

- View Cefex Certificate

- Form CRS

- Press Room

- Cyber Security Policies

- © 2026 Plancorp, LLC.

© 2026 Plancorp, LLC. All Rights Reserved.