For more than three decades we’ve experienced an incredible bull market in bonds. The probability of bond returns matching those previous three decades is extremely low, but bonds will remain an important piece of a well-diversified portfolio, even if bond returns are lower or even negative.

Low returns in any asset class have a funny way of leading to bad investment decisions. Although bonds have historically been considered the “boring” part of a portfolio, I view fixed income as an area of high risk when it comes to bad investor behavior.

1. Returns may be low or even negative, but low volatility and diversification benefits remain.

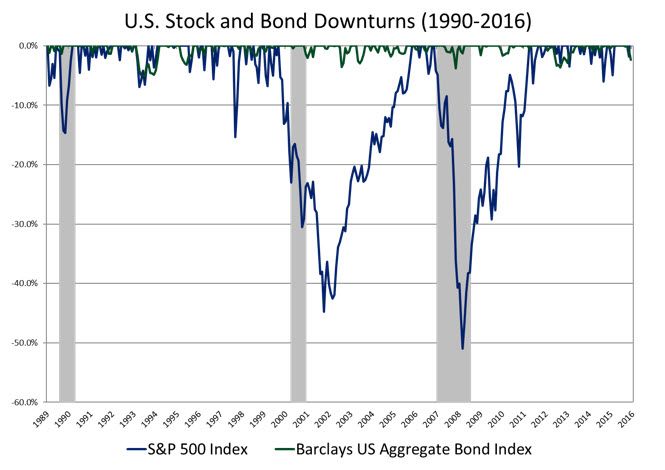

The primary purpose of your bond allocation is to decrease the volatility of a portfolio. Even if bonds experience temporary losses as interest rates rise, the worst bond market losses are not as severe as the worst stock market losses.

The chart below illustrates this point by comparing downturns on the S&P 500 and the Barclays Aggregate Bond Index since 1990. The green line represents bonds and the blue line represents stocks.

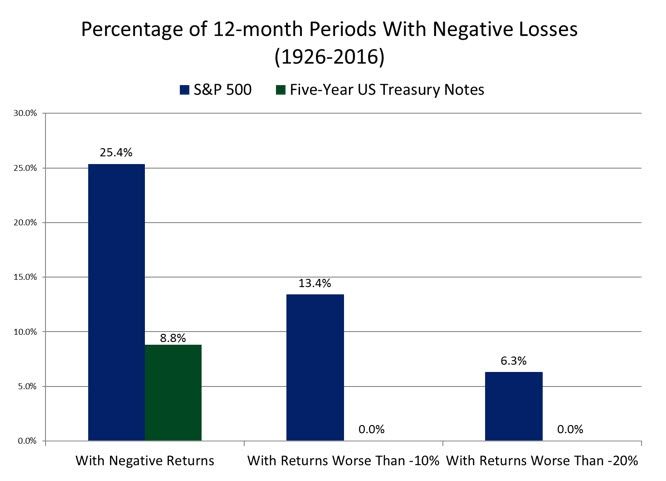

In order to take the data back even further, we compare returns of the S&P 500 (blue bars) and Five-Year Treasury Notes (green bars) below.

Since 1926, the bonds (green bars) had a negative return in only 8.8% of 12-month periods, and not once did bonds experience a 12-month period with returns worse than -10% or -20%. Compare those numbers to stocks (blue bars) and you can quickly understand the dramatic difference in the volatility between bonds and stocks.

When stock markets experience a sharp fall, bonds act as a diversifier and reduce the overall volatility of the portfolio. The relative lack of volatility is the primary reason investors should have fixed income exposure in their portfolios. That shouldn’t change regardless if rates rise, fall or stay the same.

2. Rising interest rates are good for long-term investors.

Although increasing interest rates result in immediate bond price declines, long-term returns are actually enhanced due to the ability to reinvest at higher rates.

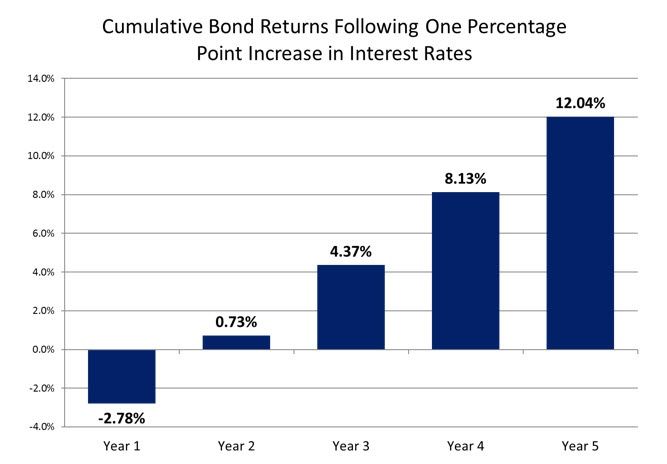

Consider the scenario below that depicts the impact of a one percentage point increase in yield on the total return of a bond.

