Investing in Your 40s: 4 Finance Strategies to Put in Place

By the time you’re in your 40s, you likely have an emergency fund (if you don’t, that’s a top priority) and your overall financial goals in place. Your retirement savings may also be well on their way to becoming a nest egg capable of supporting your desired lifestyle in retirement.

Next comes the question of whether you’ve done everything you can when it comes to retirement planning. Short answer: probably not. Planning goes far beyond saving, to ensure you’re saving in the right types of accounts and at the right level to maximize your potential over decades, not just the next month’s cash flow.

The good news? You’re moving into your peak earning years, which means you can start to catch up on any lost investing time or gaps. There are plenty of late investors who still reach their retirement goals and build wealth. It’s all about making smart financial decisions now.

Here are the top strategies to put in place in your 40s to plan for your future:

1. Get Strategic with Education Savings

If you have children, saving for their education often becomes a priority. There are several vehicles for accomplishing these educational savings goals, but the most efficient educational investment account is a 529 savings plan, which functions similarly to a Roth 401(k) or Roth IRA:

- Contributions grow tax-deferred, and withdrawals are tax-free when used for qualified education costs.

- Many states offer state income tax deductions or credits for contributions.

- Almost anyone can open and contribute to a 529, making it a flexible estate planning tool as well.

Consider setting up automatic deductions from your paycheck or checking account directly into a 529 plan so that those contributions immediately invest in a well-diversified portfolio using an appropriate mix of stocks and bonds.

The overall costs of these plans along with the tax benefits make 529 plans far more efficient in saving for education costs than opening up a taxable account on your own or with a financial advisor.

However, remember: Retirement comes first. Your kids can take out student loans – you cannot take out loans for retirement. And having a surprise outsized education bill come due in the decade or so before you plan to retire, can really knock you off track. Starting early, fully funding, and considering the tax implications are key.

Read Blog

Not sure a 529 is right for you? Read our blog Best Investment Accounts for Children for an overview of several investment options, their flexibilities, and tax advantages.

2. Optimize Your Taxes

At this stage of life, optimizing your tax strategy becomes just as important as growing your investments. Your 40s are often marked by rising income, equity compensation, or business ownership—so every financial move carries greater tax consequences. A proactive approach can preserve more of your wealth both now and in retirement.

Here’s how to make tax efficiency a core part of your investment strategy:

Leverage Tax-Advantaged Accounts

Contributions to tax-advantaged retirement funds provide immediate or future tax benefits:

- Making retirement contributions to traditional IRAs may offer tax deductions today and grow tax-deferred—ideal if you expect to be in a lower tax bracket during retirement.

- Roth IRAs provide tax-free growth and tax-free withdrawals in retirement. They’re especially valuable if you anticipate being in a higher bracket later.

- Health Savings Accounts (HSAs) offer triple tax benefits: deductible contributions, tax-free investment growth, and tax-free withdrawals for qualified medical expenses. In 2025, the annual contribution limits are $4,300 individually or $8,550 for a family.

If you’re a high earner and ineligible to contribute directly to a Roth IRA, consider a Backdoor Roth IRA strategy to work around income limits (more on that below). A financial advisor can help navigate the technicalities and potential tax traps.

Maximize Tax-Efficient Investing

The way your investments are allocated across different account types (taxable vs. tax-advantaged) matters. This is known as asset location—and it can have a meaningful impact on after-tax returns.

General principles include:

- Place tax-inefficient assets (like bonds or actively managed funds) in tax-deferred accounts.

- Reserve your taxable brokerage account for tax-efficient investments like index funds, ETFs, and municipal bonds.

- Rebalance across accounts strategically to manage capital gains and limit tax drag.

This approach helps you benefit from compound interest more effectively and retain more of your gains over time. Rule of thumb if you’re working with an advisor to manage your portfolio, if they haven’t mentioned any rebalancing after or tax loss harvesting over several years, you might not be getting the level of service your portfolio deserves.

Consider Roth Conversions and Charitable Giving

Even if retirement feels far off, now is the time to evaluate longer-term tax strategies like:

- Partial Roth conversions: Converting traditional IRA funds to Roth in lower-income years can reduce your future RMDs and create tax-free income later.

- Donor-Advised Funds (DAFs): These accounts allow you to bunch multiple years’ worth of charitable donations into one tax year to exceed the standard deduction and maximize itemized tax benefits. Ideal if you’re charitably inclined or planning for a liquidity event.

