You work hard for your paycheck. So shouldn’t your paycheck work for you? If you’re like most people, you’ve wondered what to do with your money. It can be tempting to spend it as it comes in, even if you know you should be saving. But to get the most out of your income, it’s important that you give it the number one ingredient it needs to grow: time.

Why Invest Early?

One of the greatest benefits of starting to invest early in life is time. And the more you have of it, the better off your money will be. One of the reasons for this is the power of compound interest. Many people associate interest with debt. However, the power of compounding can greatly benefit your investments as well.

Simply put, compounding is the ability to earn a return on your initial investment AND previous investment returns.

As opposed to just earning return on the initial amount of money you put in, this concept allows you to earn a return on dividend or interest income. .

This can cause a positive snowball effect, which when combined with a long-time horizon, can help grow your wealth.

Time Is On Your Side

Let’s look at this example to demonstrate how the power of time can play a crucial role in your portfolio.

Sally is 22 years old and knows she wants to be a millionaire when she retires at age 65. So, she sets the goal of having $1 million dollars by the time she retires. If Sally can earn 5% over the life of her investment, that means she will have to invest $522 per month to reach her goal. Now if we look at another case, we can see the positive effects time can have on your investment portfolio.

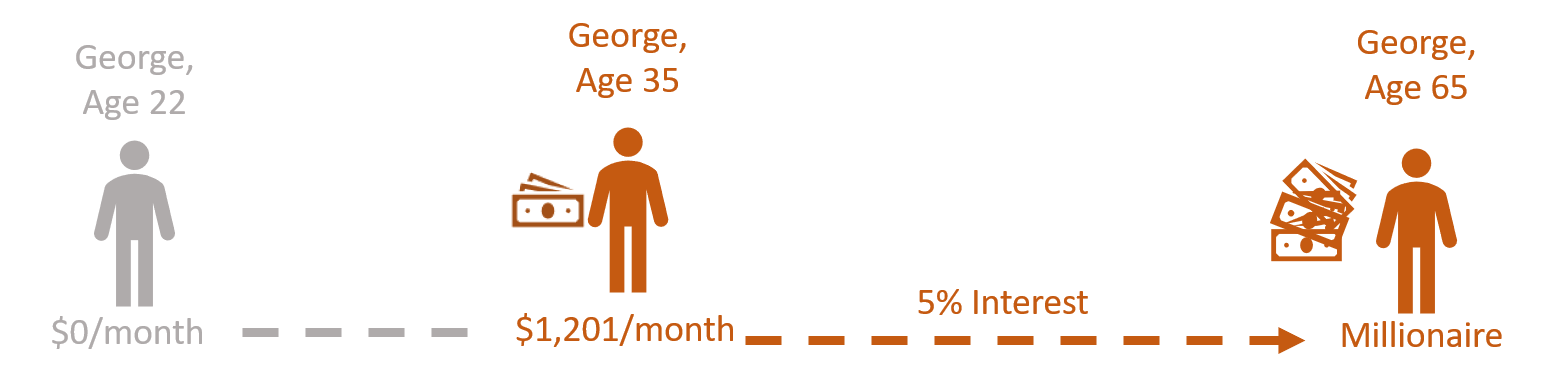

In this scenario, let’s assume Sally’s friend George has the same goal of achieving millionaire status by the time he retires at age 65. Except he decides to live large in his twenties. After all, retirement is decades away! Still, after spending heavily and enjoying a great lifestyle in his twenties he starts investing at the age of 35.

George has done well in his career, so he even decides to add an extra $300 per month above what Sally is saving. Assuming the same rate of return, George would fall short of his goal (and only have $709,188) – even when contributing $882 per month. In fact, if George waited until age 35 to start, it would take him contributing $1,201 per month, over double what he would need had he started at age 22!

Sally and George had the same goal: to be millionaires by age 65. But Sally had to save less than half of what George did-- because she used the power of time to her favor.

By starting to invest even a small portion of your income at a young age, you can take on more risk over a longer period than someone nearing retirement age. Ideally, your willingness to take on more risk over a longer period of time will also correlate to greater returns.

Time is an enviable advantage for an investor. And in today’s tech-friendly environment, there’s no reason to waste another minute. Whether you sign up for a taxable brokerage account or contribute to your 401(k), save what you can early and consistently. The sooner you start investing, the sooner you can put your paycheck–and time—to work for you.