As you can see, the one percentage point increase in interest rates results in a loss for Year 1, but by Year 2 the cumulative return turns positive because interest and principal are being reinvested at higher rates. Over time, the cumulative return grows even more as the benefit of higher rates compounds.

The above example uses the Barlcalys Aggregate Bond Index, which has a yield of 2.61% and duration of 5.89 as of December 31, 2016. For ease of presentation, this analysis assumes a one-time parallel shift in yields and then no further fluctuation in interest rates. In addition, I assume that all income received is reinvested, which is extremely important because reinvesting income at higher rates helps offset the losses in the initial hike year and increases the total return of the bond portfolio over time.

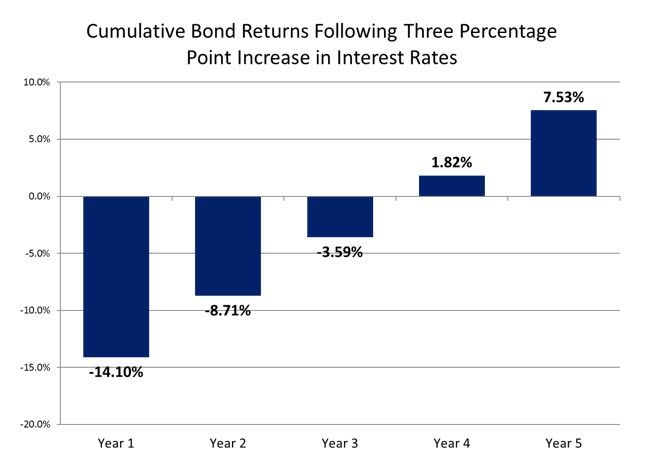

The same holds true for a more dramatic rate hike scenario of three percentage points, although recovering from the initial loss takes a little longer. An interest rate hike of this magnitude has occurred only twice in history (1980 and 1981), but serves as sort of a worst-case scenario analysis.

As you can see, the Year 1 return is dramatically worse with a larger interest rate increase – in fact, it would be the second worst 12-month return for the U.S. bond market ever. Although the initial loss is more dramatic than the initial example above, the result is the same: higher yields benefit investors in the long run by providing higher returns over time.

3. Global diversification offers diversifying opportunities.

Investors shouldn’t limit themselves to just the U.S. bond market. Global bonds are the largest investable asset class, yet the area where most investors are underexposed.

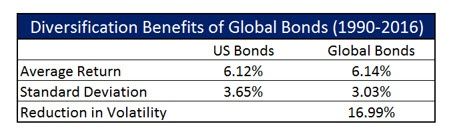

Using global bonds with hedged currency exposure has historically provided a dramatic reduction in volatility, which can be seen in the table below that compares the Barclays U.S. Aggregate Bond Index to the currency hedged Barclays Global Aggregate Bond Index.

As you can see, returns are very similar but there is a 17% reduction in volatility when using global bonds.

The biggest reason for the reduction in volatility is that each countries’ yield curve is shaped differently and the factors that impact change in yields are lowly correlated across countries. Another reason for the reduction in volatility is that global bonds adds to the number of issuers in a portfolio and, thus, diversifies among different credit risks.

Making the safest part of your portfolio even less volatile is a no brainer. As a result, the opportunity to have global bond exposure is always a great reason to buy bonds.

4. Rebalancing to maintain the target risk exposure of your portfolio.

Investors that don’t rebalance periodically may end up with more or less risk than they are willing or able to tolerate. As a result, bonds are always an important part of a rebalancing strategy.

The beauty of rebalancing is that it removes our biases and emotions from investment decisions. When stock prices are down, the low volatility of your bond portfolio provides some dry powder to rebalance and buy stocks more cheaply.

When stock prices are up, buying fixed income helps bring the portfolio risk levels back in line with your financial plan.