Run a Tax Projection

Work with a CPA or financial advisor to create a multi-year tax projection. This forward-looking analysis can help you:

- Time income and deductions strategically

- Identify which accounts to take distributions from first in retirement

- Determine the right mix of pre-tax vs. Roth savings

- Plan for potential capital gains from equity compensation or business ownership

Tax laws are always evolving, and your personal situation is likely to shift throughout your 40s. Periodic projections ensure your plan stays aligned—and no opportunity is missed.

Read Blog

Read our blog How Tax Projections Help Make Better Financial Decisions for a glimpse at how understanding future tax liabilities can guide your financial plan.

3. Tackle Your Debt

Before taking steps to become debt-free, you need a plan — especially if you also want to build up savings. The debt snowball and debt avalanche methods are common methods that provide a clear path to:

- Organize debt

- Direct additional monthly payments

- Track progress

- Save money on interest

However, one may be more advantageous than the other given your situation. With the debt snowball method, you pay the minimums on all debts and direct any remaining funds to the smallest debt.

Once that smallest debt is paid in full, you’d roll those payments into the next smallest debt, and so on. It’s a way of building momentum. You can start your debt snowball by:

- Listing out your debts in order of smallest to largest

- Paying the minimums on all your loans

- Applying extra payments to your smallest loan

- Working your way down the list!

With the debt avalanche method, you still pay the minimums first. But instead of using any extra funds to pay the smallest debt, you pay the debt with the highest interest rate. This approach allows you to save money on interest payments over the long term. You can kickstart your avalanche by:

- Listing your debts from highest interest rate to lowest interest rate

- Paying the minimums on all of your loans

- Applying extra payments to the highest interest debt

- Work your way down the list!

While it’s important to pay down high-cost debt (like credit cards) as quickly as possible, prepaying lower-cost debt like a mortgage isn’t essential, especially if you’ve got a good interest rate (at or below 3%).

With mortgage rates near historical highs, now might not be the best time to refinance unless you can shorten the term and lower the interest rate. Before you do this, you must consider your “breakeven” period or how long you need to stay in your house to make up the associated costs of refinancing.

If you’re planning on living in your house for at least as long as it takes to breakeven - or longer - then refinancing may not be the best option.

4. Hire an Advisor

It’s okay to feel overwhelmed by your finances, but it’s not okay to let that stop you from making progress toward your financial goals. Thankfully, you don’t have to do this alone. Working with a financial professional can help you:

- Optimize your investment portfolio

- Plan tax-efficient strategies

- Review estate plans and insurance

- Ensure retirement readiness

Most importantly, they help you avoid costly mistakes while freeing your time and reducing financial stress.

It’s important to find someone that always acts as a fiduciary. The most fail-safe way to ensure you work with a fiduciary is to ask your advisor to put that fiduciary commitment in writing. If your advisor isn’t willing to do that, then you should seek help elsewhere.

Download the PDF Version of this Page

Did you find the information on this page helpful? Access the free downloadable version of this page below.

Enter your email below to receive your free copy.

There’s no time like the present to set yourself up for the future. Even if you’re late to the party, don’t let that stop you from putting a plan in place and making smart long-term and short-term investments and financial decisions. No matter your age, you can still achieve financial success.

Next Steps

If you’re ready to start making smart decisions with your money, explore these resources:

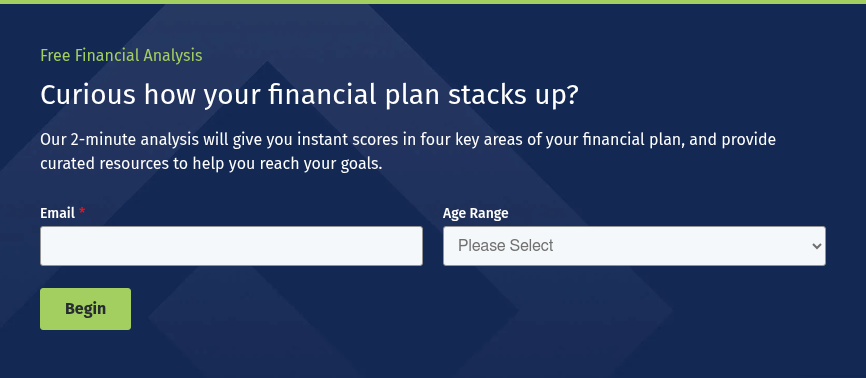

- Take our 2-Minute Financial Analysis

for a gut-check on how you’re doing in four key areas of your financial plan. We’ll give you instant scores to help pinpoint your biggest opportunities.

- Download our free worksheets and checklists to set your financial goals and plan effectively.

-1.png?width=173&name=Untitled%20design%20(3)-1.png)