From a young age, I’ve enjoyed giving back. Almost every year of high school and college I participated in a mission trip. Since college I’ve had the amazing opportunity to travel to Uganda to help those in need. (See some of the life lessons I learned on this amazing trip). Each trip was unique, but I always came home with a similar feeling – that I had received more than I gave.

Giving – whether time, talent, or treasure – has many positive benefits not only for the recipient but also the giver. For those who love to give, there are several ways to maximize your gifts:

Getting More Out of “Treasure”: Tax Advantaged Strategies

The Tax Cuts and Jobs Act of 2017 increased the standard deduction to $12,200 for single filers and $24,400 for married filing jointly (2019 amounts). The higher standard deduction resulted in fewer people itemizing their deductions and thus not getting a benefit for the contributions they made to charity. However, there are still some ways to save on taxes when making gifts to charity:

Qualified Charitable Distributions

Those age 70 ½ and older are required to start taking Required Minimum Distributions (RMDs) from their IRA accounts. These distributions are taxed as ordinary income. For those who do not need their RMDs to cover living expenses, they can instead give some or all of it (up to $105K) to qualified charities. Gross income is reduced by the amount given to charity, and thus provides a great tax savings. Read more details about QCDs here.

Charitable “Bunching” / Donor Advised Funds

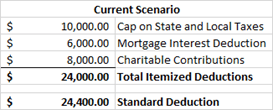

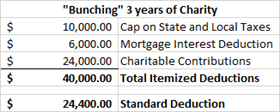

For those who cannot take advantage of QCDs, one way to get a tax break from charitable contributions is to “bunch” a few years of charity into one year. Let’s assume John and Jennifer generally give $8,000 to charity each year. They have a mortgage and paid $6,000 in interest. See summary of their itemized deductions below:

Under the new tax law, they will not receive any benefit for their charitable contributions since the standard deduction is greater than the total of their itemized deductions. However, if they “bunch” 3 years of charitable contributions into one year, it would be advantageous to itemize, thus they would receive a tax benefit for $15,600 of the $24,000 they gave to charity ($40,000 - $24,400 standard deduction).

Donor Advised Funds (DAFs) are a great place to park several years of charitable gifts because you receive the deduction in the year you put the money into the account, but you can distribute the money to charities over several years. You can read more about DAFs here.

Gifting Appreciated Securities

At the very least, you should consider using appreciated securities to make your charitable contributions. If you donate a stock or mutual fund that has increased in value from when you purchased it (and you purchased it at least one year ago), you can gift shares of that security directly to the charity and avoid paying the capital gains tax on it. Even if you aren’t itemizing your deductions, this strategy at least provides some tax benefit.

For example, Susan bought 100 shares of ABC Fund 2 years ago at $25/share for a total of $2,500. The fund is now trading at $35/share. If Susan contributes the 100 shares to a qualified charity, she gets a $3,500 charitable deduction and avoids paying the capital gains tax on the $1,000 of appreciation.

Getting More out of “Time” and “Talent”: Instilling a Generous Heart in Children

Of course maximizing the tax benefit of your gifts of “treasure” is important. But maximizing the impact of giving your time and talents is also a great goal. One way to accomplish it is to involve your children. In Carol Weisman’s book, Raising Charitable Children, she provides many great examples of ways to get your kids involved in charitable giving.

Birthday Donations

Even as early as age 3 to 4, consider giving your child an amount they get to give to a charity (not instead of gifts). “At such a young age, giving should be a totally joyful experience, so we didn’t want to make them forsake some of their birthday fun in the name of charity”. If your child struggles to decide on a charity, ask simple questions like, “’What did you enjoy doing the past year?’ or ‘What makes you happy?’”, Carol suggests. As kids get older, they may even decide to collect toys or money for a charity in leu of getting gifts.

Holiday Gifts

Carol shares a heart-warming story about a grandmother who cared deeply about instilling a sense of generosity in her privileged four-year-old granddaughter. When asked what she wanted for her birthday, the grandmother asked her granddaughter to do something for someone else and draw a picture of it. This became an annual tradition and she now has scrapbooks full of the drawings and stories of her granddaughter’s acts of kindness. Birthdays, Christmas, and Hanukkah are all great times to give gifts of giving back.

Mother/Daughter (or Son) Days

Volunteering with your kids is a great way to spend quality time with them and garner a sense of appreciation for things they might otherwise take for granted. Carol shares a story about a mother/daughter group that would perform good deeds in the community every few months. Some of these good deeds included washing dogs at an animal shelter, preparing meals for Meals on Wheels, playing Bingo with the elderly at a nursing home, among many others. “The mothers and daughters would take turns deciding what the group’s next volunteer project would be, and each member would choose a cause that was close to her heart”. What a great way to make meaningful memories with your children.

There are many other ways to instill a generous heart in your children. Your children are always watching you so be on the lookout for teachable moments and other ways to show them what giving means to you.

Giving should be a selfless act. But I can assure you, maximizing your gifts of time, talent, or treasure, will leave you feeling better off than you were before.

-3.png?width=266&name=Copy%20of%20blog%20featured%20image%20(2)-3.png)