My first opportunity to vote in a presidential election was the year 2000. Bush v. Gore. Hanging chads. A month of legal battles until we had a President Elect. I always wondered whether another election would surpass that chaos. 20 years later I have my answer.

While we still may not have absolute clarity, we can safely presume Joe Biden and Kamala Harris will be our next President and Vice President, respectively. Democrats will retain control of the House but the fate of the Senate is a little less clear.

Since we won’t know the result of the Georgia Senate races until early in 2021, year-end planning this year will be done amidst that uncertainty. A definitive “blue sweep” or a GOP controlled Senate would certainly have made things easier, but here we are – so how do we plan?

Tax proposals made by Joe Biden during the campaign

Let’s start with some of the tax proposals made by Joe Biden during the campaign. We’ll focus mostly on his proposals for high-income taxpayers. It’s important to remember that many of his proposals kick in at $400,000 – but that threshold is unclear. Earned income or taxable income? Married taxpayers or Single? For our purpose we’ll assume it’s $400,000 of taxable income, and applies to married and single taxpayers.

At $400,000 of taxable income, the marginal income tax rate would increase to 39.6% (from 37% today). Combined with a limitation on the benefit of itemized deductions, an increase in Social Security taxes for higher wage earners, and increased rates on long-term capital gains and qualified dividends for certain taxpayers.

On the estate tax side, Biden proposed that the lifetime gift and estate tax exemption would be cut in half, from $23.4 million for a married couple to $11.7m. He has also proposed eliminating the step-up in basis that occurs at the death of a taxpayer.

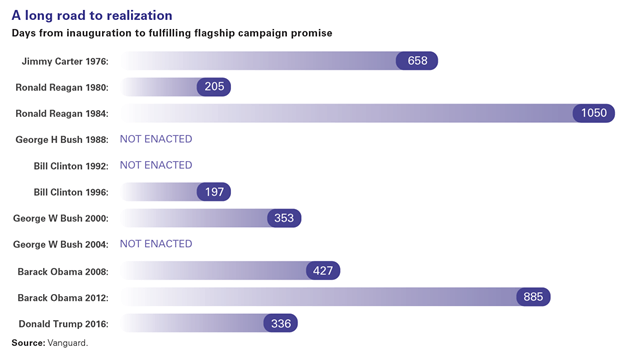

Prior to the election, many believed these proposals (or something similar) would be enacted early in 2021 and made retroactive to the beginning of the year. However, a divided Congress would make this much less likely. Even in the event of a “blue sweep” it can take time to enact new tax legislation, especially given the demands for the President to focus on economic recovery in the wake of COVID-19. The following data compiled by Vanguard illustrates this last point.

The only thing certain is uncertainty, but let’s not let the political chaos get in the way of improving your future, especially considering how elections have affected the economy over time.

Accelerate Income

Today’s income tax rates are historically low. Biden’s proposals would significantly increase taxes on high-income taxpayers. After the significant fiscal stimulus provided by the federal government in 2020, it would also be reasonable to assume that tax rates will be higher in the future to account for that spending. In such circumstances, it is prudent to consider accelerating income into the current tax year.

One option is a Roth conversion. This technique moves assets from a pre-tax IRA to a Roth IRA, and creates taxable income. Full or partial Roth IRA conversions already made a lot of sense with today’s low tax rates. The SECURE Act made them even more valuable. If tax rates rise, the window to complete Roth conversions at today’s low rates may close.

Another option: your stock options. If you are a corporate executive with non-qualified stock options expiring in the next few years, you might consider exercising vested options before the end of 2020. Other non-tax factors come into play, but when considering the tax impact for taxpayers above the $400,000 taxable income threshold, option exercises in 2020 may be your best bet, by helping you avoid a jump in marginal rate and additional FICA (Social Security) taxes in a future tax year.

Option Three is the acceleration of capital gains. If you plan to incur a long-term capital gain in 2021 or the near future (selling a vacation home, raising cash for retirement expenses, diversifying a concentrated stock position, etc.), you might think about moving a bit faster so that this income is taxed in 2020. This would only benefit taxpayers with expected taxable income above or near $1,000,000 in the future. If tax loss harvesting was done during the bear market earlier this year, those losses must first be offset by any available gains.

Accelerate Itemized Deductions

While it’s rare to plan to accelerate both income and deductions, 2020 might be that year, due to Biden’s proposal to cap the benefit of itemized deductions at 28% and reintroduce the Pease limitation. Taxpayers in a higher marginal bracket (32%, 35% or 37%) today would benefit from accelerating itemized deductions.

Moving charitable contributions into 2020 is likely the easiest way to accomplish this under our current tax law. Making charitable contributions a year earlier than planned is an effective strategy. If you previously “bunched” several years’ worth of charitable contributions into a Donor Advised Fund, it may be time to replenish the Fund, or start one if you haven’t.

Transfer Wealth

For those with a currently taxable estate, you should strongly consider using your lifetime exemption soon. A divided Congress may result in a little more time to plan, but today’s exemption amount is already scheduled to be halved in 2026. Using your lifetime exemption sooner rather than later is generally beneficial.

If you don’t have a taxable estate today, but would if the exemption was reduced, the appropriate plan is less clear. Taking aggressive action prior to year-end may not be necessary with the prospects of a divided Congress.

Even if estate tax law stays the same it’s possible future legislation might eliminate some of today’s popular tools. The SECURE Act made it clear that this is something both parties can agree on when they eliminated the “stretch IRA” for most IRA beneficiaries.

2020 has given us all a lot to think about, and it’s a great time to think through questions with your Wealth Manager. If you’d like to learn more about working with us to plan your future, reach out. We’re here to help.

Disclaimer: This material has been prepared for informational purposes only and should not be used as investment, tax, legal or accounting advice. All investing involves risk. Past performance is no guarantee of future results. Diversification does not ensure a profit or guarantee against a loss. You should consult your own tax, legal and accounting advisors.

.png?width=858&height=450&name=Blog%20Banner%20Images%20(19).png)

-3.png?width=266&name=Copy%20of%20blog%20featured%20image%20(2)-3.png)